The rise of direct-to-consumer (D2C) brands in India is one of the biggest retail revolutions outside Silicon Valley. The concept has been around for more than a decade now. However, these brands have gained significant traction since the outbreak of the pandemic, as they leverage targeted social media metrics, personalisation and digital-first strategies to build huge consumer followings. The rapid ascent of quick commerce has further accelerated D2C growth, enabling better discovery by a younger, trend-seeking audience and fast delivery for extreme convenience.

The sector’s prominence in recent years is underscored by IPOs, mega funding rounds (deal value of $100 Mn or more) and the emergence of unicorns (valuation of $1 Bn and above). For instance, pure-play D2C unicorn Mamaearth was listed on the mainboard BSE and NSE in 2023. Male grooming and lifestyle brand Menhood debuted on NSE Emerge in July 2024. And Brianbees Solutions (FirstCry) had a mainframe IPO worth INR 4K Cr+ in August this year. Jewellery brand BlueStone also filed its draft red herring prospectus (DRHP) for an INR 1K Cr initial public offering.

Between 2019 and 2023, the D2C ecosystem saw 15 mega deals. Among these were prominent players such as Lenskart (raised $1.15 Bn across five mega-rounds); FirstCry ($396 Mn from two mega-rounds); FreshToHome ($225 Mn via two mega deals); boAt ($100 Mn); Licious ($342 Mn from two mega-rounds); Furlenco ($140 Mn); MyGlamm ($150 Mn) and Country Delight ($108 Mn).

Overall, the sector has thrived on the consumer front, with innovations across health, beauty and lifestyle brands grabbing market attention.

All these should have made the sector a darling of venture capitalists in the foreseeable future. But there is a sobering flip side.

VC funding in D2C startups has taken a significant hit in the past three years. It was not unusual during 2022-23, when the broader market experienced a harsh funding winter. However, there was a thaw in 2024, and many sectors rebounded, except for D2C.

According to Inc42 data, D2C brands raised $465 Mn across 113 deals in 2024, a steep decline from $1.4 Bn from 134 deals in 2023. The average ticket size across stages also plunged by 66% (65.68%, to be precise) to $4.18 Mn this year from $12.2 Mn in the previous year.

More interestingly, the overall D2C funding plummeted by 67.44% between January 2019 and December 2024. It is the steepest decline for a six-year period despite the pandemic-driven FOMO and the subsequent funding boom right before the capital crunch.

Have Investors Lost Interest In D2C Brands?

Not quite, although the global sentiment indicates that VCs have put in money for nearly a decade when the D2C model was at the forefront of retail innovation. However, these startups are no longer very high on their priority list and many will think twice before funding pure-play D2C brands.

The reason: Their sales channels are practical table stakes for young consumer brands but may not be a sustainable business model. After all, deep-pocketed retail behemoths are already there with greater control over supply chains and typically enjoy brand loyalty that runs deep.

Additionally, thriving on niche products may not be possible in the long run, as homegrown and global conglomerates can quickly enter any subsector if it has growth potential. In fact, one brand can rarely rule the market unless it is a breakaway company in some ways or using irreplicable tech.

However, VCs deeply ingrained in the Indian D2C landscape feel more optimistic. No doubt, the funding numbers reflect a cautious approach. But the dip in deal value likely indicates a greater alignment with leaner business models.

“Think of it like this. Platforms [D2C websites and apps] and ecommerce marketplaces require heavy investments even before sales take off. But emerging D2C brands can scale faster at low cost and get more visibility through quick commerce entities. Hence, the smaller ticket size,” said Alok Mittal, angel investor and cofounder & executive chairman of Indifi Technologies, a debt financing company.

Again, investors could be recalibrating funding deals based on category potential. For example, packaged foods have yet to deliver breakout stars, while cosmetics have thrived (Mamaearth, MyGlamm, Wow Skin Science & more). Investments in fine jewellery slowed earlier. But it is now making a comeback, thanks to success stories like CaratLane (acquired by the Tata group-owned Titan) and BlueStone, observed Mittal.

Sandeep Murthy, managing partner at the VC fund Lightbox, thinks quite a few investors are grappling with the challenge of differentiation. Consider the beauty and personal care space, the fastest-growing D2C segment with a CAGR of 28%. Standing out in that segment among multiple brands is tough, prompting investors to pause and evaluate existing bets, he added.

“Investors will refine their focus and double down on proven winners. All that is part of the usual cycle, the usual sentiment,” said Mittal. Essentially, D2C brands will remain a promising investment in the long term despite a dip in funding.

