“The pot of gold at the end of the rainbow has become bigger than ever. You can invest in a new-age tech startup that could one day become a $100 Bn company,” a founding partner at a venture capital firm told Inc42.

The Indian startup ecosystem is booming, with young new-age tech companies growing at breakneck speed and trying to unseat stalwart companies across sectors like fintech, ecommerce, SaaS, artificial intelligence, and more.

The year 2024 saw the homegrown startup ecosystem come of age, with 13 new-age tech companies, including foodtech major Swiggy, omnichannel kids-focussed marketplace FirstCry, and insurtech giant Go Digit General Insurance, going public.

The boom in startup IPOs demonstrates growing investor confidence in the world’s third-largest startup ecosystem and this is not without reason. Swiggy’s public debut was a gold mine for early investors Accel India and Elevation Capital, who made over 34X returns on their investments. Similarly, BlackBuck’s IPO saw early backers Flipkart and Accel raking in 5X returns.

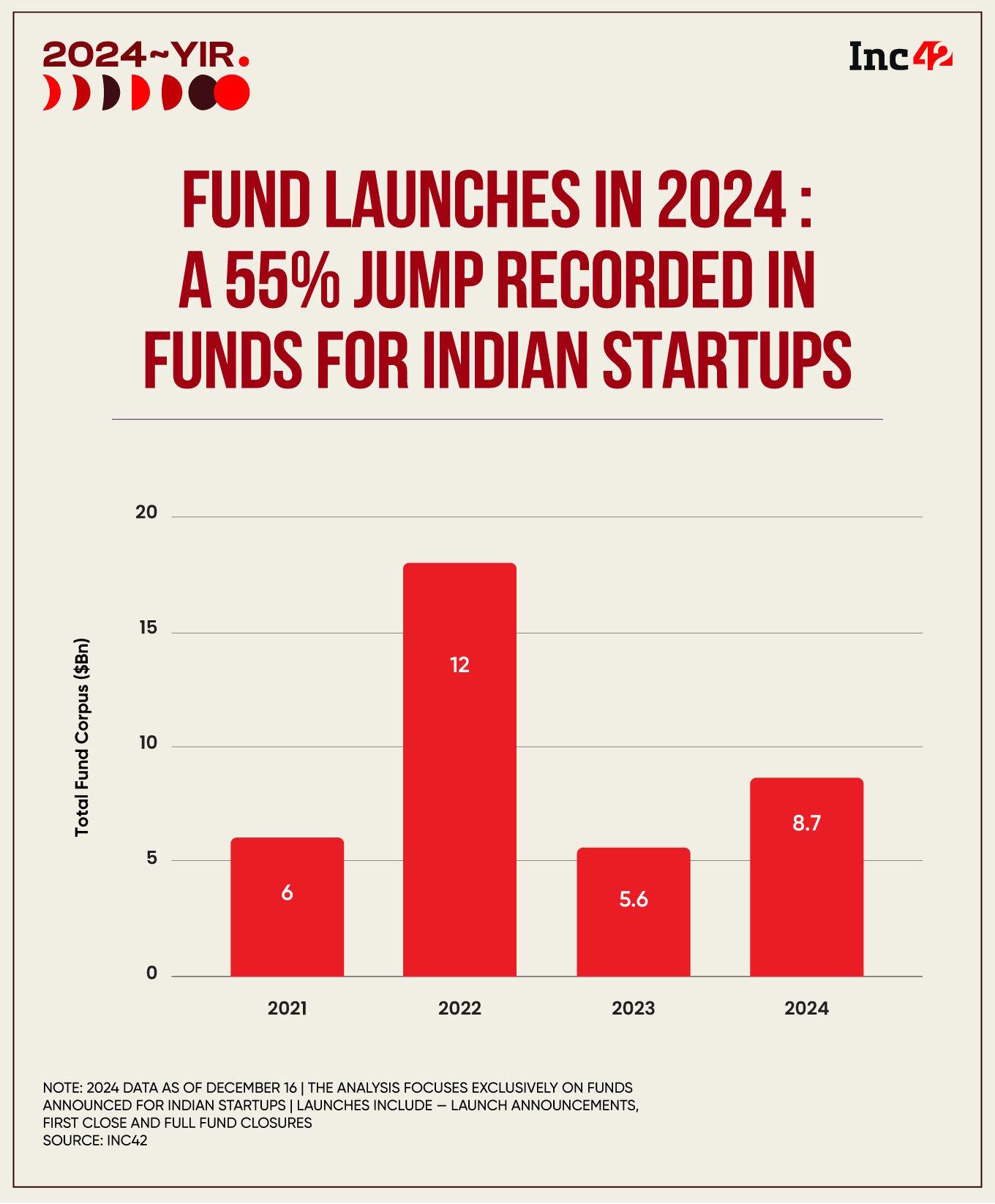

Not only an increasing number of startups are raising funds via public listings, but venture capitalists and private equity firms are also raising large funds for backing Indian startups. The data for 2024 tells the story.

Overall, the homegrown startup ecosystem saw the announcement and launch of 81 new funds, including VC funds, PE funds, micro funds, angel funds, and government funds, worth over $8.7 Bn in 2024. In comparison, 64 funds were launched for Indian startups last year, which cumulatively amounted to over $5.6 Bn.

