The year 2024 saw a flurry of initial public offerings (IPOs) of new-age tech companies, as startups brushed off the funding winter and made a beeline for the bourses. While the funding winter continued to loom large in the private market, especially in the first half of the year, public market investors did not hesitate from investing in new-age tech IPOs.

IPO-bound companies took several steps, like taking valuation cuts and reducing the size of public issue, to attract investors for their IPO. Besides, the big returns given by previously listed new-age tech companies like Zomato and RateGain also boosted the confidence of investors, resulting in oversubscription for all new-age tech IPOs this year.

Almost in line with Inc42’s IPO predictions last year, more than 10 startups (13, to be precise) went ahead with their IPOs in India and got listed on mainboard and SME platforms. Many of these startups had been eyeing their IPOs since 2021.

The public listing boom of these companies this year was also driven by higher activity in the broader IPO market. On the back of robust retail investors’ sentiment, a significant rise in mutual fund investments, and increased investments by foreign institutional investors in the primary market, companies raised over INR 1.2 Lakh Cr in total from IPOs this year.

In that, the 13 new-age tech companies raised more than INR 29,000 Cr this year. Swiggy’s IPO alone was worth INR 11,300 Cr.

The successful IPOs of the new-age tech companies also provided partial exits to top venture capital (VC) and private equity (PEs) firms by selling stakes via offers for sale (OFS), resulting in them minting big returns on their early bets.

Some of the most prominent investors in startups that listed in 2024 were Peak XV Partners, Accel, Matrix Partners, Tiger Global, SoftBank, Temasek, Elevation Capital, Prosus, and Alpha Wave, among others. Some of these investors even raked in over 30X returns from one IPO.

As part of Inc42’s flagship ‘Year In Review’ series, let’s take a look at some of the top investors who secured partial exits this year through the IPOs of new-age tech companies in their portfolios.

Editor’s Note: This is neither an exhaustive list nor a ranking of any kind. The investors have been arranged alphabetically.

Accel Gains Over 38X From Swiggy & BlackBuck IPO

Accel saw two of its portfolio companies, Swiggy and BlackBuck, getting listed this year.

Food delivery and quick commerce major Swiggy’s public listing was one of the major events of 2024. Its public issue comprised a fresh issue of shares worth INR 4,499 Cr and an OFS component of 17.5 Cr shares.

Accel, which first invested in Swiggy in 2015 during its Series A funding round, sold about 1.06 Cr shares via OFS. While the VC major acquired these shares at an average price of INR 11.17 apiece, it sold them for INR 290 each for a total of over INR 412 Cr.

Accel raked in 34.9X returns on its investment from these shares.

BlackBuck, which went public right after Swiggy, brought in 4.3X returns for the investor.

Having been an investor in the company since 2015, Accel India IV (Mauritius) Limited held 2.3 Cr equity shares of the truck management platform pre-IPO. It had acquired these shares at an average cost of INR 62.71 apiece. Of these, Accel sold 43.1 Lakh shares via the OFS for about INR 117.6 Cr.

In the upcoming months, several other portfolio companies of Accel like BlueStone, Infra.Market, and Captain Fresh are also expected to go public.

Alpha Wave Triples Its Invested Capital In Ola Electric & Swiggy

Alpha Wave, which first invested in Swiggy in 2021, made 2.2X returns by offloading a part of its stake in the company.

Ahead of the foodtech major’s IPO, the global investment company held almost 1.9 Cr shares of Swiggy which it acquired at an average cost of INR 178.9 per share, translating into a total of INR 340 Cr. Of that, Alpha Wave sold more than a quarter, or 55.7 Lakh shares, of its stake in Swiggy for a total of INR 161.6 Cr.

Similarly, Alpha Wave made 1.22X returns on its investment by selling 37.83 Lakh shares of EV major Ola Electric worth INR 28.75 Cr. While the firm had acquired these shares at an average cost of INR 62.38 apiece, it sold them at INR 76 per share.

Several of Alpha Wave’s other Indian portfolio startups, including Lenskart, Ola, and Pine Labs, are also getting ready for an IPO next year.