VCs Find Seed Funding In D2C Lucrative; Growth & Late Stage Deals Are Down

Although some investors have stayed away from D2C brands and consumer product-based businesses, several VC firms, including DSG Venture Partners, Fireside Ventures, Inflection Point Ventures and Rainmatter Capital, among others, have actively invested in this space.

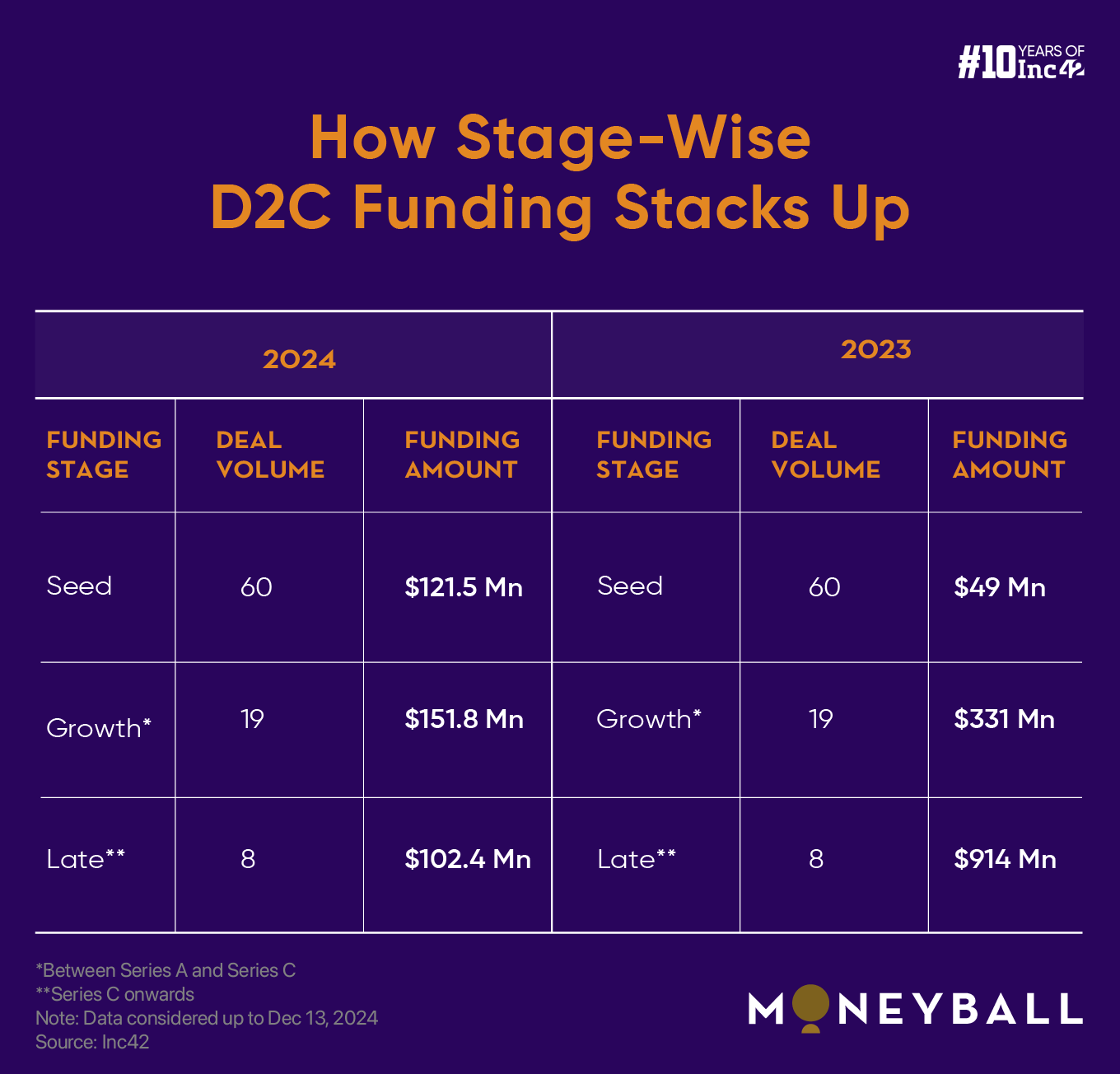

Inc42 data shows that seed stage D2C startups raised $121 Mn in 2024, up 147% from $49 Mn in the year-ago period. The deal volume also remained steady, with 60 deals in this period compared to 64 in 2023.

