India’s digital landscape is on the cusp of a massive expansion, with active internet users projected to breach 900 Mn by 2025. The rise of the new-age, digital-first consumers has transformed the country into a vibrant arena for businesses of every type and size, and even SaaS startups in India are making the most of this digital wave.

Besides massive duopolies and scaled up businesses (such as Zomato-Swiggy, Ola-Uber, Amazon-Flipkart or Paytm-PhonePe), many believe that this is the time for India’s enterprise tech or software-as-a-service (SaaS) ecosystem. .

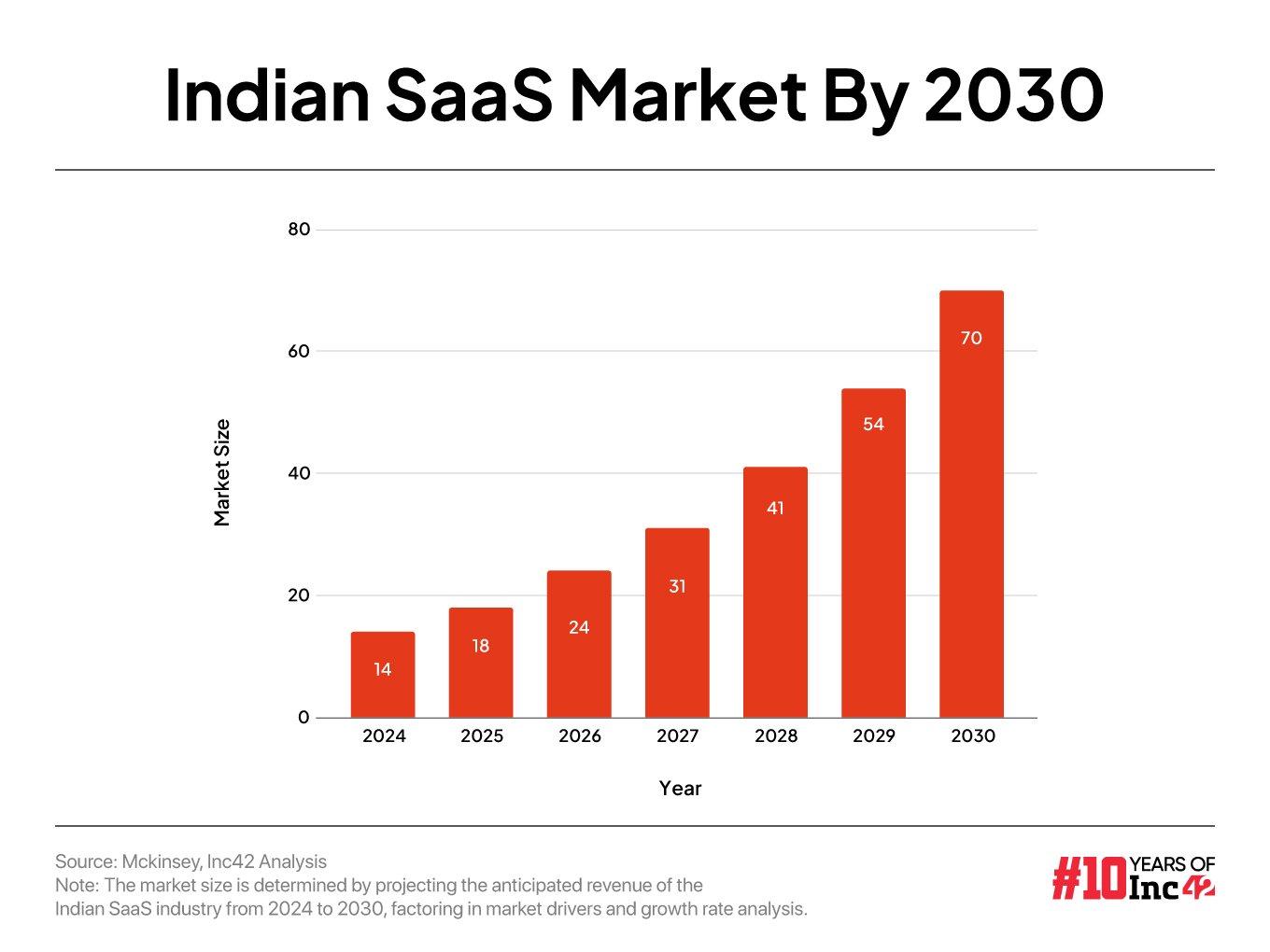

Inc42’s Decoding India’s SaaS Startup Ecosystem report shows that SaaS opportunity in the country is estimated to surpass the $70 Bn mark by 2030, up from the current $14 Bn at a staggering CAGR of 31% over the next five years.

