Between December 17 and 21, Indian startups cumulatively raised $171.2 Mn via 20 deals, down 73% from the $635.8 Mn secured across 25 deals in the preceding week.

While no mega funding rounds materialized this week, seed stage funding also went down by 85% to $9.2 Mn

IPO bound Zetwork announced the raise of $70 Mn this week, closing the year with $90 Mn in fresh capital

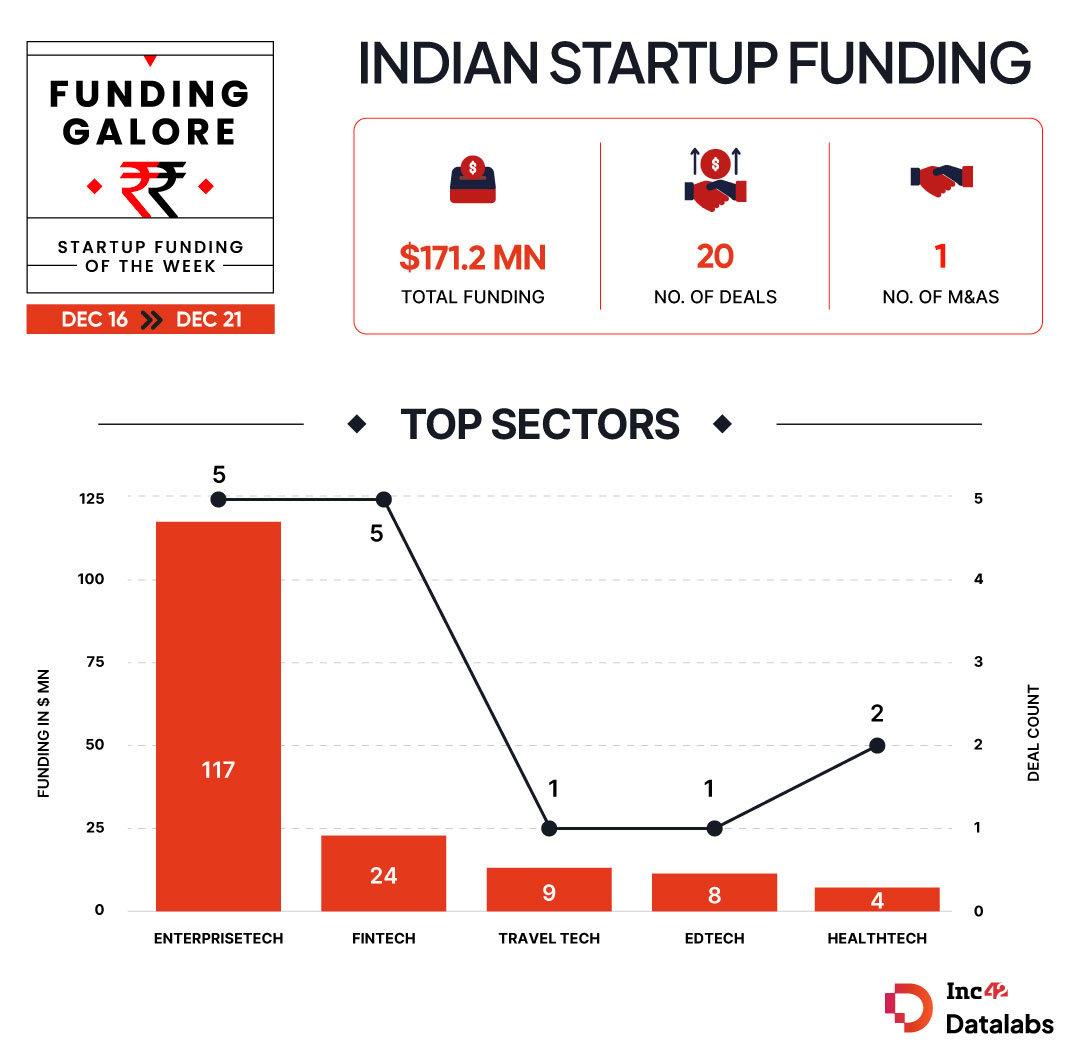

After seeing a massive resurge, funding across the Indian startup ecosystem in the third week of December took a hit. Between December 16 and 21, startups cumulatively raised $171.2 Mn via 20 deals, marking a 73% decline from the $635.8 Mn raised in the preceding week through 25 deals.

