It was a positive week for the Indian equities market, as it continued its upward momentum for the third straight week after the turbulence due to poor Q2 show by companies.

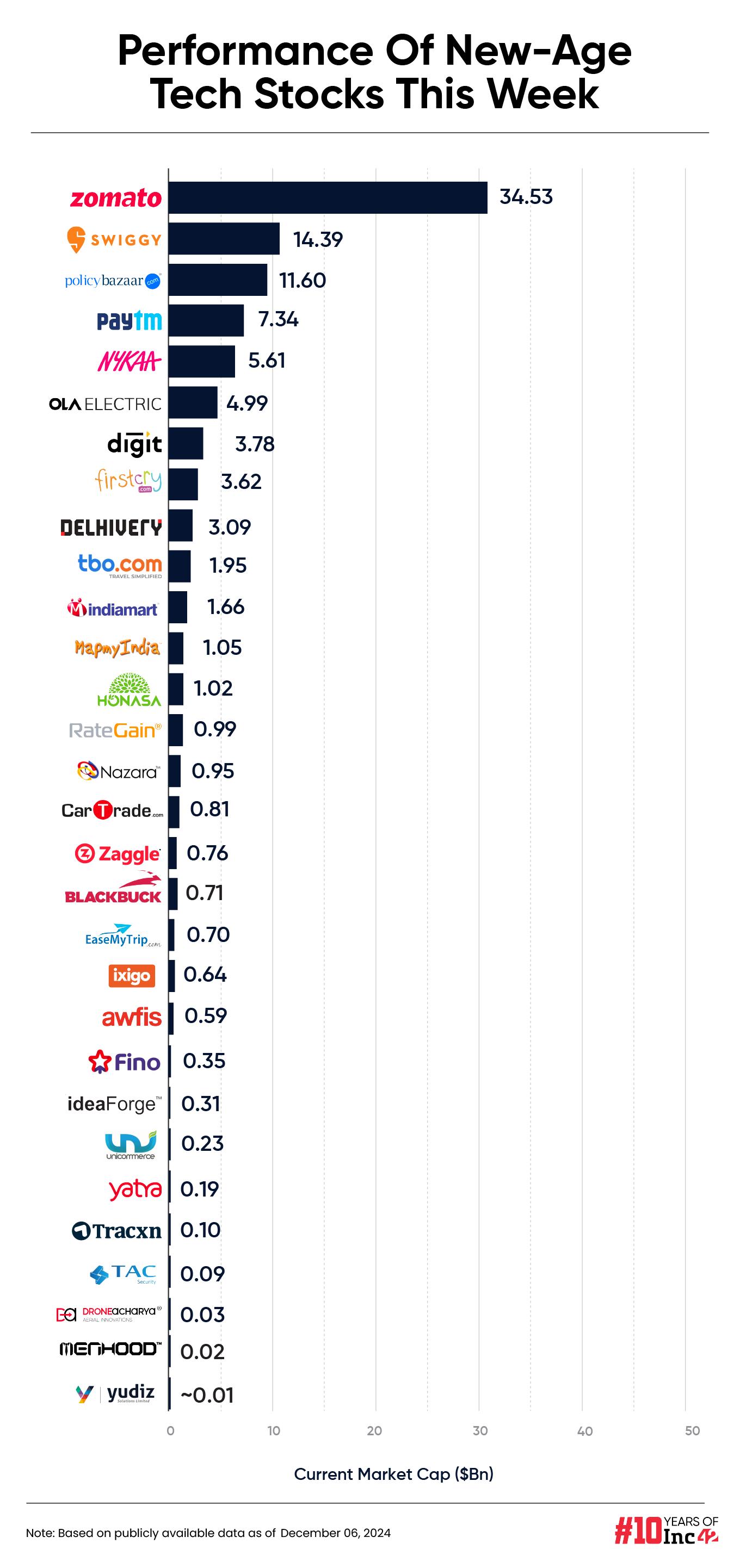

In line with this, new-age tech stocks also jumped this week. Twenty three out of the 30 new-age tech stocks under Inc42’s coverage rose in a range of 0.46% to a little under 28% this week.