Elevation Capital Emerges A Clear Winner

Of all the top investment firms who sold partial their stakes in the 2024 startup IPOs, Elevation Capital (formerly SAIF Partners) emerged as the top gainer, making a whopping 47X gains.

Two of Elevation Capital’s portfolio companies, ixigo and Swiggy, went public this year. As part of Swiggy’s INR 11,000 Cr+ IPO, Elevation Capital offloaded 73.96 Lakh shares worth over INR 288 Cr. The average acquisition price of these shares was INR 11.44 apiece. The partial stake sale in Swiggy translated to 34.1X returns on its investment.

Ahead of Swiggy, ixigo also went public. Elevation Capital held a significant 23.37% stake in the travel tech startup pre-IPO. As part of the OFS, the VC firm sold 1.94 Cr shares out of the 8.8 Cr shares it held pre-IPO. While it had acquired these shares at an average cost of INR 7.14 apiece, it sold them for INR 93 per equity share. The stake sale gave Elevation Capital 13X returns on its investment in the startup.

Elevation Capital also saw one of its early backers FirstCry go public this year. However, the VC firm exited the omnichannel kidswear brand in 2021 with 10X+ gains.

Currently, SUGAR Cosmetics from the VC fund’s portfolio is also gearing up for an IPO in the near future.

Flipkart Gains From BlackBuck Bet

Flipkart Logistics Private Limited first invested in trucking platform BlackBuck in 2015 during its $6 Mn Series A funding round. Over the years, the ecommerce platform kept increasing its stake in the company and held a 13.2% stake, or 2.1 Cr shares, in BlackBuck pre-IPO.

It is important to note that in 2018, Flipkart transferred its ownership i Flipkart Logistics Private Limited to its Singapore-based subsidiary Quickroutes International Private Limited. Hence, the 13.2% stake was held by Quickroutes.

During BlackBuck’s IPO, Quickroutes offloaded 55.3 Lakh shares for around INR 151.1 Cr as part of the OFS. The company had acquired these shares for about INR 28.8 Cr, translating to 5.24X returns on the investment.

Z47 Scores 9X Returns From Ola Electric

Z47 (erstwhile known as Matrix Partners) first invested in the Bhavish Aggarwal-led electric mobility startup in 2019, along with Tiger Global, in its Series A funding round. Following this, the VC firm kept infusing capital in Ola Electric in several follow-up rounds.

Ahead of the IPO, Matrix Partners via Matrix Partners India Investments III, LLC held 12.66 Cr shares of Ola Electric, which it acquired at a weighted average price of INR 8.22 per equity share.

As part of the OFS, the firm sold 37.27 Lakh shares for around INR 28.33 Cr, translating to 9.2X returns on its investment for these shares.

Z47 continues to hold 30.2 Lakh shares of Ola Electric via Matrix Partners India III AIF Trust.

In the coming months, Ola Consumer from the VC firm’s portfolio is expected to go public. Its other IPO-bound portfolio startups include Razorpay, Captain Fresh, and OfBusiness.

Swiggy Delivers 26X Gains For Norwest Venture

US-based Norwest Venture Partners was one of the early backers of Swiggy. Norwest Venture Partners VII-A Mauritius first invested in the company in 2015 in its Series B funding round.

Ahead of Swiggy’s IPO, Norwest held 7.06 Cr shares of the company which it acquired at an average cost of INR 14.82 per share. By selling 64.06 Lakh shares as part of the OFS, it raked in 26.3X returns on its investment for these shares.

Going ahead, Norwest will have more opportunities to rake in big gains from its India investments as OfBusiness and Mensa Brands from its portfolio are eyeing IPOs.

