What’s happening at Unacademy? Reports indicate that the company is close to an acquisition, but cofounder and CEO Gaurav Munjal has immediately come out and denied this speculation.

This is not the first time that Unacademy

After the troubled times of the past two years, a potential deal for Unacademy could be a silver lining for the sector and indeed for Unacademy, which has downsized in a big way in the past 24 months.

Will Unacademy eventually cave in to potential pressure from investors to find an exit and go in for an M&A or will Munjal & Co finally be able to deliver some positive news in terms of profit in the next future? Let’s look to answer these two questions but after a look at the top stories from our newsroom this week:

- The 80/20 Podcast: The 80/20 Podcast by Inc42 is here — catch the first episode now — offering you a backstage pass to the minds shaping the future of India’s startup economy. We’re diving deep into the trenches with maverick startup founders who are rewriting the rules of success in the digital age.

- The Quick Commerce Pill: Many believe pharma and healthcare are the biggest untapped segments in quick commerce, where average order value is the current big focus for players such as Swiggy, Blinkit, Flipkart Minutes and Zepto.

- The AI Policy Push: Government initiatives like IndiaAI Mission and Future Skills are expected to position India as a global AI leader and an attractive destination for global investors, but what more do startups in the GenAI and AI segment want from the policymakers?

Unacademy’s Year, According To Gaurav Munjal

Unacademy was already in the news this week when reports suggested that Unacademy was in advanced discussions with Allen Career Institute for a potential sale for $800 Mn. This would represent a big haircut on the company’s last private valuation of close to $3.4 Bn, but it would still be a relative success story in edtech, after the past two years.

However, Unacademy CEO Munjal took to LinkedIn today (December 7) and dismissed the reports of acquisition talks as “rumours”. “We are building Unacademy for the long run. We are not doing any sale or M&A. Ignore the rumours,” Munjal said.

Incidentally, just hours before Munjal posted on LinkedIn, sources at Allen told Inc42 that the deal is most likely to go through, but that the valuation is unclear.

Besides denying talks over an M&A, Munjal added that 2024 will be the best year for Unacademy in terms of growth in the offline business and overall unit economics.

He claimed the edtech startup had seen 30% growth in its offline business with unit economics improving considerably. He also added that despite degrowth in the online test prep business, the vertical has seen improved unit economics.

Munjal also claimed that the company’s monthly cash burn had declined by 50% in 2024, with $170 Mn in cash reserves, no debt and a runway of over four years. He claimed that SaaS arm Graphy grew by 40% profitably, language learning product Airlearn surpassed ARR of $400K in the US, just four months after launch.

What’s Unacademy’s True Picture?

Unacademy narrowed its consolidated net loss by almost 40% in FY23 (ended March 31, 2023), but there’s no clarity on how it has performed in terms of the unit economics and revenue growth since then.

Even last year, Munjal claimed that Unacademy had managed to reduce its cash burn by 60% in 2023, and also said that the online business had shrunk. These are the only updates from Unacademy in the past two years in terms of the financials.

It’s certainly not helpful when Munjal’s claims aren’t backed by financial disclosures, and instead one has to rely on numbers from more than 18 months ago to ascertain how Unacademy has performed.

As of March 2023, the Peak XV-backed edtech unicorn had a net loss to INR 1,678.1 Cr (down 40% compared to FY22). Operating revenue had seen a 26% growth YoY to INR 907 Cr, with INR 137 Cr in non-operating income.

Between March 2023 and December 2024, Unacademy has seen a slew of exits. Partner and chief operating officer Karan Shroff, strategy head Arnab Dutta, COO Vivek Sinha, chief of staff Abhyudaya Singh Rana were among those who quit last year.

The exits continued this year too. In June 2024, cofounder Hemesh Singh stepped down and moved on to an advisory role, followed by the exit of chief operating officer (COO) for offline centers Jagnoor Singh in July 2024.

But to bulk up its leadership, Unacademy appointed former CRED head of finance Pratik Dalal as chief financial officer (CFO) of its offline business Unacademy Centres, as it looked to put this vertical front and center in its operations.

Combined with the fact that online test prep has seen degrowth as Munjal claimed, it’s looking like Unacademy is clearly an offline learning company today.

Offline Rivals Grow Big

Having $170 Mn in cash reserves is only good as long as Unacademy can show actual profits in the offline learning business, which can contribute to the capital reserves and be leveraged for expansion.

Competition such as Physics Wallah (PW) has raised $210 Mn this year to capture the offline learning opportunity. Outpacing such a well-capitalised rival will not be easy. Allen too is a major competitor for Unacademy, so perhaps the legacy company is looking at Unacademy has a way to add some distance between itself and PW.

This is the only position in which Unacademy might be able to bargain for a higher valuation, according to the CEO of an education business. At the moment, it’s not clear how far Unacademy has improved its unit economics in all of FY24 and more than six months into the ongoing fiscal year.