Those familiar with the history of SaaS would not be surprised at these estimates. Since the Covid-19 pandemic, SaaS offerings (along with digital transformations) have been embraced by most and multiple SaaS indices boomed between 2021 and early 2022. In India, where SaaS startups started taking shape nearly two decades ago, the sector has been spurred. by its two pillars – horizontal and vertical SaaS.

In horizontal SaaS, software providers offer solutions suitable for multiple industries. Think of Zoho or Freshworks and how their industry-agnostic CRM solutions in the cloud can help millions of businesses, irrespective of industry segments.

Again, organizations with a diversified workforce and multiple projects turn to platforms like Asana and Slack for efficient workflows and seamless communication. Given their vast addressable markets, horizontal SaaS players have led the Indian SaaS story until now.

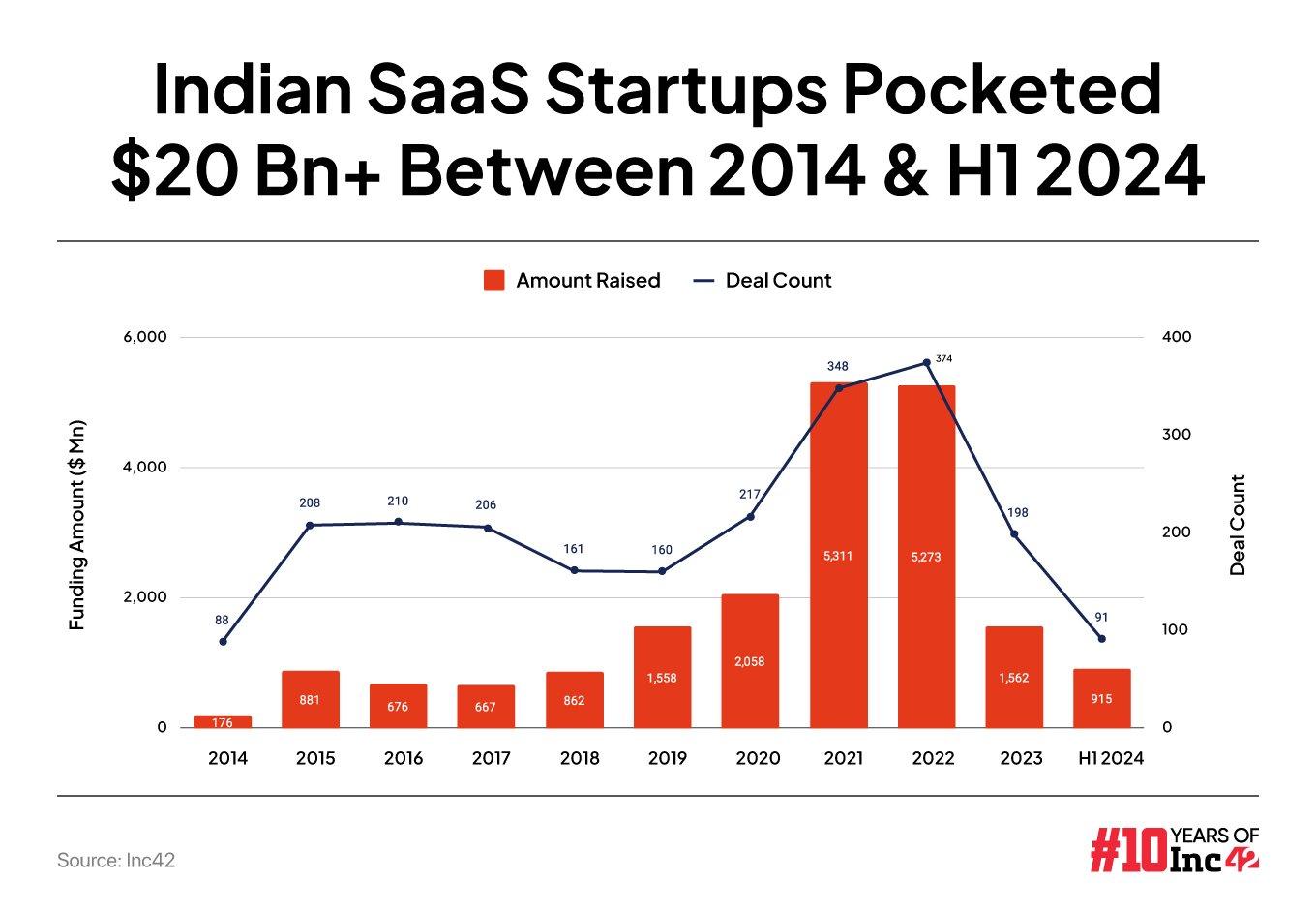

Of the $20 Bn raised by the sector between 2014 and H1 (January-June) 2024, $14.6 Bn, or about 72.9%, has flowed into the horizontal SaaS segment. Also, 20 out of the 27 SaaS unicorns belong to this category, including prominent names like Amagi, Capillary Technologies, BrowserStack and more.

The Shift From Horizontal SaaS To Vertical SaaS

Unlike the horizontal model, vertical SaaS startups are banking on deep domain expertise and provides industry-specific solutions. It is a comparatively recent trend and has started gaining traction as businesses require software tools tailored for specific functions.

Take, for instance, Chargebee or Perfios. The first has developed revenue growth management solutions for subscription businesses, while the second caters to the BFSI segment.

Given the specialized nature of its business, vertical SaaS has understandably trailed the horizontal model in terms of funding, bagging only 27% of the capital raised during 2014-H1 2024. This was also reflected in the deal count, as horizontal SaaS players secured 1,380. or 61.1% of the 2,200 deals during this period.

Conversely, vertical SaaS grew at an 18% CAGR in funding during 2018-2023, outpacing horizontal SaaS, which grew at 10%. A similar trend was seen in terms of deal volume. The CAGR of deal count in vertical SaaS was 6% during this period compared to 3% in the horizontal SaaS space, according to Inc42 analysis.

