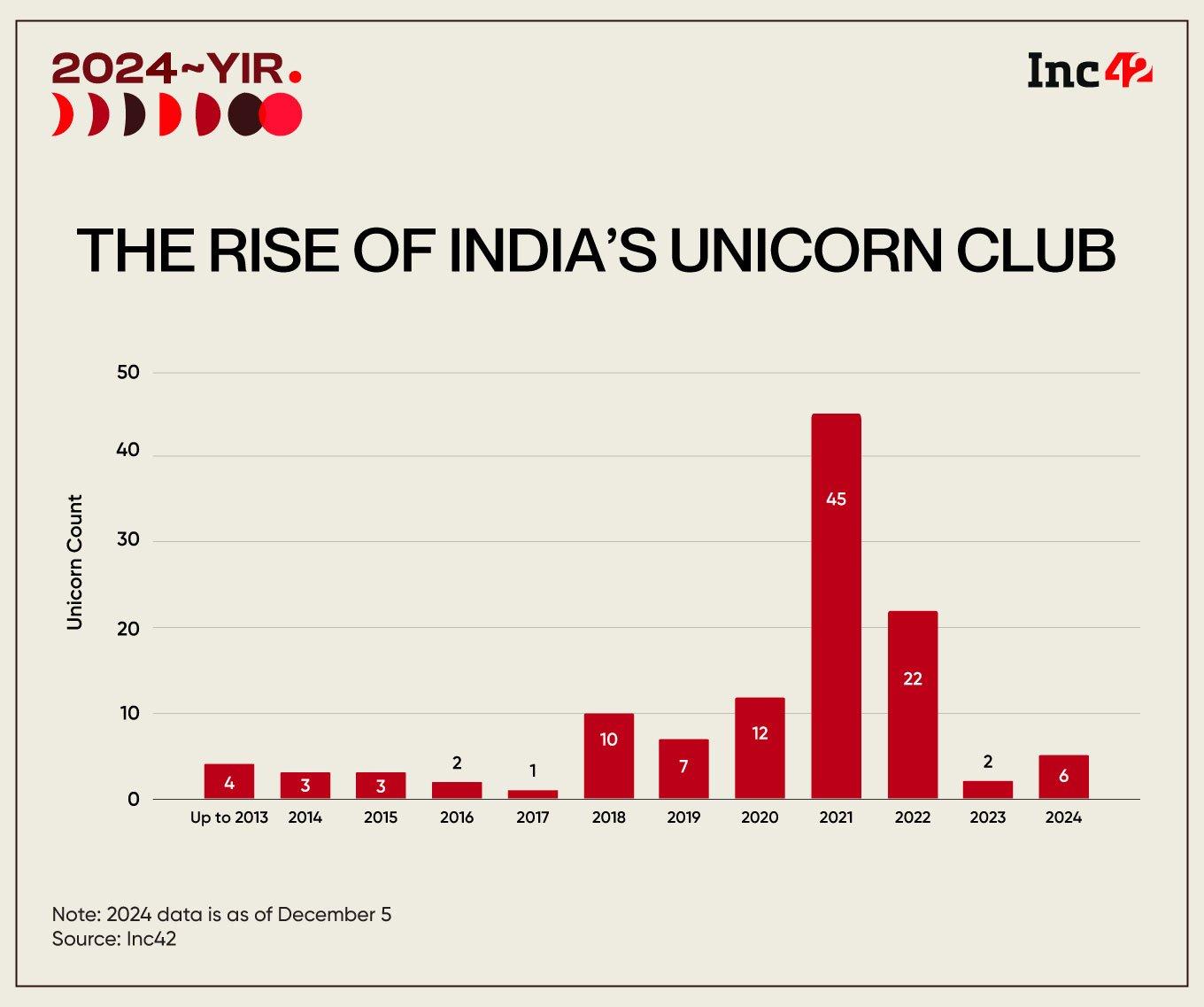

After a brief lull in 2023, the Indian startup ecosystem regained its momentum and churned out unicorns in healthy numbers in 2024. While just two startups achieved the coveted status last year on account of the extended funding winter, as many as six new-age tech companies entered the billion-dollar valuation club in 2024.

