Till Friday evening, Zepto

The startup has announced 2X-plus revenue growth and has shown great control on its losses. And now with a plan to push Zepto Cafe as a separate app, Zepto is also stepping into the food delivery waters.

So far, Zepto has delivered on the execution front for quick commerce, and outpaced Blinkit and Swiggy Instamart in terms of revenue. In fact, as of FY24, Zepto has 2X and 4X the revenue of Blinkit and Swiggy respectively as of FY24, which is staggering for such a new company and given the strengths of Zomato and Swiggy in this space.

What’s next for Zepto and how much will the Zepto Cafe entry change the company going forward? Let’s answer, but first a look at Inc42’s Year In Review series which was rolled out this week and will be our big focus all the way till the end of the year.

- The Acquisitions Game: While the first half of the year still faced the ripple effects of the funding winter, the second half hogged the limelight for some notable acquisitions, turning over a new leaf for the Indian startup ecosystem.

- Startups That Bit The Dust, From Koo to Kenko Health to Stoa — at least a dozen startups shut shop in 2024, most of them owing to a cash crunch while others due to unsustainable business models

- The Make In India Wave: Tech giants continued to push the envelope in 2024 when it comes to manufacturing in India, with Apple, Google and others leading the charge with a host of domestic manufacturing partners.

- Startup Layoffs In 2024: In terms of layoffs, there was some respite in 2024 after a terrible two years. Even though more than 9,000 startup employees lost their jobs in the year, that’s just half of what we saw in 2023. Will 2025 bring more relief?

How Zepto Changed Its Tune

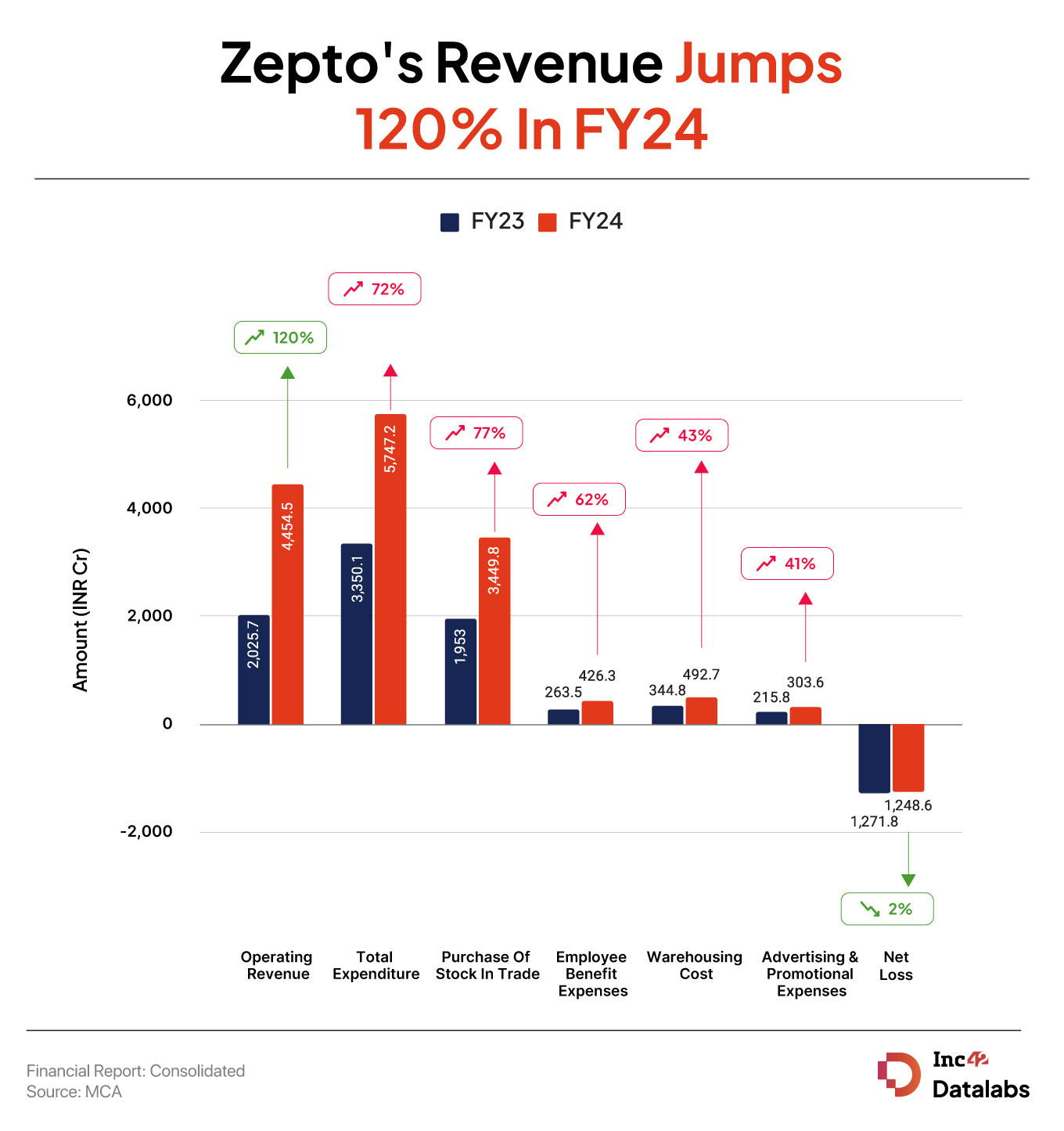

Diving into the financials, we can see that Zepto saw the revenue surge along with a significant rise in spending.

