In 2020, Pratilipi founders found themselves in a tough spot.

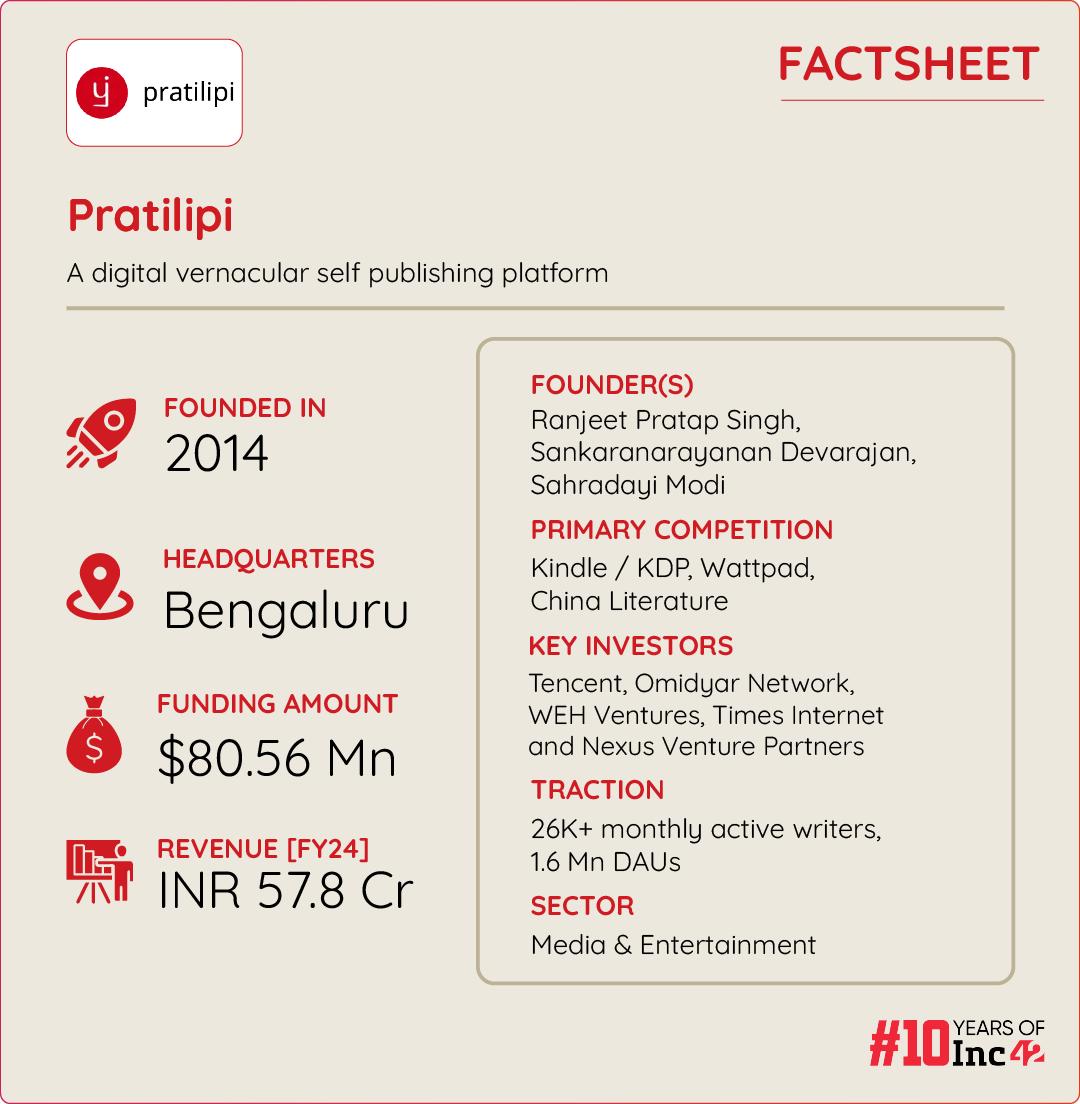

The Bengaluru-based self-publishing platform had just completed six years of operations and had already raised $29.6 Mn from investors like Tencent, Omidyar Network, WEH Ventures, Times Internet and Nexus Venture Partners since inception in 2014.

While its monthly active user base ballooned, Pratilipi lacked a clear revenue model. By June 2020, the platform had over 100,000+ writers and more than 20 Mn monthly active users. But the absence of a strong monetization strategy was always a pain point.

In fact, in cofounder and CEO Ranjeet Pratap Singh’s words, “we didn’t have any revenue model in place at all.”

Pratilipi’s Early Subscription Bet

Looking at the competitive landscape at the time, most domestic self-publishing players did not have the funding to grab market share like Pratilipi, while global publishers lacked the depth and nuance needed for the Indian market.

“When the lockdown initially hit, we had about 8-10 months of runway and investors were moving very slowly given no one knew how the pandemic would play out,” Singh revealed.

That’s when Pratilipi added subscriptions, betting that it would be a force multiplier for the business. Plus, in those early days of the Covid pandemic, any hope of a funding round from investors had dissipated. So there was nowhere to go but turn to subscriptions, and this is a big step for a company that had thus far never asked users to pay.