With this, multiple new-age tech stocks touched 52-week/ all-time highs this week. The biggest gainer this week was recently listed logistics company BlackBuck (Zinka Logistics Ltd), with its shares surging 27.97% to end the week at INR 340.40. The stock surged to a all-time high of INR 381.85 during the intraday trading on December 4.

The stock has gained 21.99% from its listing price of INR 279.05The company’s market capitalization stood at $709.47 Mn at the end of trading session on Friday (December 6) as against its IPO valuation of $570 Mn.

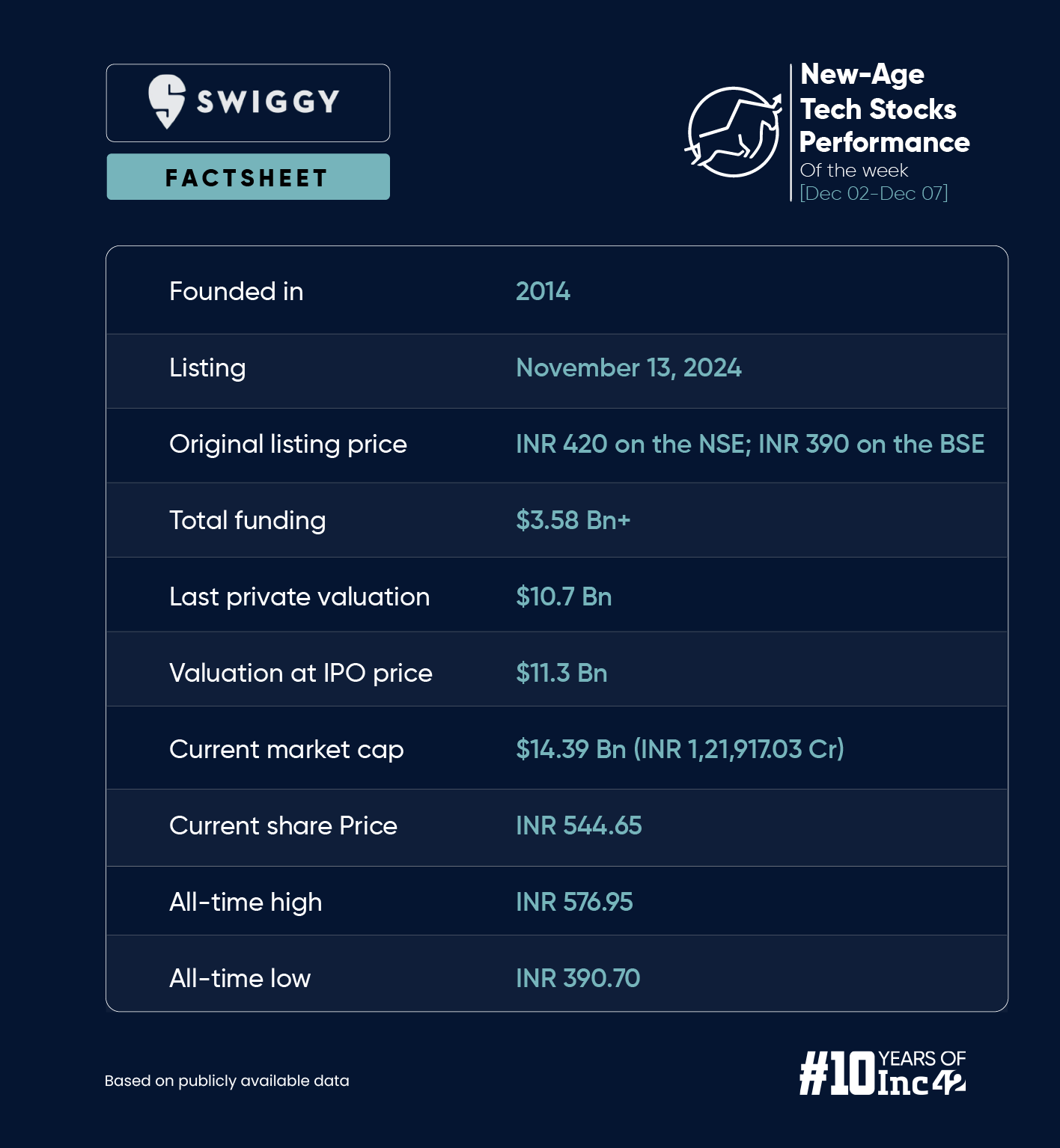

Shares of foodtech major Swiggy also zoomed to an all-time high of INR 576.95 on December 5, after it narrowed its Q2 loss. The stock ended the week at INR 544.65, up 15.56% from previous week.