With the new additions, India is now home to 118 unicorns which have collectively raised more than $100 Bn in funding to date.

The 2024 numbers were somewhat of a consolation prize considering the entire startup ecosystem was grappling with a capital drought at the start of the year. However, the number of new entrants to the unicorn club in 2024 was far below 2022 and 2021, when India minted 21 and 42 unicorns, respectively.

As 2024 nears its end, it is a good time to look at how the world’s third-largest startup ecosystem charted a turnaround on the unicorn front in 2024 compared to 2023. Largely responsible for this surge was the higher capital inflow and investors somewhat reposing their faith in late-stage deals.

As per Inc42 data, Indian new-age tech companies bagged $8.7 Bn in the first nine months of the calendar year 2024, up more than 20% from $7.2 Bn raised during the same period last year.

While two SaaS startups, Perfios and publicly listed RateGain, joined the unicorn club in 2024, Moneyview was the fintech sector’s sole contribution to the unicorn tally.

India also got its first unicorn from the generative artificial intelligence (GenAI) sector when Bhavish Aggarwal-led Krutrim crossed the $1 Bn valuation mark in January 2024. Ather Energy was the newest entrant from the cleantech sector to the unicorn club, while the mobility space got its representation in the form of Rapido.

In terms of geographical spread, five out of the six unicorns minted this year came from the country’s startup powerhouse Bengaluru.

As the funding winter seems to be waning and India continues to further cement its position as one of the innovation capitals of the world, the year 2025 can see the country getting many more unicorns.

That said, as part of Inc42’s annual 2024 in Review series, we bring you a detailed look at the startup which entered the coveted unicorn club this year.

Editor’s Note: This is not a ranking of any kind, and the startups have been listed alphabetically.

Indian Startups That Entered The Unicorn Club In 2024

Ather Energy

Electric two-wheeler manufacturer Ather Energy turned a unicorn in August after securing funding of INR 600 Cr ($71 Mn) from the National Investment and Infrastructure Fund (NIIF). The round valued the company at $1.3 Bn.

Founded in 2013 by Tarun Mehta and Swapnil Jain, the IPO-bound startup is one of the major players in the Indian electric two-wheeler market. It also operates its own charging infrastructure and is involved in storing, distributing, and managing electric power and other auxiliary services.

Ather Energy has raised a total funding of $630 Mn to date and counts InnoVen Capital, Stride Ventures and Caladium Investment among its investors.

Ather Energy is eyeing a public listing, likely next year, at a valuation of around $2 Bn. it converted into a public limited entity in June and filed its draft red herring prospectus (DRHP) with the Securities and Exchange Board of India (SEBI) in September 2024.

Ather Energy’s operating revenue declined 1.5% to INR 1,753.8 Cr in the financial year 2023-24 (FY24) from INR 1,780.9 Cr in the previous fiscal year. Meanwhile, the net loss widened by over 22% to INR 1,059.7 Cr during the fiscal from INR 864.5 Cr in FY23.

The Bengaluru-based startup competes with the likes of Ola Electric, TVS Motor, Bajaj Auto, Hero MotorCorp, among others.

Krutrim

Ola Consumer cofounder Bhavish Aggarwal’s third startup Krutrim became India’s first AI unicorn in January 2024 after it bagged $50 Mn in a round led by Z47 (formerly Matrix Partners India).

Krutrim was also the first Indian startup to turn unicorn in the calendar year 2024 and the third fastest startup in India’s history to achieve a billion-dollar valuation.

Founded in 2023, Bengaluru-based startup Krutrim is building a family of large language models (LLMs). In August this year, Aggarwal also announced Krutrim’s plans. to develop India’s first homegrown family of chips for AI, general compute and Edge.

The startup has raised a total funding of $74 Mn to date. Of this, $24 Mn was raised via the debt route from existing investor Z47 in October 2024. Krutrim competes with global giants such as OpenAI and Google, as well as Indian startups such as SarvamAI.

moneyview

Lending tech startup Moneyview clinched the unicorn tag in September 2024 after raising $4.6 Mn in an equity funding round from Accel India and Nexus Ventures at a valuation of $1.2 Bn.