The fact that the company laid off 250 employees earlier this year as part of a restructuring exercise to improve its bottom line does not necessarily go towards long-term profitability moves. It also laid off 145 employees from PrepLadder in March.

Unacademy has been the subject of acquisition talks for a number of months. Just earlier this year, the company was said to be in talks with fellow Peak XV portfolio company K-12 Techno Services, but sources close to the latter indicated that Unacademy’s unit economics situation was not clear, and there was no path to profitability yet.

Can Gaurav Munjal Turn It Around?

In light of this, Munjal’s defense of Unacademy’s financial position is reminiscent of another edtech founder who insisted that everything is well despite the worsening situation. Of course, we are talking about BYJU’S, which once claimed to be profitable, only to retract it later.

Unacademy’s Munjal had once said that Raveendran not listening to “anyone” was one of the reasons for BYJU’S troubles. In a post on X, Munjal had said, “Byju failed because he didn’t listen to anyone. He put himself on a pedestal and stopped listening. Don’t do that. Never do that. Don’t listen to everyone but have people who can give you blunt feedback.”

It was almost exactly one year ago that Munjal claimed the company turned down a tempting $500 Mn debt offerand a host of merger and acquisition (M&A) opportunities in 2021, at the height of the funding peak. Coincidentally, this December, Munjal is back saying that he is not interested in selling the company.

“We are building Unacademy for the long run. We are not doing any sale or M&A. Ignore the rumours,” the CEO said.

But it’s hard to ignore the speculation when it comes every now and then, and when the company does not seem to have seen any major improvements in its financials, its retention of key employees, and degrowth in the core business.

In lieu of these indisputable indicators, what we have is Munjal’s claims about Unacademy’s best year yet. And if we have learned anything in the past two years, it’s that such claims need to be taken with a grain of salt.