Swiggy’s archrival Zomato also saw its shares zoom to an all-time high of INR 304.50 on December 5. However, it ended the week slightly lower at INR 303. The shares rallied 8.41% from the previous week, during which it raised $1.3 Bn through qualified institutional placement (QIP).

Another gainer of the week was fintech SaaS player Zaggle, which ended the week at an all-time high of INR 524.90. Its shares ended the week 4.01% higher. The stock is now up 224% from its listing price of INR 164 in September last year. The company won four new contracts in the past week. Its founder and executive chairman Raj Narayanam told Financial Express that Zaggle is looking to double its revenue by FY26.

CarTrade, Paytm, and TAC Infosec also touched fresh 52-week highs during the intraday trading this week. Other gainers this week included Yudiz, Ola Electric, Unicommerce, Nazara Technologies, PB Fintech and Awfis.

Meanwhile, six startups ended the week in the red, falling in a range of 1.33% to slightly under 7%. The week’s biggest loser was online travel aggregator EaseMyTrip, ending the week 6.89% lower at INR 16.76. The company’s shares started trading ex-bonus on November 29.

Other losers this week were MapmyIndia, TBO Tek, Fino Payments Bank, Nykaa, FirstCry and ixigo.

In the broader market, Sensex ended the week 2.39% higher at 81,709.12 and Nifty 50 surged 2.26% to close at 24,131.10.

One of the major reasons that drove the resurgence in the broader market was the return of foreign institutional investors (FIIs). After turning net sellers over the past couple of months, FIIs bought shares worth INR 24,453 Cr in the first week of December. On the contrary, they sold securities worth INR 1,13,858 Cr in October and INR 39,315 Cr in November.

VK Vijayakumar, chief investment strategist at Geojit Financial Services, believes that the relentless FII selling in the Indian market is over. “FIIs turning buyers in early December, in total reversal of their sustained selling strategy during the last two months, has altered the market sentiments. There is a clear change in their strategy in India,” he said.

Meanwhile, the Reserve Bank of India (RBI) kept the repo rate unchanged this week but cut the cash reserve ratio (CRR) by 50 basis points to 4%. The central bank also cut the GDP growth projection for FY25 to 6.6% from 7.2% earlier.

It is pertinent to mention that India’s GDP growth fell to a seven quarter low of 5.4% in the second quarter of FY25.

Amid all these, the IPO boom in the new-age tech companies continued. Fintech Major MobiKwik filed its red herring prospectus (RHP) on Friday (December 6) for its IPO. It has reduced the size of the fresh issue by around 18% to INR 572 Cr from INR 700 Cr earlier. The company’s IPO will open on December 11 and close on December 13.

Earlier in the week, logistics major Ecom Express and coworking space provider Smartworks also received SEBI’s go-ahead for their proposed INR 2,600 Cr and INR 550 Cr IPOs, respectively. They join ArisInfra in the line of startups whose IPOs have been cleared by SEBI.

“What was once the domain of institutional investors is now seeing a remarkable surge in retail participation. This shift is being fueled by the allure of higher returns and the growing ease of access to financial markets, making it an exciting time for individual investors to dive in,” Pantomath Capital Advisors said on the IPO trends.

Now, let’s take a deeper look at the performance of some of the new-age tech companies this week.

The total market cap of the 30 new-age tech companies under Inc42’s coverage stood at $102.11 Bn at the end of the week as against $92.45 Bn at the end of the previous week.

