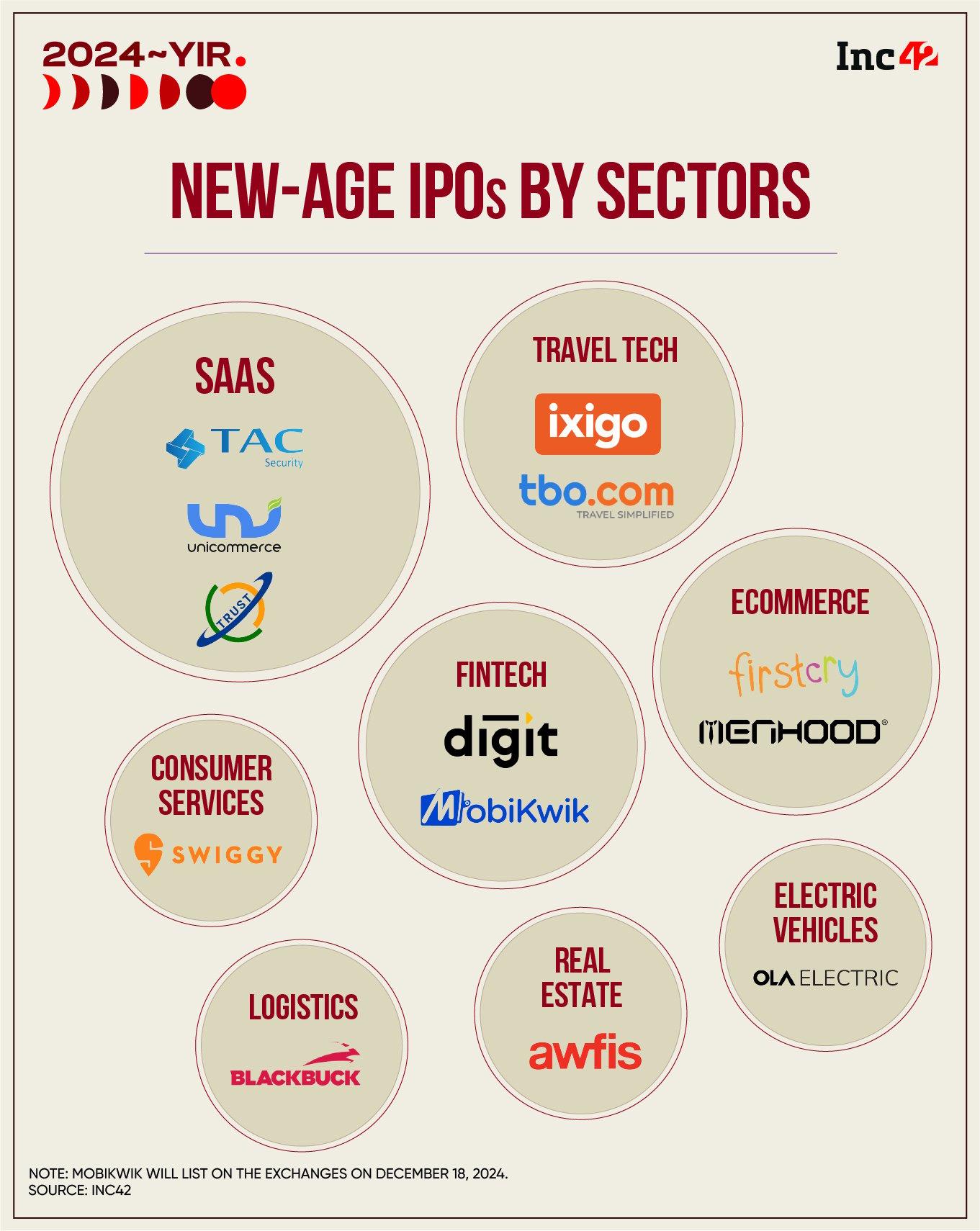

It was a bittersweet 2024 for the Indian startup ecosystem. While extended funding continued to loom over new-age tech companies, the homegrown startup landscape came of age as a record 12 startups went public this year so far.