Sunday Roundup: Tech Stocks, Startup Funding & More

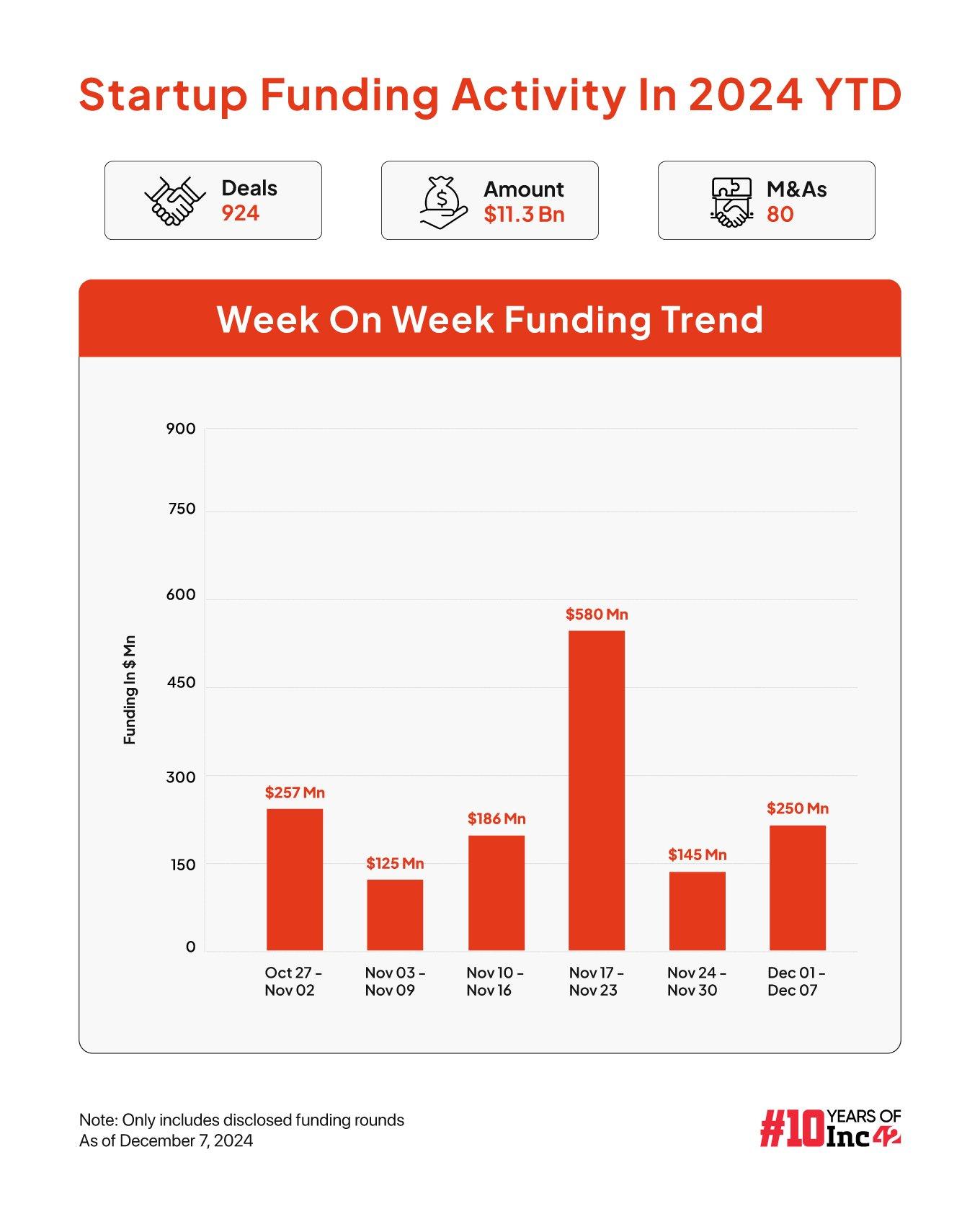

Funding Up: Indian startups continued to show some signs of funding resurgence with $249.6 Mn raised across 18 deals in the past week, led by deals for Vastu and Prosus-backed Mintifi.

Funding Up: Indian startups continued to show some signs of funding resurgence with $249.6 Mn raised across 18 deals in the past week, led by deals for Vastu and Prosus-backed Mintifi.- Antler’s India Bet, Venture capital firm Antler has expanded its India portfolio by backing 30 startups in 2024 through its maiden $75 Mn fund. This takes Antler’s total India portfolio to 80 startups

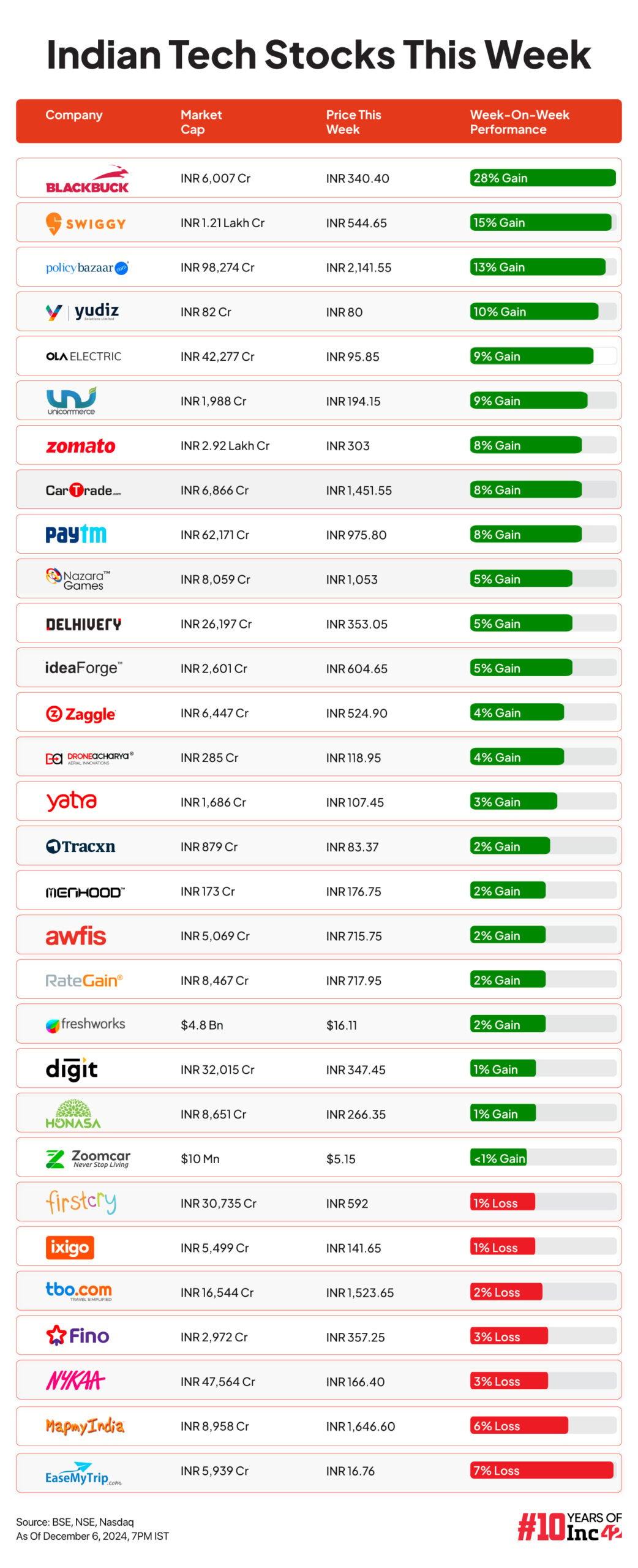

- Swiggy’s Jump: Shares of Swiggy surged as much as 11.35% on Friday, December 5 to reach an all-time high at INR 576.95, before settling on INR 544.65

- SEBI’s IPO Approvals, Logistics company Ecom Express and coworking space provider Smartworks have received SEBI approval for their IPOs.

- Paytm Offloads PayPay: Paytm’s subsidiary in Singapore has sold its stake in Japanese digital payments firm PayPay for 279.19 Mn boosting the fintech giant’s cash reserves.