In the next six years, the vertical SaaS market size (based on total revenue) is projected to surge from $5 Bn to $26 Bn. Meanwhile, the horizontal SaaS space, currently valued at $9 Bn, is estimated to reach $44 Bn.

More importantly, the Inc42 report has detailed how SaaS, in general, and the best-in-breed vertical platforms, in particular, have started leveraging the advantages of AI-GenAI and the critical growth drivers enabling the adoption.

Artificial intelligence is also creating new categories within SaaS offerings, such as code and software testing automation, LLM operations (large language models are essential for chatbots), enhanced cybersecurity and more.

Again, integrating GenAI models with vertical SaaS helps develop specialized software, while access to granular data enables smart workflows and advanced predictive analytics. These will ensure greater efficiency, tailored insights and better decision-making for niche businesses.

The upcoming shift from horizontal to vertical SaaS was mirrored in recent SaaS funding. Of late, mega deals ($100 Mn and above) in the SaaS space or other sectors have dried up due to the harsh funding winter. Still, the latest SaaS unicorn, Perfios, came close to the coveted figure and raised $80 Mn earlier this year, which pushed its valuation past the $1 Bn mark.

Sandiip Bhammer, founder of the VC fund Green Frontier Capital (GFC), thinks that the ‘specialised’ nature of the vertical SaaS industry makes it a more lucrative investment opportunity.

“We believe that vertical SaaS platforms, especially in agritech and climate tech, have great potential to drive innovation and sustainability. These platforms also align with our goal to invest in solutions that bring both financial returns and positive environmental impact,” he told Inc42.

Funding Trends For Indian SaaS Startups

More than half of SaaS investments came in 2021 and 2022, the peak funding years for Indian startups. SaaS funding hit an all-time high in 2021, with startups raising $5.31 Bn across 348 deals. The deal count peaked at 374 in 2022, but the capital inflow slightly dipped to $5.27 Bn. The surge in investor interest at the time was fueled by higher capital efficiency and better exit opportunities, a 2021 report by Bain & Company said.