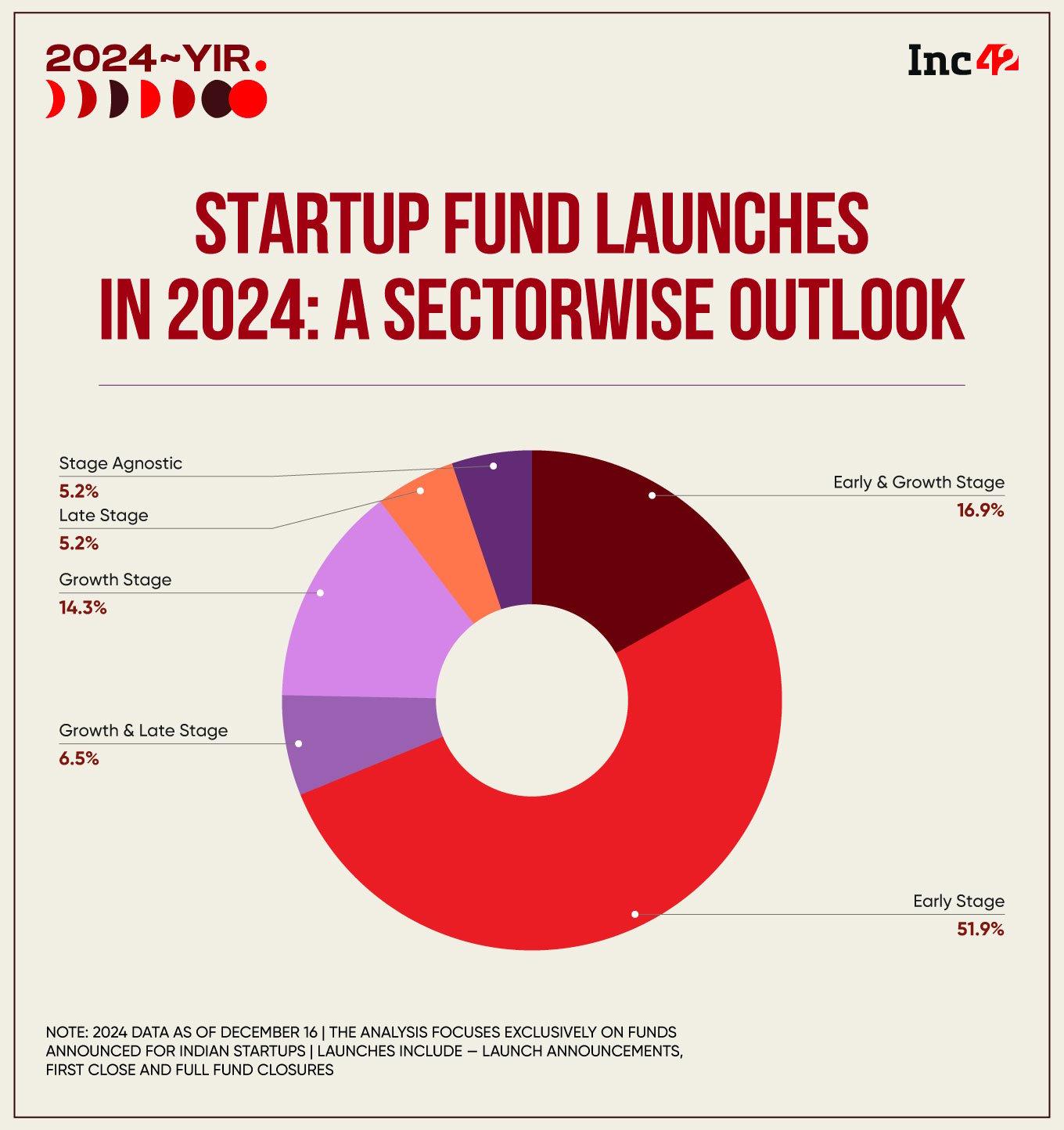

Early stage startups emerged as the darling of investors as 40 funds, with a total corpus of over $1.94 Bn, were floated in 2024. In comparison, 31 funds worth $1.8 Bn were launched for early stage Indian startups last year.

Further, more than a dozen early to growth stage funds were launched this year, looking to cumulatively raise $702.34 Mn for homegrown startups.

After an extended funding winter, the year 2024 also saw a revival in growth, growth to late and late stage funds. A total of 19 funds were launched for these categories amounting to over $4.8 Bn.