Defying geopolitical tensions, funding winter, and macroeconomic pressures, India’s IPO market thrived thanks to steady economic growth, growing appetite among investors for new-age tech companies, favourable market conditions, and growing investor participation.

In a big contrast with 2023, when a mere five startups listed on the bourses, 2024 was a bright spot as giants like Go Digit General Insurance, Swiggy, FirstCry, Ola Electric, among others, made a beeline for the stock exchanges.

MobiKwik, which is scheduled to list on the exchanges on December 18, would become the 13th new-age tech company to go public in 2024.

Of the 12 new-age tech companies that listed on the bourses in 2024 so far, 11 made their debuts at a premium over their respective issue prices.

The cumulative size of the initial public offerings (IPOs) of these 12 companies was INR 29,070.57 Cr. Of this, a total of INR 19,292.6 Cr was raised via offers for sale (OFS) and INR 9,778 Cr came from fresh issue of shares.

Commenting on the rise in the IPOs of new-age tech companies, Krishna Appala, senior research analyst at Capitalmind, said, “There is a clear trend where a significant portion of IPOs in 2024 belong to the technology sector. This shift reflects the growing maturity of investors who now differentiate between traditional and new-age tech businesses.

Concepts like blitzscaling, front-loaded costs for long-term benefits, and the importance of scaling have gained acceptance among Indian investors.”

The stellar market performances of IPOs triggered a snowball effect as more and more startups lined up their plans for a public listing. As per Inc42 data, as many as 34 companies are in various stages of their IPOs, including big names like Ather Energy, Bira91, BlueStone, boAt, Infra.Market, among others.

This year also marked a significant win for investors, who reaped the rewards of years of investing in building startups. Another interesting theme this year was that most of the companies that went public were profitable or spelled out a clear path to profitability before making their public market debuts.

As 2024 comes to an end, we, at Inc42, saw it fit to showcase the new-age tech companies that hit stock exchanges in 2024 as part of our annual “Year In Review” series. So, without further ado, let’s dive deeper into the startup listings of the year.

Startups That Jumped On The IPO Bus In 2024

Editor’s Note: This is not a ranking of any kind and the featured companies have been listed in alphabetical order.

Awfis

Coworking space provider Awfis became the fifth homegrown startup to list on the bourses this year. It listed at a healthy premium of 12.8% on the BSE against the issue price of INR 383.

Awfis’s INR 598.9 Cr IPO comprised a fresh issue of shares worth INR 128 Cr and an OFS of up to 1.23 Cr shares. Promoter Peak XV Partners and Bisque Limited were among the investors that sold their stakes via the OFS.

Awfis filed its DRHP with SEBI in December last year and the market regulator greenlit the company’s public issue in April 2024. Its IPO received an overwhelming response with 108.56X oversubscription.

Founded in 2015 by Amit Ramani, Awfis has evolved from just being a coworking network to a tech-enabled workspace solutions platform, catering to freelancers, startups, SMEs, large corporates, and MNCs.

Awfis posted a consolidated profit of INR 38.67 Cr in Q2 FY25 as against a net loss of INR 4.34 Cr in the year-ago period. Operating revenue soared 40.46% to INR 292.38 Cr during the quarter under review from INR 208.15 Cr in Q2 FY24.

BlackBuck

Shares of Zinka Logistics, the parent company of BlackBuck, listed on the stock exchanges on November 22. The public issue of the logistics major saw a muted response and its shares were listed at INR 279.05 on the BSE, a modest premium of 2.2% to the IPO issue price of INR 273.

BlackBuck’s INR 1,114.72 Cr IPO was a combination of fresh issue of shares worth INR 550 Cr and an OFS component of more than 2.06 Cr shares. The public issue was oversubscribed 1.8X.

The Flipkart-backed logistics unicorn filed its IPO papers with SEBI in July 2024 and received approval from the SEBI for its IPO in October.