The decline is a result of no mega funding rounds materializing in the week. However, things also went south in terms of fresh capital netted by early stage startups.

Despite startups experiencing volatility in terms of investor interest, the IPO momentum continued to prevail in the week. While non banking finance company Aye Finance filed its draft red herring prospectus this week, edtech unicorn Physics Wallah took its first step towards turning into a public entity.

With that said, let’s take a look at the key funding trends of the past week.

Funding Galore: Indian Startup Funding Of The Week [ Dec 16 – Dec 21 ]

| date | Name | sector | Subsector | Business Model | Funding Round Size | Funding Round Type | Investors |

| 20 Dec 2024 | Zetwerk | enterprisetech | Enterprise Services | B2B | $70 Mn | , | , |

| 18 Dec 2024 | Bureau | enterprisetech | Horizontal SaaS | B2B | $30 Mn | Series B | Sorenson Capital, PayPal Ventures, Commerce Ventures, GMO Venture Partners, Village Global, Quona Capital, XYZ Ventures |

| 19 Dec 2024 | Veefin | fintech | Lending Tech | B2B | $16 Mn | , | , |

| 18 Dec 2024 | Bizom | enterprisetech | Vertical SaaS | B2B | $12 Mn | Series B | Pavestone VC, IndiaMART |

| 17 Dec 2024 | zingbus | Travel Tech | Transport Tech | B2C | $9 Mn | bp ventures | bp ventures |

| 17 Dec 2024 | Seekho | Edtech | Skill Development | B2C | $8 million | Series A | Lightspeed, Elevation Capital |

| 16 Dec 2024 | HostBooks | enterprisetech | Horizontal SaaS | B2B | $5 Mn | Series B | Orange Orbit LLP |

| 19 Dec 2024 | Quid cash | fintech | Lending Tech | B2B | $4.5 Mn | pre-Series A | Piyush Jain, MINTCAP |

| 21 Dec 2024 | Arata | Ecommerce | D2C | B2C | $4 Mn | Series A | Unilever Ventures, BOLD, Skywalker Family Office |

| 19 Dec 2024 | Confidence | Healthtech | Healthcare SaaS | B2B | $3 Mn | Seed | Together Fund, MedMountain Ventures, Rebellion VC, DeVC, Operators Studio |

| 19 Dec 2024 | ZunRoof | cleantech | Solar Technology | B2B-B2C | $2.3 Mn | , | Godrej family office, ANBG Enterprise LLP, Ravindernath Chadha |

| 18 Dec 2024 | Quanfluence | deeptech | Hardware & IoT | B2B | $2 Mn | Seed | pi Ventures, Golden Sparrow, Reena Dayal |

| 18 Dec 2024 | Mili | fintech | Fintech SaaS | B2B | $2 Mn | Seed | Chiratae Ventures, BoldCap, Sparrow Capital, SFMG Wealth Advisors, Gregg Fisher, Better Capital |

| 19 Dec 2024 | Curie Money | fintech | Neobanks | B2C | $1.2 Mn | Seed | India Quotient |

| 19 Dec 2024 | Fitsol | cleantech | Climate Tech | B2B | $1 million | Seed | Transition VC |

| 15 Dec 2024 | Fibroheal | Healthtech | medtech | B2C | $741K | pre-Series A | , |