Ticket sizes at the seed stage also improved. As many as four startups – Foxtail ($14.4 Mn), Libas ($18 Mn), TechnoSport ($25 Mn) and Hocco ($12 Mn) – raised more than $10 Mn each. In contrast, the largest seed round in 2023 was a modest $4 Mn, raised by the fashion app Freakins.

The rising interest can be attributed to three major factors: Opportunities for early exits with high returns, low-risk investments and the ability to explore niche markets.

Growth stage D2C brands, on the other hand, saw a more cautious approach. They raised $152 Mn across 19 deals, and the biggest round amounted to $34 Mn bagged by Kushal’s, a fashion and silver jewellery brand. It was a significant drop compared to 2023 when growth stage D2C businesses raised $331 Mn across 29 deals. At the time, D2C sportswear brand Agilitas netted the biggest haul, around $52 Mn.

Late stage D2C brands fared even worse, raising $102.4 Mn across eight deals in 2024, compared to $914 Mn raised across 10 deals in the year-ago period. Country Delight ($28.3 Mn), BlueStone ($21 Mn), Lenskart ($19 Mn), Curefoods ($25 Mn), Bombay Shaving Company ($3 Mn) and High Street Essentials ($6 Mn) were the top fundraisers in 2024.

The key issue with growth and late stage brands is that many have already raised too much too quickly but are delivering poor RoI. Among the 13 D2C startups which reported FY24 financials, nearly 50%, including BlueStone, boAt, Lenskart, Purplle, Ustraa and Wrogn, were in the red. Those claiming profitability included Zappfresh, CaratLane, iD Fresh Food, Mamaearth, Milk Mantra, Minimalist and Rare Rabbit.

According to Mittal, there is still a funding pipeline covering up to Series C, but future investments will primarily depend on the size of the VC fund. Smaller VCs managing funds worth $200 Mn or thereabouts may target startups with a valuation of $40 Mn or so. Larger VC firms handling more than $1-2 Bn corpus may focus on businesses nearing billion-dollar valuations.

“That said, there won’t be those mega deals where more than $100 Mn was pushed into ecommerce marketplaces in a single round. D2C funding is unlikely to see that. Founders will have to prove their mettle and become profitable. Huge funding to enable scaling up or support growth at all costs – trends we saw in the marketplace era – is no longer viable.”

Alternative Debt Financing: Will It Be A Game Changer For D2C Brands?

Although traditional investors have tightened their purse strings, it does not mean that a slow fade or a hard pass will hurt the D2C segment for good. Capital is still available to drive sustainable growth across stages but does not come as typical equity funding. In sync with the current landscape, revenue as well as cash-flow-based alternative debt financing platforms like Velocity, Indifi and GetVantage are redefining funding access with data-driven financing solutions. These platforms assess real-time sales data, GST returns, bank statements and digital transactions to provide non-dilutive working capital without collateral.

Revenue-based debt financing differs from the more popular venture debt model. Most venture debt funds require a company to provide warrants to the venture debt lender. This means shareholders will experience dilution with venture debt. Also, one must pay high interest rates, repay the money within a short tenure and return a fixed amount every month regardless of the cash flow. In contrast, repayments are flexible in revenue-based debt financing and calculated based on the revenue earned by the debtor in the preceding month.

“These [debt] financing platforms integrate with marketplaces like Shopify, Amazon and Flipkart to analyse online revenue streams,” explained Abhiroop Medhekar, cofounder and CEO of Velocity. “This allows brands to secure growth capital quickly, often with term sheets issued within 48 hours of data submission. It is an efficient way to meet requirements during peak sales cycles.”

He claims that the scalable financing model helps D2C brands navigate seasonal demands while maintaining growth momentum. Here is a case in point. The 2024 festive season saw more than 1 Lakh Cr in sales on ecommerce platforms, while Black Friday sales saw a 28% surge in D2C order volumes. Therefore, brands relied heavily on debt financing solutions To avoid supply chain bottlenecks and manage limited supplier credit.

The growing appeal of debt financing was evident in 2024. Unlike the previous year, when equity deals ruled the startup ecosystem, 2024 saw late stage D2C brands increasingly opt for alternative debt financing.