Peak XV Partners’ Mixed Performance

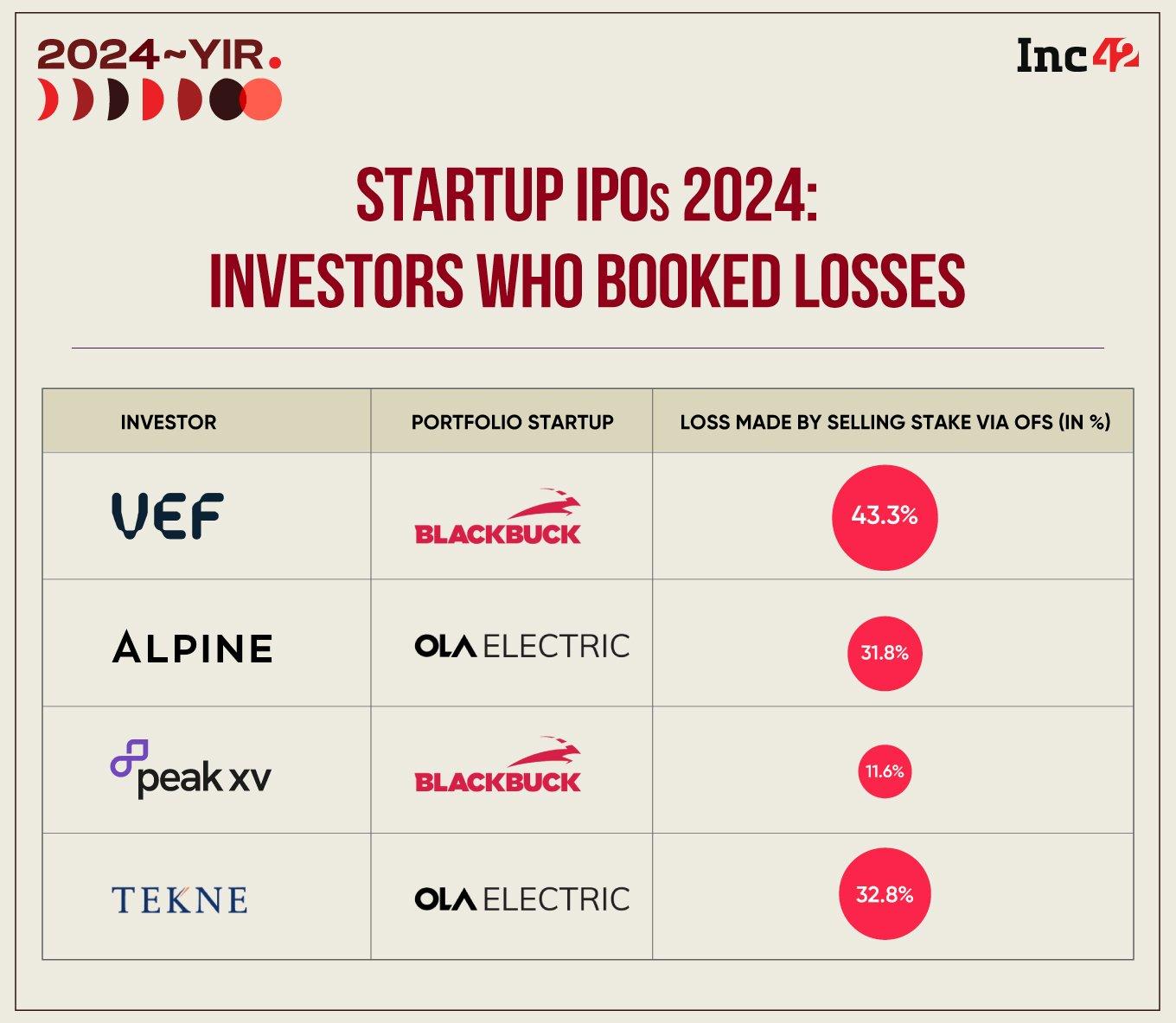

Peak XV Partners (formerly Sequoia Capital India) sold partial stakes during the IPO of three of its portfolio startups in 2024 but not all led to gains.

While the VC major raked in 8.2X and 2.8X gains from the IPO of ixigo and Awfis, its partial stake sale via BlackBuck IPO led to a loss of 11.6% on the invested capital.