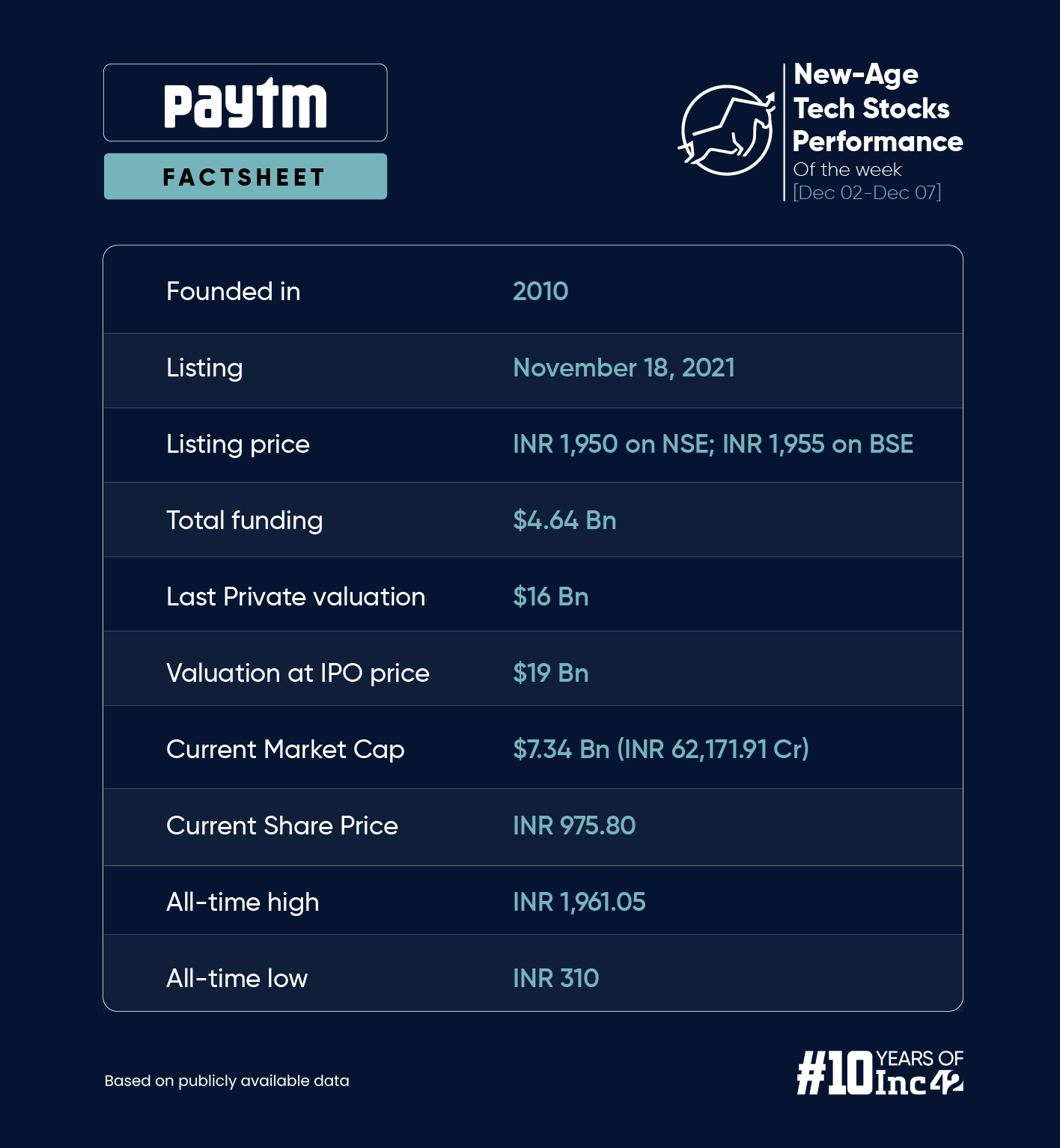

Paytm Top-Ups Its Cash Reserves

Continuing its resurgence, fintech major Paytm’s shares touched a fresh 52-week high of INR 990.90 on Friday (December 6). The stock ended the week 8.30% higher at INR 975.80. The company’s market cap stood at $7.34 Bn at the end of the week.