| 19 Dec 2024 | MBG Card | enterprisetech | Horizontal SaaS | B2B | $320K | , | Inflection Point Ventures, Velocity Revenue Based Financing, Klub Revenue Based Financing |

| 18 Dec 2024 | GroceryPro | Consumer Services | Hyperlocal Delivery | B2C | $188K | pre-seed | Yatish Talvadia, Vikas Taneja, TurboStart, Unpopular Ventures, Blume Founders Fund, Snow Leopard Ventures |

| 19 Dec 2024 | Kissht | fintech | Lending Tech | B2B-B2C | , | , | Sachin Tendulkar |

| 19 Dec 2024 | Rebel Foods | Consumer Services | Hyperlocal Delivery | B2C | , | , | kkr |

| Source: Inc42 *Part of a larger round Note: Only disclosed funding rounds have been included |

|||||||

Key Startup Funding Highlights Of The Week

- Enterprisetech unicorn Zetwork raised $70 Mn this week, closing the year with $90 Mn in fresh capital. The IPO-bound startup bagged fresh funds from Indigo cofounder Rakesh Gangwal, Khosla Ventures, Greenoaks, Avenir Growth, among others this year.

- On the back of Zetwerk’s fundraise, enterprisetech emerged as the investor favorite sector this week. Startups in this sector raised $117.32 Mn this week via five deals.

- A same number of deals materialized in the fintech sector with five startups raising $23.7 Mn this week. Among this, BSE-SME listed Veefin bagged the biggest check in the sector this week, raising $16 Mn.

- In line with the substantial dip in the funding numbers this week, funding at the seed stage went down significantly. Startups at this stage raised $9.2 Mn, an 85% dip from last week’s $17 Mn.

Updates On Indian Startup IPOs

- Fintech Aye Finance filed for an INR 1,450 Cr IPO this week. Its public offer is expected to consist of a fresh issue of equity shares worth INR 885 Cr and an offer-for-sale (OFS) amounting to INR 565 Cr by existing shareholders.

- Edtech unicorn PhysicsWallah set the ball rolling on its much anticipated IPO by turning into a public company this week. Following this, it is eyeing a public listing in 2025.

- In its Board meeting on December 18, SEBI decided on introducing profitability requirements as well as put a cap on shares to be sold through the offer for sale (OFS) route for NSE SME IPOs,

- Fintech unicorn InCred Financial Services set its public listing plans into motion, planning to raise INR 4,000 Cr (about $470 Mn) to INR 5,000 Cr (about $590 Mn) via its initial public offering (IPO) late next year.

Fund Launches This Week

- Fintech platform Velocity launched a new fund worth INR 200 Cr (around $23.5 Mn) to boost growth of India’s restaurant and cloud kitchens selling on food aggregator platforms.

- Micro VC firm Warmup Ventures floated its second fundwith a target corpus of $35.3 Mn. It aims to back 25-30 early-stage startups operating in segments like deeptech, climate and sustainability with an average ticket size of INR 5-7 Cr.

Other Developments Of The Week

- Amid a bull run, listed fintech SaaS company Zaggle announced a fundraise of INR 950 Cr ($112 Mn) via a qualified institutional placement (QIP). The fund raising committee of its board approved the opening of the offer this week and set a floor price for the QIP at INR 550.73 per equity share.

- Nazara’ NODWIN Gaming completely acquired gaming and esports media company AFK Gaming for INR 7.6 Cr via cash and equity swaps.

- Info Edge’s Redstart Labs plans on investing INR 3 Cr in Sploot to increase its stake in the pet care startup to 26.40%.

- Cornerstone Ventures completely exited retail analytics startup Intelligence Node, following the company’s acquisition by global advertising conglomerate Interpublic Group (IPG).

- Early stage investor Athera Venture Partners netted an undisclosed funding from HDFC AMC’s Select AIF FoF I Scheme for its fourth fund this week. It targets the closure of the fund, via which it will invest in consumer internet, enterprise software, AI startups, in 2025.