Ahead of ixigo’s IPO, Peak XV held a 15.66% stake in the travel tech startup with a total of 5.92 Cr shares. Of that, the VC major offloaded 1.3 Cr shares at INR 93 apiece as against the average acquisition cost of INR 11.32 per share.

Peak XV also offloaded almost 70 Lakh shares of ixigo at INR 93 per equity share in a pre-IPO secondary sale for INR 65 Cr.

The VC firm held 1.5 Cr shares of flexible workspace startup Awfis ahead of its public listing. With a 22.86% stake in Awfis, Peak XV was also a promoter. During the IPO, it offloaded more than 66 Lakh shares as part of the OFS for INR 253 Cr. The cost of acquiring these shares was about INR 89.7 Cr, giving the VC firm almost 3X returns.

However, Peak XV made INR 30.7 Cr by offloading 11.26 Lakh shares during BlackBuck’s IPO as against INR 34.8 Cr it spent to acquire these shares.

Peak XV’s other portfolio startup Go Digit also went public this year, but it did not sell any stake in it during the listing, which would have also resulted in a loss on its investment. It also did not sell any stake in MobiKwik’s INR 572 Cr IPO.

Multiple portfolio companies from Peak XV’s portfolio, including BlueStone, Meesho, Ola Consumer, OYO, Pine Labs, among others, are also preparing for their respective IPOs in the near to mid term. Razorpay is also eyeing an IPO after FY26.

Prosus’ India Bet Sees Big Success With Swiggy

It was a mixed year for Prosus in India, with it writing-off its investment in BYJU’S and seeing a success in the form of Swiggy’s IPO.

Prosus booked 3X returns on its investment in the foodtech company. It first invested in Swiggy via Myriad International Holdings (MIH) India Food Holdings in 2018, leading the company’s $1 Bn funding round.

Ahead of Swiggy’s IPO, Prosus held a 31% stake or more than 69 Cr shares in Swiggy that had an average acquisition cost of INR 131.15 per share. As part of the OFS, it sold 10.9 Cr shares for INR 390 apiece, making 3X gains.

In the coming months, some of Prosus’ top IPO-bound portfolio companies in India are Meesho, PayU and BlueStone. Its other startups such as Mensa Brands and Captain Fresh are also gearing up for public listings.

Fabricio Bloisi, chief executive officer of Prosus, recently said, “India remains a key growth market for Prosus given the country’s impressive digital transformation in the consumer and enterprise sectors. We are excited about the region and see huge opportunities for value creation including a strong IPO pipeline within our current portfolio.”

Schroders Capital Exits FirstCry With 3X Returns

During the IPO of FirstCry in August 2024, UK-based global investment firm Schroders Capital was the only one which completely exited the kids-focussed omnichannel retailer.

Schroders Capital Private Equity Asia Mauritius II Limited sold its entire 0.78% stake, or 38 Lakh shares, for INR 465 per share, making 3.2X returns on its investment. It had acquired the shares of FirstCry at INR 145.26 apiece.

SoftBank’s India IPO Hat Trick

The Japanese investment giant minted 8X returns by offloading parts of its stakes in three tech startup IPOs this year – Unicommerce, FirstCry, and Ola Electric.

SoftBank’s SVF Frog (Cayman) Ltd infused over INR 2,000 Cr in the Supam Maheshwari-led kidswear brand since its inception and had a pre-offer shareholding of 25.52%.

Out of the 12.4 Cr shares it held, SVF sold 2.03 Cr shares of FirstCry for INR 944.8 Cr as part of the OFS during the IPO, making 3X gains on its investment in these shares.

During Unicommerce’s IPO, SoftBank’s SB Investment Holdings (UK) Limited offloaded 1.62 Cr shares out of the 3.2 Cr shares it held. SB Investment Holdings had invested around INR 50 Cr to buy these shares of Unicommerce. It sold them for INR 174.6 Cr, translating to 3.5X returns on its investment.