Founded in 2014 by Puneet Agarwal and Sanjay Aggarwal, Moneyview offers personal loans, personal finance management solutions, and credit trackers. It was the sixth Indian startup to enter the unicorn club in 2024.

Moneyview has raised a total funding of $188.30 Mn to date from Tiger Global, Accel, Ribbit Capital, Winter Capital, among others. Previously, it raised $75 Mn in Series E funding round led by the UK-based Apis Partners in 2022 at a valuation of $900 Mn.

The startup reported a 75% jump in its operating revenue to INR 1,012.01 Cr in FY24 from INR 576.75 Cr in FY23. Net profit rose 5.2% to INR 171.15 Cr during the year from INR 162.57 Cr in the previous fiscal.

Moneyview competes with the likes of Flexiloans, Fibe, among others.

Perfios

Fintech SaaS company Perfios entered the billion-dollar valuation club in March 2024 after it raised $80 Mn from Teachers’ Venture Growth (TVG), the late stage-focused investment arm of the Canadian pension fund Ontario Teachers’ Pension Plan.

The investment catapulted the valuation of Perfios beyond the $1 Bn mark, making it India’s second unicorn of 2024 after Krutrim.

Founded in 2008 by VR Govindarajan and Debasish Chakraborty, Perfios caters to clients in the B2B and B2C segments. Currently operating in 18 countries, the company claims to work with over 1,000 financial institutions.

It has raised a total funding of $441.21 Mn to date and counts the likes of Bessemer Venture Partners, Warburg Pincus, Stride Ventures, among others, as its backers.

The startup turned profitable in FY23 after reporting a consolidated net profit of INR 7.8 Cr on the back of a significant jump in its service income due to strong performance of its India business. The fintech startup’s operating revenue more than tripled year-on-year (YoY) to INR 406.8 Cr in the fiscal ended March 2023.

It is also looking to list on Indian bourses and is eyeing a $500 Mn initial public offering (IPO). Perfios is also in discussions to venture into the US market,

Rapido

Ride-hailing startup Rapido clinched the unicorn status in July 2024 after it secured a funding of $120 Mn from existing investor WestBridge Capital at a post-money valuation of a little over $1 Bn. The startup became the third unicorn of 2024.

Founded in 2015 by Rishikesh SR, Pavan Guntupalli, and Aravind Sanka, Rapido primarily operates in the bike taxi and auto transportation segments. In December last year, it also launched cab services in some citiesIn addition, it also offers peer-to-peer delivery services via Rapido Local.

Headquartered in Bengaluru, the startup has raised a total funding of $625.75 Mn to date from Swiggy, TVS Motors, Nexus Ventures, Shell Ventures, among others.

On the financial front, Rapido trimmed its loss by more than 45% to INR 370 Cr in FY24 from INR 675 Cr in the previous fiscal year.

It also claimed to have reduced its loss by more than 77% to INR 17 Cr in Q2 FY25 compared to INR 74 Cr during the corresponding quarter of previous fiscal.

Rapido competes with the likes of Ola, Uber and BluSmart across various categories.

RateGain

Founded in 2004 by Bhanu Chopra, RateGain offers SaaS solutions for travel and hospitality businesses. With over 3,200 customers and 700 partners spanning 100 countries, the company claims to help brands accelerate revenue generation through acquisition, retention, and wallet share expansion.

It raised a total funding of $221.74 Mn from the likes of Avaatar Ventures, Plutus Wealth Management, among others, before listing on the bourses at the end of 2021.

RateGain was the sole listed new-age company to enter the unicorn club in 2024. The Delhi NCR-based company entered the coveted club largely on the back of its profitable financials and growing investor interest in new-age tech stocks.

RateGain’s operating revenue surged 18% to INR 277.2 Cr in Q2 FY25 from INR 234.7 Cr in the year-ago period. The SaaS company’s profit after tax zoomed 74% to INR 52.2 Cr in the quarter under review from INR 30 Cr in Q2 FY24.

[Edited By Vinaykumar Rai]