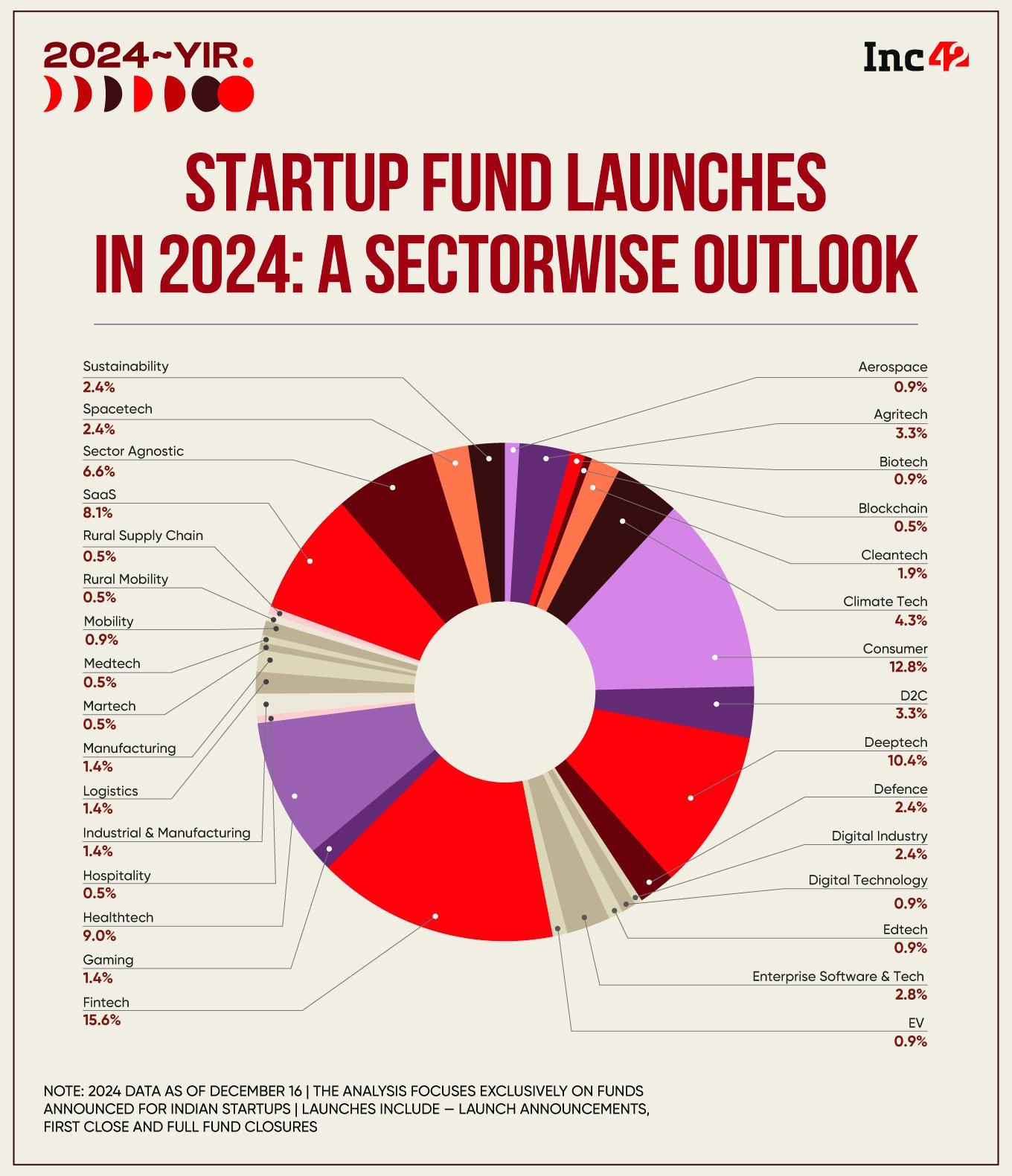

The data for 2024 also reveals other interesting trends, with the fintech sector taking the spotlight and accounting for 15.6% of the total fund launches this year. It was followed by consumer-focussed funds at 12.8%, deeptech funds at 10.4%, healthtech funds at 9% and SaaS funds at 8.1%.

As 2024 comes to a close, Inc42 has curated a list of top 15 fund launches, as part of our flagship ‘Year In Review’ series, that will drive the next phase of growth of the world’s third-largest startup ecosystem.

Editor’s Note: This is neither an exhaustive list nor a ranking of any kind. The funds have been chosen on Inc42’s editorial discretion.

Kedaara Capital Closes India’s Largest PE Fund At $1.7 Bn

In April this year, Kedaara Capital announced the close of India’s largest private equity fund, Kedaara IV, at $1.7 Bn (about INR 14,417 Cr).

It was Kedaara Capital’s fourth fund and was closed within four months of its launch. Nearly 85% of the fund’s total corpus was funded by existing investors and leading Canadian pension funds — CPPIB, CDPQ and OTPP.

The India-focussed PE firm said it plans to invest in startups across sectors such as banking, healthcare, consumer, and SaaS.