Founded in 2015 by Rajesh Yabaji, Chanakya Hridaya and Rama Subramaniam, BlackBuck operates an online marketplace for inter-city full truck load (FTL) transportation. It claims to be the largest online trucking platform in India, and connects suppliers with truckers.

Backed by the likes of Tiger Global, Accel, Peak XV Partners and Goldman Sachs, BlackBuck raised more than $360 Mn in funding ahead of its IPO.

On the financial front, BlackBuck posted a net profit of INR 28.67 Cr in Q1 FY25 as against a net loss of INR 35.93 Cr in the corresponding quarter last year. Revenue from operations jumped nearly 55% to INR 92.16 Cr during the quarter under review from INR 59.46 Cr in Q1 FY24.

FirstCry

Kids-focussed omnichannel marketplace FirstCry listed on the stock exchanges in August 2024. The stock listed at a premium of 34.4% at INR 625 on the BSE. On NSE, it listed at a 40% premium to the issue price of INR 549.

FirstCry’s INR 4,194 Cr IPO comprised a fresh issue of shares worth INR 1,816 Cr and an OFS component of 5.4 Cr equity shares. However, the company later reduced the size of its fresh issue by around 8% to INR 1,666 Cr, as per its RHP.

The Pune-based startup refiled its draft IPO prospectus in April following a directive from SEBI to include key metrics in its DRHP, first filed in December 2023. The company received the market watchdog’s approval for a public listing in July.

FirstCry clocked sales of INR 1,935.85 Cr in Q2 FY25, up 26.7% from INR 1,527.68 Cr in Q2 FY24. Meanwhile, its loss declined almost 47.4% YoY to INR 62.85 Cr in the quarter ended September 2024.

Go Digit General Insurance

Go Digit General Insurance became the fourth Indian startup of the year to make its public market debut on May 23. Its INR 2,614.6 Cr IPO received a positive response with 9.6X subscription.

The insurtech company’s shares were listed at INR 286 apiece on the NSE, a 5.1% premium to the issue price of INR 272. Similarly on the BSE, the Virat Kohli-backed startup’s shares listed at INR 281 apiece, 3.3% higher than the issue price.

The IPO offer consisted of a fresh issue of shares worth INR 1,125 Cr and an offer for sale (OFS) of 5.47 Cr equity shares.

The insurtech unicorn refiled its DRHP with SEBI in March 2023 after the capital markets regulator flagged concerns over its employee stock appreciation rights scheme. A year later in March 2024, the startup received approval for its IPO.

Founded in 2017 by Kamesh Goyal, Go Digit offers insurance policies across verticals like health, motor vehicle, travel, property, and more.

Go Digit’s profit after tax (PAT) surged 221% YoY to INR 89 Cr in Q2 FY25 from INR 27.69 Cr in the year-ago period. Gross written premium rose 14.2% to INR 2,368.57 Cr in the quarter ended September 2024 from INR 2,073.84 Cr in the year-ago period.

ixigo

Another startup that got listed in 2024 was online travel aggregator (OTA) ixigo. The company listed on the bourses on June 18, becoming the sixth new-age tech company to do so in 2024. It made its market debut at 138.10 per share on the NSE, a premium of 48.5% to the issue price of INR 93.

ixigo’s INR 740.1 Cr IPO included a fresh equity issue of INR 120 Cr and an OFS of 6.67 Cr shares, totalling to INR 620 Cr. Its IPO was oversubscribed 98X.

Ahead of the IPO opening, the company raised INR 333 Cr from 23 anchor investors, including the likes of SBI Magnum Children’s Benefit Fund, the Government of Singapore, Tata Investment Corporation Limited, and Bajaj Allianz Life Insurance Company.

The company previously filed for an IPO in 2021 with the aim of raising INR 1,600 Cr. However, it postponed its public offer despite receiving approval from SEBI, citing macroeconomic conditions.