The funding winter that followed hit the industry hard. SaaS investments crashed more than 71% in 2023 compared to the previous year, slumping to $1.56 Bn from 198 deals. The first half of 2024 saw the downward trend continue, with SaaS startups securing $915 Mn across 91 deals.

Even now, investor sentiment is split over a rapid and robust funding recovery in the SaaS space.

Asked about the funding slowdown, Gemba Capital’s associate vice-president Kamini Shivalkar said, “Investor interest in Indian SaaS startups has been dwindling for some time. It’s because SaaS businesses without a clear go-to-market strategy in the US or product-led growth or those with a low average/annual contract value [ACV is a key indicator of steady income] have struggled to reach scale.”

Nevertheless, most people are excited about AI/GenAI-driven SaaS, which can be a game-changer and rekindle investor interest.

“SaaS businesses leveraging AI [and its variations] to build for the world are attractive to investors seeking good returns. GFC, too, is looking to invest in mature SaaS startups that offer scalable, AI-driven solutions in climate tech and other sustainability sectors,” said GFC’s Bhammer.

AI Powering Nex-Gen SaaS

Akin to what the GFC founder mentioned, the Inc42 report has explored how AI/GenAI is transforming the SaaS industry in India. From content creation and user experience personalization to product development, automation and data augmentation, SaaS startups have leveraged the power of artificial intelligence in various ways and adopted the technology more quickly than any other sector.

About 85% of Indian SaaS companies – around 1.5K firms – have already come up with AI-based projects and solutions. Among these are leading players like Fractal, Zoho and Freshworks, and very young ventures such as Highperformr.ai, Portkey and Pepsales, all keen to benefit from the ongoing AI-GenAI boom.

GenAI in SaaS will also shift the sales model from direct selling to assisted buying, allowing software companies to reach a broader audience, engage customers more effectively and drive growth.

Shivalkar of Gemba Capital thinks AI SaaS applications will disrupt industries by automating routine but labor-intensive processes.

“We are particularly interested in companies developing enterprise-grade SaaS solutions that target niche verticals like financial services and healthcare, employing a sales-led approach and bagging high ACVs,” she said.

Further conversations with investors revealed a bullish approach to SaaS startups using AI-GenAI. A case in point is Pepsales, which secured $1.1 Mn in a pre-seed round in September 2024. Set up in 2023, the SaaS startup creates customized, cloud-based product demos and plans to use the funding to develop AI software.

In a conversation with Inc42, Pepsales co-founder and CTO Abhinandan Sahgal cautioned against the risks associated with AI-GenAI, noting that concerns around plagiarism and inherent biases are growing among investors.

“AI must be used responsibly,” he said. “Companies should closely monitor the outputs to ensure they get genuine value instead of rephrased or reassembled content. Achieving this requires stringent checks, especially as platforms want to balance speedy content production with ethical standards.”