Founded in 2012 by ex-Temasek and General Atlantic executives Manish Kejriwal, Sunish Sharma and Nishant Sharma, Kedaara Capital is one of India’s oldest PE firms that has backed startups like Lenskart, Perfios, and Purplle.

Chrys Capital Closes $700 Mn Continuation Fund

In April this year, ChrysCapital announced the close of its $700 Mn (about INR 5,947 Cr) Continuation Fund. The fund was anchored by US-based HarbourVest Partners and European funds LGT Capital Partners and Pantheon Ventures.

The fund will allow Chrys Capital to retain its stake in the National Stock Exchange. Further, the PE firm will use the funds to invest in Indian startups operating in sectors such as enterprise tech, manufacturing, financial services, healthcare and life sciences, among others.

Founded in 1999 by Raj Kondur and Ashish Dhawan, ChrysCapital is an India-focussed PE firm that has raised more than $5 Bn across nine funds.

It claims to have so far invested more than $4 Bn via 100+ deals and realised $7 Bn from 80 full exits. It counts startups such as Lenskart, Awfis, Dream11, and Xoriant in its portfolio.

Capital A Launches INR 400 Cr Fund To Invest In 20 Startups

In September, early stage VC firm Capital A launched its Fund II with a target corpus of INR 400 Cr (about $48 Mn).