The rise in the share price on Friday came after it was reported that the company was looking to sell its stock acquisition rights (SARs) in Japanese payments firm PayPay. On Saturday, the Vijay Shekhar Sharma-led company said that its Singapore subsidiary will be selling the SARs to SoftBank for $279.19 Mn (about INR 2,364 Cr). The transaction, which is expected to close within this month, will value PayPal at $7.06 Bn.

This would be the second such stake sale by Paytm this year. Earlier, it sold its events and ticketing business to Zomato for INR 2,048 Cr. As a result, Paytm’s cash reserves at the end of the second quarter of FY25 stood at INR 9,999 crore, an increase of over 23% from INR 8,108 crore at the end of the previous June quarter.

While Paytm’s future plans remain to be seen, founder and CEO Sharma previously said that the company will be expanding its core consumer payments businessIn October, Sharma stated that the company would focus on reinvesting in the consumer payments sector.

Last month, Paytm launched new features, including UPI Lite Auto Top-Ups ,UPI Internationalal in select overseas markets, and UPI statement download options.

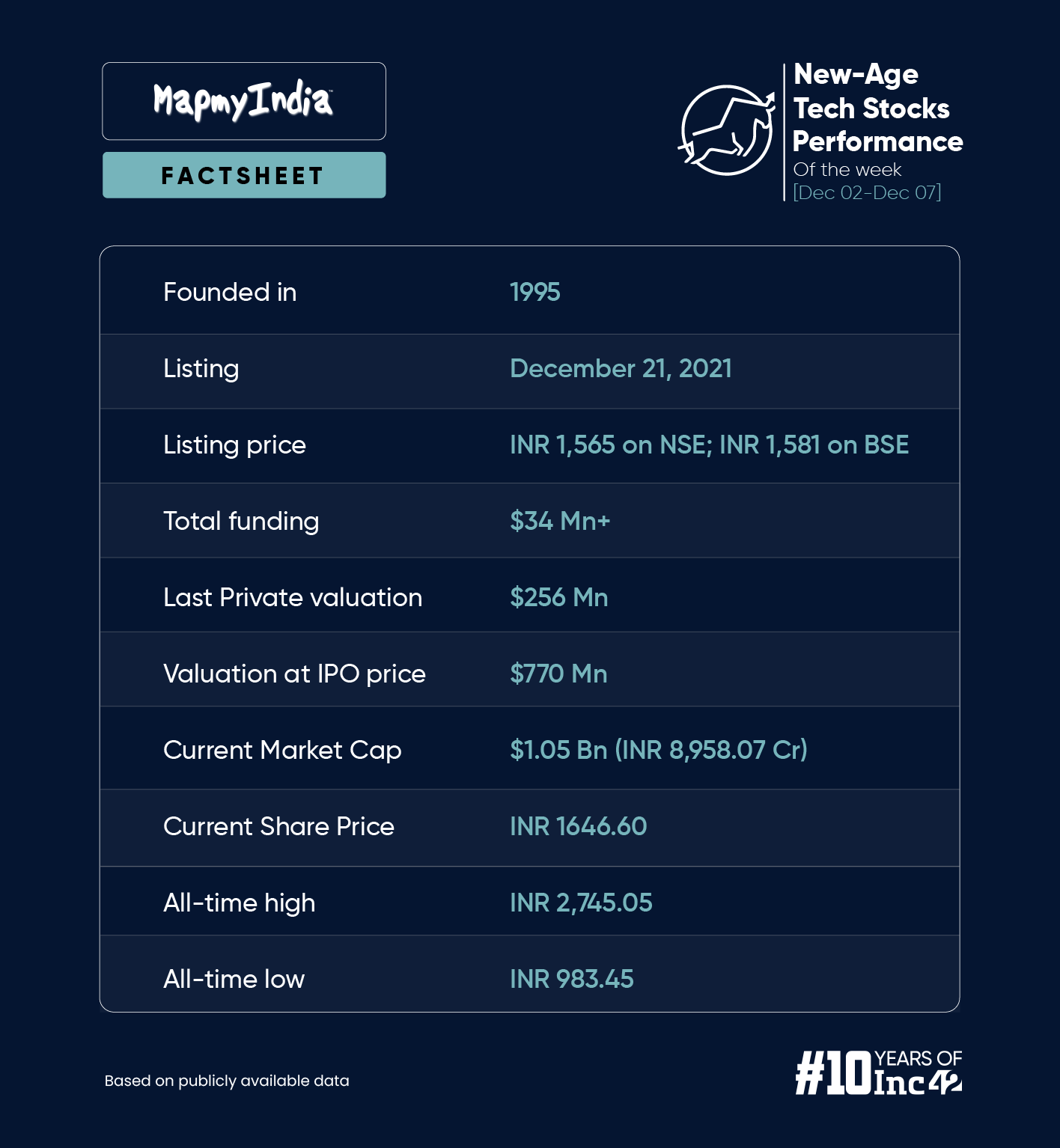

Tumultuous Week For MapmyIndia

The listed geotech company saw extreme bearish sentiment at the start of the week, leading the stock to crash to a 52-week low of INR 1,514.70 on Wednesday (December 4). However, the share prices recovered slightly to end 5.89% lower on a week-on-week basis at INR 1,646.60.

On November 29, MapmyIndia parent CE Info Systems announced that its CEO Rohan Verma will be departing from his active executive duties with effect from April 1, 2025 to focus on building a new B2C business as a separate entity. Despite remaining a non-executive director at MapmyIndia, Verma will hold a 90% stake in the new venture.

During an investor call held on December 3, the company clarified that it would hive off its B2C business, which includes its consumer facing map product Mappls. The new venture will own Mappls. MapmyIndia will retain access to Mappls for its core B2B and B2B2C operations, while the new entity will bear its own expenses and operate independently.

MapmyIndia has invested INR 10 Lakh for a 10% stake in the new entity and said it plans to subscribe to INR 35 Cr worth of compulsorily convertible debentures (CCDs) moving forward.