Revenue more than doubled to INR 4,454 Cr, compared to Blinkit’s INR 2,300 Cr in FY24 and Swiggy Instamart’s INR 1,100 Cr. That’s an achievement by itself.

Zepto spent INR 5,747.21 Cr in FY24, a 72% increase from FY23, with procurement costs dominating at INR 3,449.83 Cr, or 60% of total expenses. However, loss as a percentage of its revenue dropped to 28% in FY24 from 63% in FY23, which indicates improving profitability.

Cofounder and CEO Aadit Palicha said the company is on course to hit profits in the near term based on this unit economics trajectory. “We expect to continue this growth momentum with a clear path to PAT profitability in the near term,” he added.

What exactly changed for Zepto in the past year? The biggest change has come in reduced contribution margin loss or the loss per order after deducting variable costs (product price, delivery fees, etc) but before deducting fixed expenses such as employee salaries and marketing.

Contribution margin loss was around INR 8 at the end of 2023, and improved to INR 0.5 in April. This massive change proves that Zepto doubled down on profitability instead of growth earlier this year. This is also when Palicha’s first comments around profitability started appearing.

As per sources close to the shareholder group, Zepto focused largely on unit economics between February to April in 2024, which has reflected to some extent in the improved margins. This is expected to improve further, but perhaps not immediately, because right now the company is looking to add to its dark store network and come closer to Blinkit’s base.

Expansion Fueled By Billions

By March 2025, Zepto is likely to have more than 1,200 dark stores around India, and many of these would also be part of the Zepto Cafe push. Anything over 1,000 dark stores would put Zepto in the same ballpark as Blinkit and Swiggy Instamart.

This scale is a moat for Blinkit, Swiggy and Zepto against the likes of BBNow, Flipkart or Amazon which are still transitioning to quick commerce in some ways.

For Zepto, accelerating the dark store expansion is largely only possible because the management went back to investors with its improved numbers by March this year, and was able to convince them to infuse billions. Plus, the spotlight on Blinkit’s improving profits also helped Zepto in showing investors the upside of the segment.

The fact that quick commerce itself was becoming a beast was another factor in Zepto’s favor in a year that has been relatively muted in terms of funding. Zepto’s $1.3 Bn round is more than 10% of all funding for startups this year. It underscores the company’s rise to prominence, but nothing cements it like great financial performance.

Zepto Cafe In The Picture

So credit where it’s due for Zepto, but now perhaps comes the tricky part. Zepto Cafe will be a separate app, Palicha has said, and with it the startup is entering Zomato and Swiggy territory. Not exactly, but it’s still closer to home for the two veterans.

Zepto Cafe will come up against Blinkit’s Bistro and Swiggy Instacafe or Swiggy Bolt. The 10-minute delivery war is shifting its battleground.

There may well be more on the horizon for Zepto. Quick commerce players are testing the waters when it comes to pharmacy, electronics and fashion. Other ecommerce giants are moving into this space, with strengths in each of these verticals.

Zepto has definitely made the most of the quick commerce limelight thus far. The company’s recent move to Bengaluru has also thrown a challenge to Swiggy directly, and with billions of dollars in its coffers, Zepto has the ammunition to attract talent and partnerships.

Zomato and Swiggy are also ready for this test.

Zomato’s first big fundraise — the INR 8,500 Cr QIP — since its 2021 IPO came just a couple of weeks after its rival Swiggy’s public debut, where the company raised close to $1.4 Bn.

Like Zomato, Swiggy is ready to launch multiple new services in the coming year to bolster its food delivery and quick commerce plays.Previously, Zomato CEO Deepinder Goyal had claimed that QIP was a key move for Zomato as the company needed additional capital because of “ the competition landscape and much larger scale of our business today.”

There’s no doubt that Zepto is part of that competition. However, both Zomato and Swiggy have shown better profitability on food delivery after years of operations and trust building in the market.

Breaking into this will not be easy, even if Zepto Cafe is not going after the full food delivery pie. The logical extension of this model is food delivery.

In fact, Zomato today enjoys a 58% market share in the food delivery segment as of June 2024, according to a Motilal Oswal report. Given that it’s a near duopoly, Swiggy had about 42% share. It’s not clear how much of this market share will be lost to quick commerce cafes.

According to the brokerage, Zomato has grabbed market share at the expense of Swiggy, driven by “stronger execution”, which would be critical for Zepto in the long run with Zepto Cafe.

With its FY24 numbers, Zepto seems to have cracked the business model to a large extent. Now it has to show how well it handles potential challenges such as government regulations for quick commerce, amid concerns of kiranas and traditional retailers being displaced.