The VC firm said it would invest in 17 to 20 startups. It will dish out cheques in a range of $750K to $1 Mn at an initial stage and later increase the capital infusion to $2-3 Mn over each startup’s lifecycle.

Founded in 2021 by Ankit Kedia, Capital A backs early stage startups across fintech, cleantech and other emerging sectors. It invested in startups such as Chargeup, Bambrew, Jiraaf, Leumas BharatSure, and Entuple via its Fund I.

Centre Launches INR 750 Cr AgriSure Fund To Back Agritech Startups

In September, the union agriculture ministry launched an INR 750 Cr (about $88.3 Mn) ‘AgriSURE’ fund (Agri Fund for Start-ups & Rural Enterprises) to back agritech and rural area-focussed startups.

At the time, the ministry said that the union government will invest INR 250 Cr in the AIF and National Bank for Agriculture and Rural Development (NABARD) will pump in another INR 250 Cr into the fund. The remaining INR 250 Cr of the total corpus will be mobilised from banks, insurance companies, and private investors.

The announcement came on the heels of the union cabinet approving the INR 2,817 Cr digital agriculture mission (DAM) that will leverage emerging technologies to build digital public infrastructure (DPI) to boost the country’s farm sector.

India is home to more than 1,000 agritech startups that leverage new technologies such as internet of things (IoT), AI, and machine learning (ML) to offer farm-centric services to streamline agriculture.

Navy Veteran Floats Angel Fund To Back Defence Tech Startups

Navneet Kaushik, former director at Technology Development Board, launched Jamwant Venture Fund to back early stage Indian startups in the defence sector.

Backed by SKI Capital, the fund, launched in April 2024, aims to encourage innovation and indigenisation in the homegrown defence industry. Jamwant Venture Fund will primarily focus in areas like defence, aerospace and deeptech, with a special emphasis on product, materials and manufacturing domains.

With a ticket size ranging between INR 25 Lakh and INR 2 Cr, the fund aims to back 5-10 startups with an initial corpus of INR 20-40 Cr (about $2.3-4.7Mn).

Tribe Capital Floats $500 Mn Secondaries Fund With Oistel Global

In September 2024, Silicon Valley-based VC firm Tribe Capital teamed up with homegrown investment firm Oister Global to launch its first alternative investment fund dedicated to secondary transactions in the Indian startup ecosystem.

Dubbed ‘Oister Tribe Ace Fund 1’, the fund will have a target corpus of $500 Mn (about INR 4,248 Cr), which would be deployed in the next two years.

The fund will operate under Tribe Capital India, the India arm of the US-based VC firm, launched earlier this year. In April, Tribe Capital roped in Shiprocket cofounder Vishesh Khurana to lead its maiden Indian fund.

It is pertinent to mention that the Indian startup ecosystem saw more than a dozen secondary deals in the first half of 2024, with several early investors exiting from startups such as Capillary, ixigo, Urban Company, Porter, Pocket FM, among others. Many of these deals came at a discount to the last valuations of those startups, offering new investors a lucrative entry point.

100Unicorns Launches Second Fund With A Corpus Of $200 Mn

In May this year, early stage VC fund 9Unicorns rechristened itself to 100Unicorns and launched its second fund, 100Unicorns Fund II, to back 200 early stage startups.

100Unicorns cofounder Apoorva Ranjan Sharma said that the new fund will follow the Y Combinator model in India and will offer support and mentorship to startups right from the ideation stage.

The fund has an initial corpus of $200 Mn (about INR 1,670 Cr), along with a green shoe option of $100 Mn. 100Unicorns will target startups across EV, defence, travel, SaaS, and fintech sectors, as well as the D2C ecosystem.

Around 60% of the corpus has been earmarked to invest $250-300K in startups at an initial stage, while the remainder will be deployed towards follow-up investments.

Notably, 100Unicorns (then 9Unicorns) closed its first fund at $100 Mn in 2022. It counts startups like VideoVerse, Trunativ, Zypp Electric, and Renee Cosmetics, among others, in its portfolio.