On the financial front, ixigo posted a PAT of INR 13.08 Cr in Q2 FY25, down 51% from INR 26.70 Cr in the year-ago period. Revenue from operations jumped 26% to INR 206.47 Cr during the quarter from INR 163.91 Cr in Q2 FY24.

Menhood

Men’s grooming brand Menhood listed on NSE Emerge on July 24 at INR 96, a premium of 28% to the issue price of INR 75. Its public issue saw a healthy response and was oversubscribed 157.5X.

Menhood’s INR 572 Cr public issue comprised a fresh issue of 25.95 Lakh shares of face value of INR 10 each.

The startup’s parent entity Macobs Technologies Limited filed its DRHP in January 2024.

Founded in 2019 by Dushyant Gandotra, Menhood is a D2C men’s grooming brand that sells products such as trimmers, intimate perfumes, intimate wash and moisturiser, among others.

In the first half (H1) of FY25, Manhood’s PAT zoomed 190% to INR 1.84 Cr from INR 63.5 Lakh during the same period last fiscal. Operating revenue zoomed 86% to INR 16.55 Cr during the period under review from INR 8.90 Cr in H1 FY24.

Ola Electric

In what was touted as the first EV IPO in India, Bengaluru-based Ola Electric made its market debut on the bourses on August 9. The stock listed flat at INR 75.99 apiece on the BSE as against the issue price of INR 76.

Ola Electric’s INR 6,145 Cr IPO included a fresh issue of shares worth up to INR 5,500 Cr and an OFS component of up to 8.49 Cr shares. Its public issue opened on August 2 and was subscribed 4.27X at the end of the last day of the bidding on August 6.

The EV startup filed its DRHP with SEBI in December 2023 and secured approval from the markets regulator for its IPO in late June. Ahead of the market debut, the EV major raised INR 2,763 Cr from 84 anchor investors, including SBI, HDFC, Nippon Life, Nomura Asset Management, Government Pension Fund of Norway, among others, at INR 76 per equity share.

In Q2 FY25, Ola Electric managed to narrow its loss by 5.5% to INR 495 Cr from INR 524 Cr in the year-ago quarter. Meanwhile, it reported sales of INR 1,214 Cr during the period under review, up 39% from INR 873 Cr in Q2 FY24.

Swiggy

Foodtech unicorn Swiggy became the 11th Indian startup to debut on the bourses in 2024. The Bengaluru-based startup made its public debut on November 13.

Its much-awaited INR 11,324 Cr IPO opened for subscription on November 6 and closed on November 8, receiving bids for approximately 57.53 Cr shares against the 16.01 Cr shares on offer

Swiggy’s public listing journey began in April with the filing of its DRHP via a confidential pre-filing route. In September, it updated its IPO papers and underlined plans for fresh issuance of shares worth INR 3,750 Cr and an offer for sale component of 18.57 Cr shares.

Following this, on October 28, Swiggy filed its red herring prospectus (RHP) with SEBI, adjusting the fresh issue size to INR 4,499 Cr and trimming the size of the OFS component to up to 17.5 Cr shares from 18.53 Cr previously.

Swiggy secured INR 5,085 Cr from anchor investors on November 5 at INR 390 per share.

Finally, the foodtech major made its market debut on November 13.The stock listed at INR 412, a 5.6% premium to the IPO price, on the BSE. Similarly, it was listed at INR 420 on the NSE, a premium of 8% to the issue price.

Founded in 2014 by Nandan Reddy, Phani Kishan Addepalli, Rahul Jaimini, Sriharsha Majety, Swiggy began operations as an online food delivery platform in 2014. It diversified its offerings and forayed into the grocery delivery business with Swiggy Instamart in 2020.

On the financial front, the company trimmed its net loss by 4.78% to INR 625.53 Cr in Q2 FY25 from INR 657 Cr in the year-ago quarter. Meanwhile, revenue grew 30% to INR 3,601.45 Cr during the quarter under review from INR 2,763.33 Cr in Q2 FY24.

TAC Infosec

TAC Infosec listed on NSE Emerge on April 5 at a premium of 173.6% to the issue price of INR 106. Its IPO also received an overwhelming response with 392.5X subscription.