Zepto’s fundraise had raised some eyebrows. There’s always skepticism when one company tends to dominate the investment activity in this way, but it’s also a sign that it’s in the big leagues. The revenue surge is also a testament to new-age consumer services in India.

Sunday Roundup: Tech Stocks, Startup Funding & More

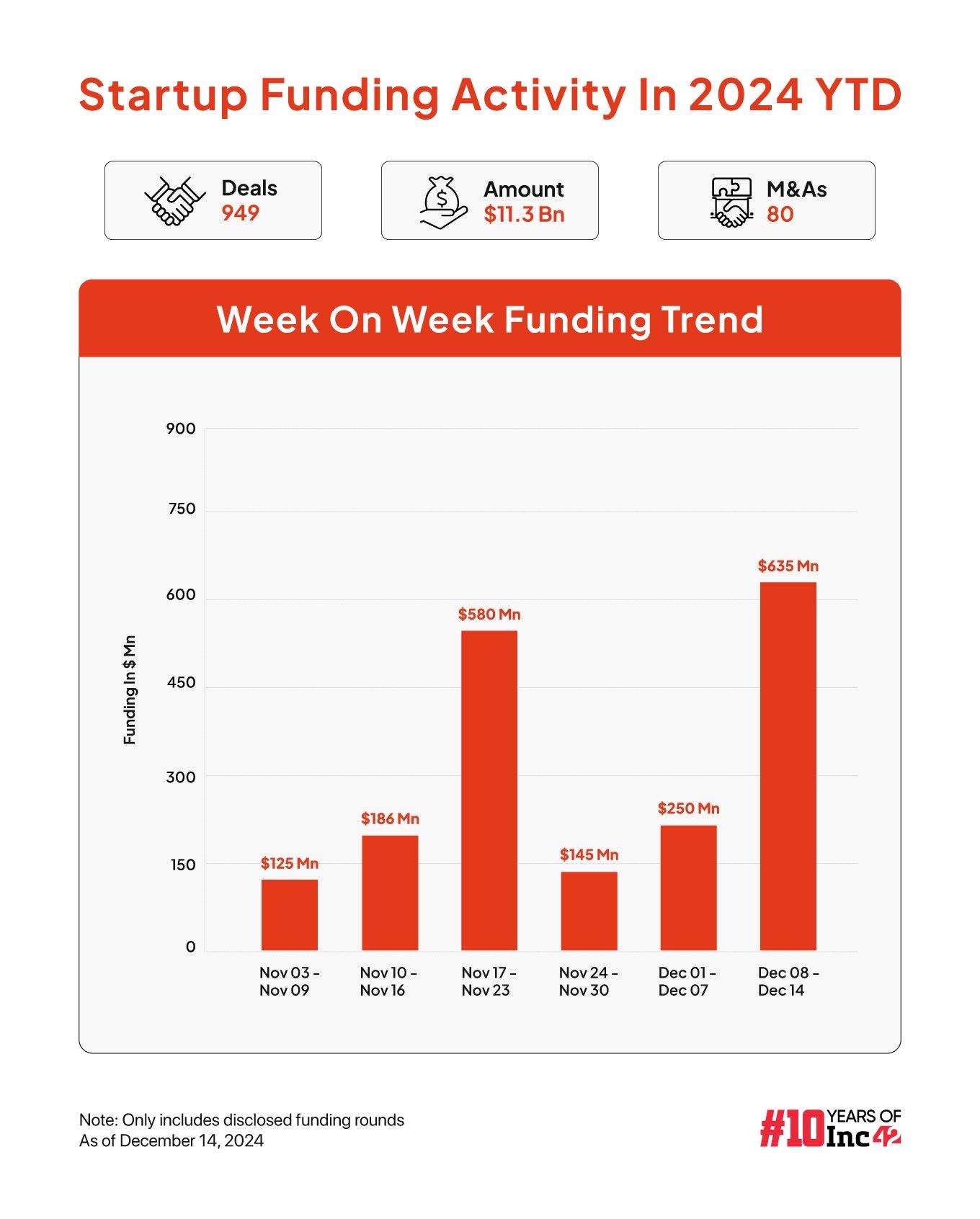

- Funding Shoots Up: Between December 9 and 13, Indian startups cumulatively raised $635.8 Mn via 25 deals, up 155% from the $249.6 Mn secured across 18 deals in the preceding week.

- Zerodha’s Revenue Milestone: The stock broking major’s consolidated revenue neared the INR 10K Cr mark in FY24, with INR 5,496 Cr in profits for the year

- Bluestone Takes IPO Step: Omnichannel jewelery company Bluestone has filed its DRHP with SEBI for an INR 1,000 Cr-plus IPO, after reporting a net loss of INR 142.2 Cr in FY24.

- MobiKwik Attracts A Crowd: MobiKwik’s issue closed with an oversubscription of 119.38X, becoming one of the most heavily bid public issues among new-age tech companies.

- BlackBuck Suffers Losses: Logistics major BlackBuck slipped into the red in the September quarter, reporting a loss of INR 308 Cr, weeks after its public listing.