Stellaris Closes Third India-Focussed Fund At $300 Mn

In November, VC firm Stellaris Venture Partners, which has so far invested in companies like D2C personal care brand Mamaearth, SaaS startup Whatfix, and digital lending startup Propelld, marked the final close of its third India-focussed fund at $300 Mn (around INR 2,534 Cr).

The new fund will invest in Seed and Series A rounds of 25-30 startups across sectors like AI, enterprise tech, consumer technology financial services, among others, over the next three years.

Founded by former Helion Ventures partners Ritesh Banglani, Alok Goyal and Rahul Chowdhri, Stellaris counts software giants Cisco and Infosys, along with the World Bank’s International Finance Corporation, among its limited partners (LPs) and backers.

Since its launch in 2017, the VC firm has built a portfolio of over 40 companies across sectors such as SaaS, consumer, financial services, B2B commerce, education, mobility and healthcare.

Cabinet Approves INR 1K Cr VC Fund To Back Spacetech Startups

With an eye on giving a boost to the country’s spacetech ecosystem, the union cabinet greenlit the launch of an INR 1,000 Cr VC fund under the Indian National Space Promotion and Authorization Centre (IN-SPACe).

The fund was announced by finance minister Nirmala Sitharaman during her budget speech in July this year.

In a statement later, the government said that the funds will be deployed over a period of five years from FY26 to FY30. “The average deployment amount could be INR 150-250 Cr per year, depending on the investment opportunities and fund requirements,” it added.

The average ticket size will be in the range of INR 10 Cr to INR 60 Cr, depending on factors like stage of the company, growth trajectory, and potential impact on the national spacetech arena. While growth stage companies will get equity investment of about INR 10 Cr to INR 30 Cr from the fund, late growth stage companies will get investments between INR 30 Cr to INR 60 Cr.

The announcement came against the backdrop of the rise of Indian startups in the spacetech arena amid the Centre’s policy push for the sector.

From establishing the Indian National Space Promotion and Authorization Centre (IN-SPACe) to allowing up to 100% foreign direct investment (FDI) via the automatic route for certain sub-segments in the space sector, the government has taken several steps to enable the development of the spacetech ecosystem over the past few years.

Avendus Floats INR 3,000 Cr Fund For Late Stage Startups

In May 2024, Avendus launched its late-stage ‘Future Leaders Fund (FLF) III’ with a total corpus of $350 Mn (INR 3,000 Cr). The Category II AIF will also have a green shoe option of up to INR 1,500 Cr.

Under this, Avendus will make 10-12 investments with an average ticket size of INR 200 Cr to INR 300 Cr ($25 Mn to $35 Mn).

With an eye on “market-leading businesses and category-defining companies”, the fund will target startups across sectors such as financial services, consumption, digital and technology, healthcare, and manufacturing.

Under the new fund, the firm’s investments will comprise both primary and secondary transactions in companies that have disaggregated institutional investor shareholding.

Floated in 2019, Avendus Future Leaders Fund partners with other PE firms to invest in late stage startups. It raises capital from India and the US-based family offices, HNIs, and domestic institutions.

The homegrown financial services firm claims to have assets worth INR 1,850 Cr under its management via its previous two funds. Its portfolio companies include Lenskart, Delhivery, VerSe Innovation (DailyHunt), Licious, Juspay, Zeta, and FirstCry.

Ankur Capital Announces INR 1,200 Cr Third Fund

In August this year, Ankur Capital announced the launch of its third fund with a target corpus of INR 1,200 Cr (around $150 Mn). At the time, the VC firm said that it had already received commitments from two existing LPs — British International Investment and John D. and Catherine T. MacArthur Foundation – for the fund.

Set to be closed by early next year, Ankur Capital’s Fund III will back startups working on disruptive technologies with themes spanning digital transformation and decarbonisation.

The VC firm will dole out the first cheque size in the range of $1 Mn to $2 Mn, across Pre-Series A rounds, with continued support of up to $10 Mn.

Founded in 2014, Ankur Capital is an early stage-focussed VC firm that has invested in more than 30 startups and counts seafood B2B platform Captain Fresh, biotech startup String Bip, battery chemistry developer Offgrid Energy Lab, and agri inputs marketplace BigHaat, among others, in its portfolio. Ankur Capital manages assets worth $200 Mn.