While this approach to financing is quite new, a quick look at the numbers will solidify the trend. In 2024, only six late stage D2C brands managed to raise funding, with most deals involving debt or a mix of debt and equity. Take Country Delight, for instance. It secured $28.3 Mn in two rounds – $20 Mn in equity from Temasek Holdings and Venturi Partners and $8.3 Mn in venture debt from Alteria Capital. BlueStone also raised $21 Mn in debt funding through two rounds – $9 Mn in venture debt from Trifecta Capital and $12 Mn in cash flow-based financing from Neo Asset Management.

According to Indifi founder-angel investor Alok Mittal, the lending platform collaborated with more than 400 D2C brands in 2024 for debt financing across various stages. “Many of these debt financing rounds go unreported, though. Nonetheless, we are seeing robust activity, as a growing number of D2C businesses are going for this kind of financing,” he said.

Challenges Galore: Does The D2C Ecosystem Face An Existential Threat?

Ask industry experts, and you will get a mixed response. Most investors think there is no shortage of opportunity, but brands need to address the core problems to thrive in the long run. And it all evolves around efficiency and cost-effectiveness.

For the majority of D2C businesses, distribution remains a crucial challenge even today. Most have adopted a 360-degree omnichannel strategy – a seamless mix of online and offline via their websites/apps, ecommerce marketplaces, quick commerce and collaboration with brick-and-mortar retail. They also expand their global footprints, requiring efficient operations and distribution, scalability and sustainable growth, and better unit economics.

The next hurdle is creating a ‘meaningful’ differentiation. As Ninad Karpe, founder and partner at 100X.VC, points out, the market is nearly saturated, and “more of the same” is not cutting it anymore. Investors are now looking for brands that stand out through true innovation, whether by offering unique products, adopting disruptive business models, or building a strong narrative.

Talking to Inc42, many VC players have stressed that to scale successfully and secure growth capital in 2025, Indian D2C brands must focus on profitability, operational excellence and customer retention. These evolving strategies will gradually build long-term resilience rather than short-term growth.

Others say engaging more with shoppers and being where they are will be critically important because that is how the buying happens. Targeted social media campaigns can be excellent at times for customer acquisition and retention. But one must be able to analyse what kind of traction drives sales. (Amazon versus Instagram will be an interesting case study here.) Additionally, the rising costs of digital ads and the diminishing returns tend to drive customer acquisition costs (CAC), making this strategy increasingly unsustainable. The key to success lies in timely and strategic shifts from the classic D2C model.

Murthy of Lightbox thinks D2C brands must learn to walk and chew gum at the same time. Overall, a delicate balancing act is required to grow without sacrificing profitability. “The downturn forced companies to focus on profitability. The challenge now is accelerating growth while maintaining that focus,” he said.

“Striking that balance is critical for attracting growth capital. We are seeing that in our portfolio. Nua, a brand specialising in female hygiene products, became profitable in June this year and has continued to grow rapidly. This ability to achieve profitable growth has generated significant interest from investors.”

Through The VC Lens: Five D2C Trends In 2025

The ecosystem will mature: The D2C landscape in 2025 is set to evolve due to dynamic consumer preferences and innovative approaches to scaling. The recent decline in deal value and volume may seem a matter of concern. But it actually reflects a maturing ecosystem rather than shrinking opportunities. This will lead D2C brands to innovate boldly, build deeper consumer connections and address gaps in profitability to harness growth.

New execution standards on the cards: As new-age consumers increasingly explore quality, affordability and convenience, brands will set up impeccable execution standards and adapt ahead of time. Quick commerce will continue to reshape retail, creating opportunities for D2C players in popular categories like beauty & personal care, electronics and household goods. Fast delivery will no longer be an added advantage but a must-have capability for instant gratification.

Marketplace integration will diminish: Established D2C brands may rely less on online marketplaces and sell directly through their websites and apps. This approach will give them greater control over their brands and supply chains, reduce marketplace commissions and fees and foster stronger customer relationships.

AI/GenAI will enhance D2C retail: Cutting-edge technologies, especially AI/GenAI, will take D2C retail to the next level. By leveraging these tech tools, brands can personalise offerings, automate workflows and enhance customer engagement. The growing adoption of digital platforms in Tier II and III cities will also open doors for further expansion.

Rural markets will drive growth: Brands that meet the unique requirements of rural consumers, create affordable yet aspirational products, or focus on niche markets will stand out from the rest. Rising incomes and growing interest in personalised and premium experiences will make this an exciting time for the D2C sector.

Is the D2C ecosystem all set to cope with the changes ahead? Many VCs and angel investors think so and pin their hopes on D2C 2.0. If D2C founders make informed decisions aligned with the evolving market, the sector will thrive again.