In Ola Electric’s IPO, SoftBank via SVF II Ostrich (DE) LLC sold 2.38 Cr equity shares out of the 81.04 Cr shares it held in the EV startup. SoftBank sold shares worth about INR 181.31 Cr as part of the OFS as against its investment of INR 122.55 Cr to acquire those shares, which translated to 1.5X returns.

While Swiggy was another startup from its portfolio which went public this year, SoftBank did not sell any stake in the company during its public market debut.

IPO-bound Ola Consumer, Meesho, OYO, OfBusiness, and Flipkart are also backed by SoftBank.

Temasek Makes Lacklustre Returns From Ola Electric

Singapore government’s sovereign wealth fund Temasek saw Ola Electric go public this year, the second company from its portfolio to do so after Zomato in 2021.

However, Temasek only made 1.01X returns by partially selling its stake in the Bhavish Aggarwal-led electric two-wheeler startup.

Temasek, which held 4.6 Cr shares of Ola Electric via MacRitchie Investments Pte. Ltd, sold 13.5 Lakh shares as part of the OFS for INR 10.3 Cr. The average cost of acquiring these shares was a little over INR 10.1 Cr.

Recently, Temasek invested in Rebel Foods, which is preparing for an IPO. Besides, two of its other Indian portfolio companies, Star Agriwarehousing and Dr Agarwal’s Health Care recently filed their DRHPs.

Tencent Strikes Gold With Swiggy

Like Prosus, Tencent also made big gains from Swiggy’s public listing.

Tencent Cloud Europe B.V. held 8.12 Cr shares of Swiggy at a weighted average price of INR 165.47 per equity share. As part of the OFS, the Chinese internet company sold 63.27 Lakh shares worth INR 246.7 Cr, translating to 2.3X returns on its investment in these shares.

Tencent is also a backer of IPO-bound Flipkart.

Tiger Global Rakes In Over 10X Returns From BlackBuck, Ola Electric

Tiger Global was one of the top gainers from EV startup Ola Electric’s INR 6,000 Cr+ public listing this year.

Via its Internet Fund III Pte Ltd, the global PE fund sold almost 63.61 Lakh shares worth INR 48.34 Cr in Ola Electric. The fund had invested around INR 7.44 Cr to buy these shares, which gave it 6.5X returns on its investment.

Besides, Tiger Global also made 3.95X returns by selling 13.69 Lakh shares of BlackBuck. It acquired these shares for approximately INR 9.4 Cr and sold them at INR 37.4 Cr in the OFS.

Tiger Global recently exited Flipkart, whose public issue is one of the most-awaited in the Indian startup ecosystem, reportedly making $3.5 Bn in gains. Besides, many of its other portfolio companies are getting ready for public market debuts in India, including Ola Consumer, Razorpay, Captain Fresh, Infra.Market. On the other hand, Meesho, which is also planning for a listing in 2025, recently roped in Tiger Global as an investor.

TPG Rakes In 5X Gains From FirstCry

TPG holds stakes in FirstCry via two funds – TPG Growth V SF Markets Pte. Ltd and NewQuest Asia Investments III Limited. Ahead of the startup’s IPO, together it held an 8.76% stake.

During FirstCry’s IPO, TPG Growth offloaded about 39 Lakh shares for INR 465 apiece while the weighted average cost of acquiring these shares was INR 280.87 apiece, translating to 1.66X returns.

TPG’s NewQuest Asia offloaded 41.4 Lakh shares of FirstCry for INR 192.5 Cr. It had acquired these shares at INR 55.4 Cr, translating to 3.48X returns.

Overall, it raked in 5.14X gains.

World Banks’s IPO Bet In India

The private sector lending arm of the World Bank Group, International Finance Corporation (IFC), first invested in BlackBuck in 2017 in its Series C funding round.

Ahead of the startup’s IPO, IFC held 92.2 Lakh shares in it. It made 1.4X returns by selling almost 23.4 Lakh shares as part of the OFS.

In the coming months, several of IFC’s portfolio startups in India are expected to go public, including logistics startup Shadowfax, healthcare startup Portea Medical, and online grocery platform BigBasket.

(Edited by: Vinaykumar Rai)