However, investors and analysts expressed dissatisfaction with the separation during the investor call, citing concerns about diversion of capital and potential impact on operational efficiency.

Critics, including proxy advisory firm InGovern, questioned the fairness of the deal’s terms and the potential conflict of interest arising from Verma’s continued role on both boards. Primarily, the spin-off of Mappls and its long-term impact on MapmyIndia’s financial health were the key concerns for the investors.

Following this, the outgoing CEO said that he would fund the new venture himself and would not take the INR 35 Cr investment via CCDs. However, MapmyIndia hasn’t made any disclosure on the bourses about these plans since the call.

Swiggy Jumps As Co Sets Profitability Target

Recently listed Swiggy declared its financial results this week, trimming its consolidated net loss by 4.78% to INR 625.53 Cr in Q2 FY25 from INR 657 Cr in the year-ago quarter. Revenue from operations zoomed 30% to INR 3,601.45 Cr during the quarter under review from INR 2,763.33 Cr in the year-ago period.

With the positive financial statement, shares of Swiggy zoomed 15.56% to end the week at INR 544.65.

The foodtech major said it aims to achieve adjusted EBITDA profitability on a consolidated level in the third quarter of the financial year 2025-26 (FY26).

In Q2, Swiggy’s bread-and-butter food delivery business raked in a profit of INR 121.93 Cr. While quick commerce arm Instamart incurred a loss of INR 317.25 Crthe Out of Home Consumption vertical’s loss stood at INR 9.26 Cr in the quarter.

Swiggy expects Instamart to achieve contribution break-even by Q3 FY26 and adjusted EBITDA breakeven by Q2 FY27. It is also looking to expand its 10-minute deliveries service by doubling its dark store count by March 2025 from the 523 dark stores it operated in March 2024.

Despite the upbeat financials, brokerage HDFC Securities downgraded Swiggy to ‘reduce’ from ‘add’ but bumped up its target price to INR 470 per share from INR 430 apiece earlier. The brokerage said that while key performance indicators for Swiggy are improving in food delivery and quick commerce segments, it still lags behind Zomato.