IvyCap Ventures Closes Third Fund At INR 2,100 Cr

In April, Mumbai-based venture capital firm IvyCap Ventures, which has backed startups such as Biryani By Kilo, Lendbox, BlueStone, among others, marked the final close of its third fund at INR 2,100 Cr (around $251 Mn).

The VC firm, via the IvyCap Ventures Trust Fund 3, will invest in about 25 early stage startups with an average ticket size of INR 30-50 Cr.

Of the total corpus, the firm has already deployed 40% in startups like Celcius, Agraga, Eggoz, ZestIot, Snitch, GradRight, Flexifyme, Beatoven.ai and Dhruva Space.

Nearly 20% of the capital will be deployed for investing in IvyCap Ventures’ existing portfolio companies. Further, it has set aside INR 100 Cr to back seed stage startups.

Founded in 2011 by Vikram Gupta, IvyCap Ventures has 50 startups in its kitty across sectors such as healthtech, edtech, consumertech, deeptech, fintech, agritech and spacetech.

Green Frontier Capital Launches INR 1,500 Cr Climate Opportunities Fund

Last month, the VC firm launched the Green Frontier Capital India Climate Opportunities Fund with a target corpus of INR 1,500 Cr.

The fund will push India’s low-carbon transition through investments in transformative climate technologies. It will focus on digitisation and investment in IoT, big data, and AI to optimise resources.

Further, it will support emerging solutions in biological intelligence and other fields that reshape sustainability, food systems, and life sciences.

Founded in 2020, Green Frontier Capital is a climate-focussed VC firm that backs startups across sectors such as electric mobility, batteries and energy storage, dronetech, agritech sustainability, biofuels, healthtech, foodtech, waste management, among others.

Since its inception, it has invested in more than a dozen new-age tech companies, including Euler Motors, Battery Smart, ElectricPe, EMotorad, KisanKonnect, Nutrifresh, Revfin Services, among others.

Sorin Investments Closes First Fund At INR 1,350 Cr

In May this year, Mumbai-based VC firm Sorin Investments hit the final close of its maiden fund at INR 1,350 Cr (around $158.8 Mn).

The fund has so far made five investments in startups like Uniqus Consultech, Venwiz, Litestore, Freed and Shivalik SFB, with many more deals nearing closure. Key backers of the fund include KKR cofounder Henry Kravis, Hero Group’s Munjal family, and Banga family of The Caravel Group.

The fund also raised capital from SIDBI-sponsored Fund of Funds for Startups (FFS) scheme and a startup fund floated by the Uttar Pradesh state government.

The fund would invest in Series A rounds and plans to participate in key decision-making processes of its portfolio companies.

Founded in 2021 by former KKR India head Sanjay Nayar, Sorin Investments primarily invests in early stage startups across Series A and Series B rounds. It focusses on sectors such as fintech, ecommerce, SaaS, B2B tech and climate tech.

VentureSoul Partners Marks First Close Of Maiden Fund At INR 600 Cr

Mumbai-based venture debt firm VentureSoul Partners marked the first close of its INR 600 Cr (about $70.5 Mn) maiden fund in June 2024 by raising INR 146.5 Cr ($17.4 Mn). The Category II AIF is eyeing a corpus of up to INR 300 Cr, with an additional INR 300 Cr in greenshoe option.

It plans to back around 20-25 startups in Series A or later stages across sectors like fintech, B2B, B2C and SaaS. While the average ticket size will be in the range of INR 25-30 Cr, the maximum amount will be capped at INR 60 Cr.

VentureSoul claims to have already secured commitments from a diverse group of investors, including family offices, corporates, HNIs, among others.

Founded in 2023 by three ex-HSBC bankers Ashish Gala, Anurag Tripathi, and Kunal Wadhwa, VentureSoul Partners is a sector-agnostic fund that aims to back startups via debt financing.

[Edited By Vinaykumar Rai]