TAC Infosec’s INR 30 Cr IPO consisted solely of a fresh issue of 28.29 Lakh equity shares.

The Vijay Kedia-backed startup filed its DRHP in January to list on NSE Emerge. The IPO opened for subscription from March 27 to April 2.

Founded in 2016, TAC Infosec (also known as TAC Security) is a SaaS-based cybersecurity company. It offers risk-based vulnerability management and assessment solutions, cybersecurity quantification, and penetration testing to enterprises.

Its net profit soared 240% to INR 6.52 Cr in H1 FY25 from INR 1.92 Cr in the year-ago period. Meanwhile, operating revenue zoomed 162.4% to INR 13.15 Cr during the period under review from INR 5.01 Cr in H1 FY24

TBO Tek

TBO Tek made a strong entry in the public markets on May 15. Its shares got listed at INR 1,426, a 55% premium over the issue price of INR 920, on the NSE. On the BSE, the stock got listed at a 50% premium at INR 1,380.

TBO Tek’s INR 1,550.8 Cr IPO witnessed an overwhelming response, with investors oversubscribing to its public issue 86.7X. The IPO received bids for 80.5 Cr shares as against 92.85 Lakh shares on offer.

Founded in 2006, TBO Tek provides travel solutions to travel agents and tour operators. It offers white-label solutions, hotel and flight booking APIs and dynamic packages, among others.

On the financial front, the TBO Tek posted a 7% jump in PAT to INR 60.1 Cr in Q2 FY25 from INR 56.1 Cr in the year-ago quarter. Revenue from operations stood at INR 450.7 Cr during the period under review, a 28% increase from INR 352.3 Cr in Q2 FY24.

Trust Fintech

Trust Fintech was the first Indian startup in 2024 to make its market debut. Shares of the company listed on April 4 at a premium of 42% on the NSE’s small and medium enterprise (SME) platform, NSE Emerge. The INR 63.45 Cr IPO witnessed a substantial subscription of 101X.

The IPO comprised a fresh issue of 62.82 Lakh equity shares and its price band was set in the range of INR 95-101 apiece.

The fintech SaaS company filed its DRHP with NSE Emerge in February. The public issue was open for subscription from March 26 to March 28 and was listed on the SME platform on April 4.

Founded by Hemant Chafale, Heramb Ramkrishna, and Mandar Kishor Deo, Trust Fintech offers SaaS products and fintech solutions for ERP implementation, and offshore IT services for the BFSI sector. It caters to district central cooperative banks, urban cooperative banks, rural banks, commercial banks, credit cooperative societies, and non-banking financial companies (NBFCs).

Its net profit declined to INR 4.85 Cr in the first half (H1) of the financial year 2024-25 (FY25) from INR 12.5 Cr in the year ago period. Operating revenue also tanked by more than half to INR 16.7 Cr during the six-month period as against INR 35.04 Cr in H1 FY24.

Unicommerce

The enterprise tech startup made a stellar listing on the BSE on August 13 at INR 230 per share, a premium of 112.96% to its issue price of INR 108. Similarly, on the NSE, the stock was listed at INR 235, a premium of 117.59%.

Unicommerce’s INR 103.5 Cr IPO, which comprised only OFS component of 2.56 Cr shares, was oversubscribed 168.3X.

Unicommerce filed its DRHP in January this year and received regulatory approval on July 1. Ahead of its IPO, Unicommerce raised INR 124.4 Cr from 14 anchor investors.

Founded in 2012, Unicommerce helps businesses manage inventory across all online marketplaces. It claims to be the largest ecommerce enablement SaaS platform in transaction processing in terms of revenues (in FY23).

Unicommerce’s net profit stood at INR 4.47 Cr in Q2 FY25 as against INR 3.69 Cr in the year-ago period. Operating revenue stood at INR 29.30 Cr in the quarter ended September 2024, up 13% from INR 25.93 Cr in Q2 FY24.