Building SaaS For The World From India

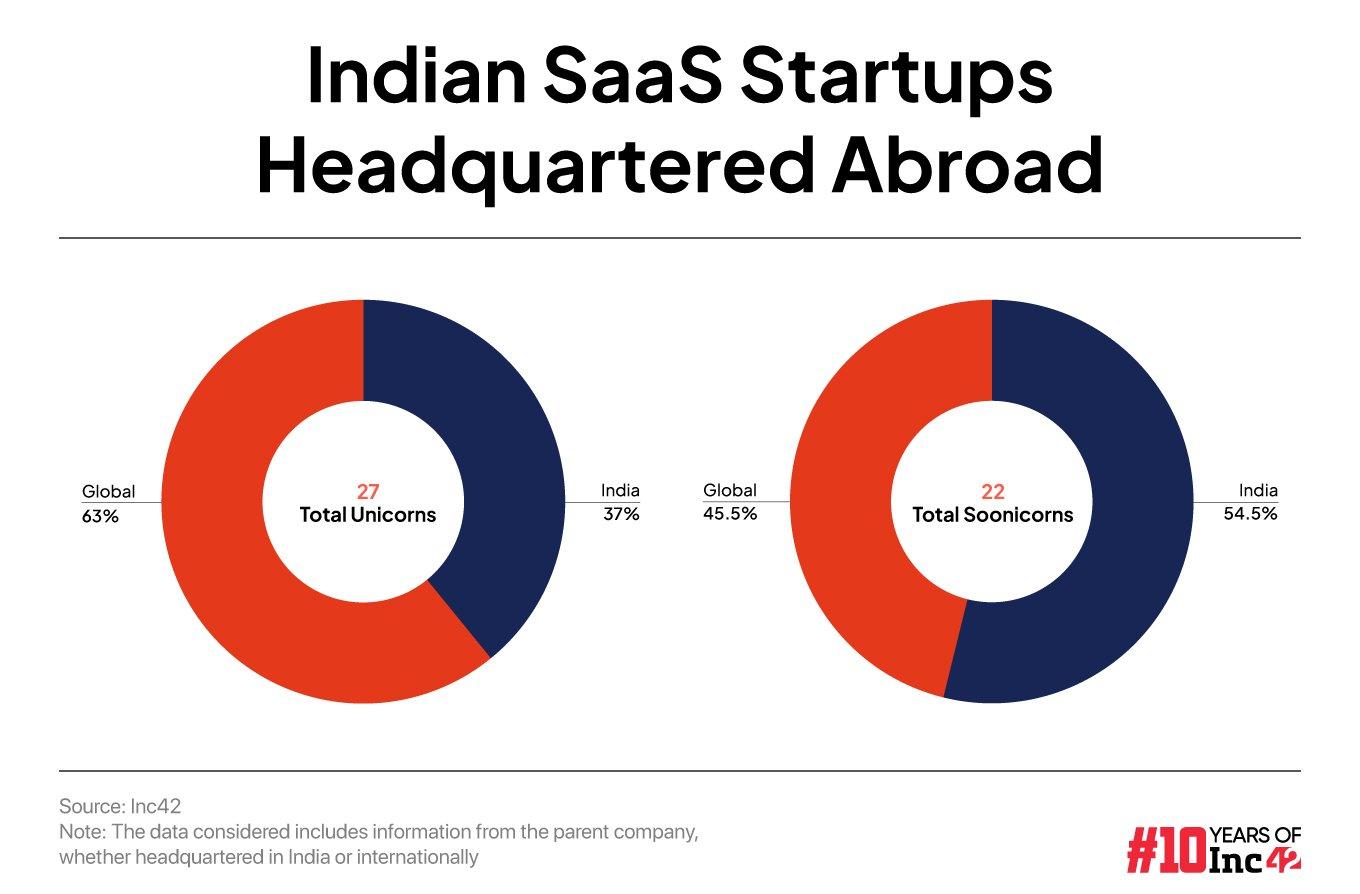

Although the ecosystem has fostered more than 2.2K funded SaaS startups, nearly 38% of these companies operate from their overseas headquarters. Among India’s 27 SaaS unicorns, 63% are based abroad, including notable players like Zoho, led by Sridhar Vembu, and NASDAQ-listed Freshworks.

Similarly, more than 45% of 22 SaaS soonicorns – companies on track to achieve unicorn status – are headquartered outside the country, per the Inc42 report.

However, investors believe India’s appeal as a home base is growing among its rising tech giants.

“Conventional wisdom dictates that North America provides the largest profit pool for SaaS players. This still holds, but with SaaS adoption growing in India, we believe the Indian market can also support large outcomes for SaaS players in select verticals,” said Dushyant Singh, managing director at growth stage VC fund Playbook Partners.

Others, too, sense a shift, speculating that India may increasingly produce SaaS companies serving global markets from their home base.

Interestingly, Bengaluru tops the list of India’s SaaS hubs, attracting maximum funding and deal flow in the past decade. It also hosts the highest number of AI SaaS ventures. Startups in the city raised $8.6 Bn across 890 deals. Mumbai ranks second, securing $2.9 Bn across 327 deals, while Delhi NCR has raised $2 Bn from 428 deals.

As stakeholders look to the future, many believe India is primed to be more than just an origin story for SaaS. It can be the place where these companies scale to global prominence.