The startup put all its eggs in the subscription basket. “I wanted to ensure everyone could access content without barriers like language, money, or devices. We aimed to avoid blocking access just because someone couldn’t pay. However, we still needed a way to earn, so we introduced a subscription model,” the CEO recalled.

Pratilipi immediately saw an engagement jump from those who paid the subscription fee, starting at INR 25 per author and going up to INR 150 per month for unlimited access. Free users spent about six hours per week on the app, but paid users were spending 14 hours a week.

The CEO and cofounder also took matters into his own hands for working capital during the pandemic.

He first sold shares in two of his angel investments and decided to lead a round himself with INR 90 Lakh (a little over $100K today). He rallied fellow founders to invest $2 Mn into the company, and Pratilipi also raised debt.

In a twist of fortune, Krafton, one potential investor, exceeded Singh’s expectations. What started as a $2 Mn round surged to $48 Mn by July 2021, a lifeline that would take Pratilipi to its next stage.

But operating a subscription-based media company in India is neither cheap nor efficient.

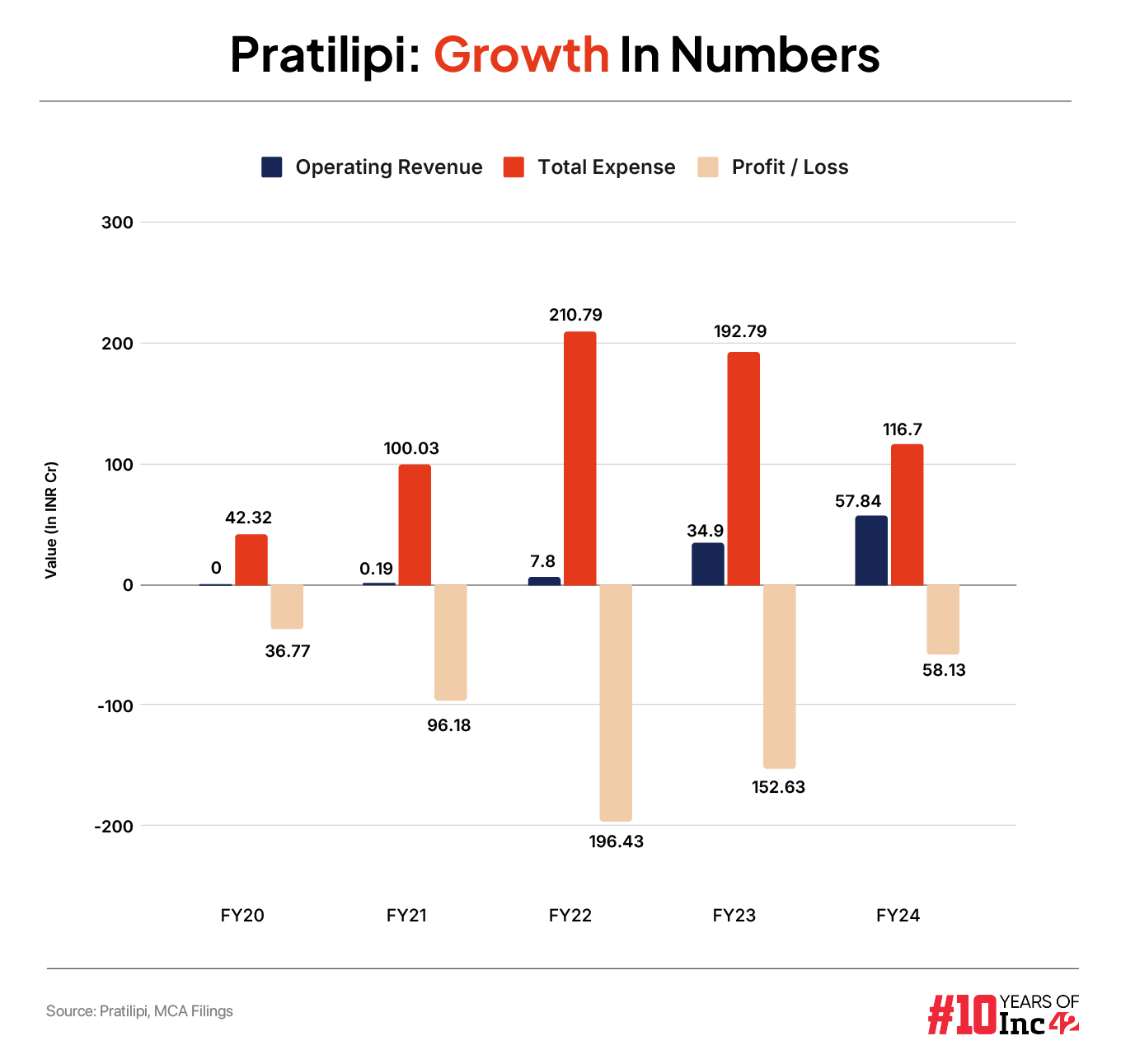

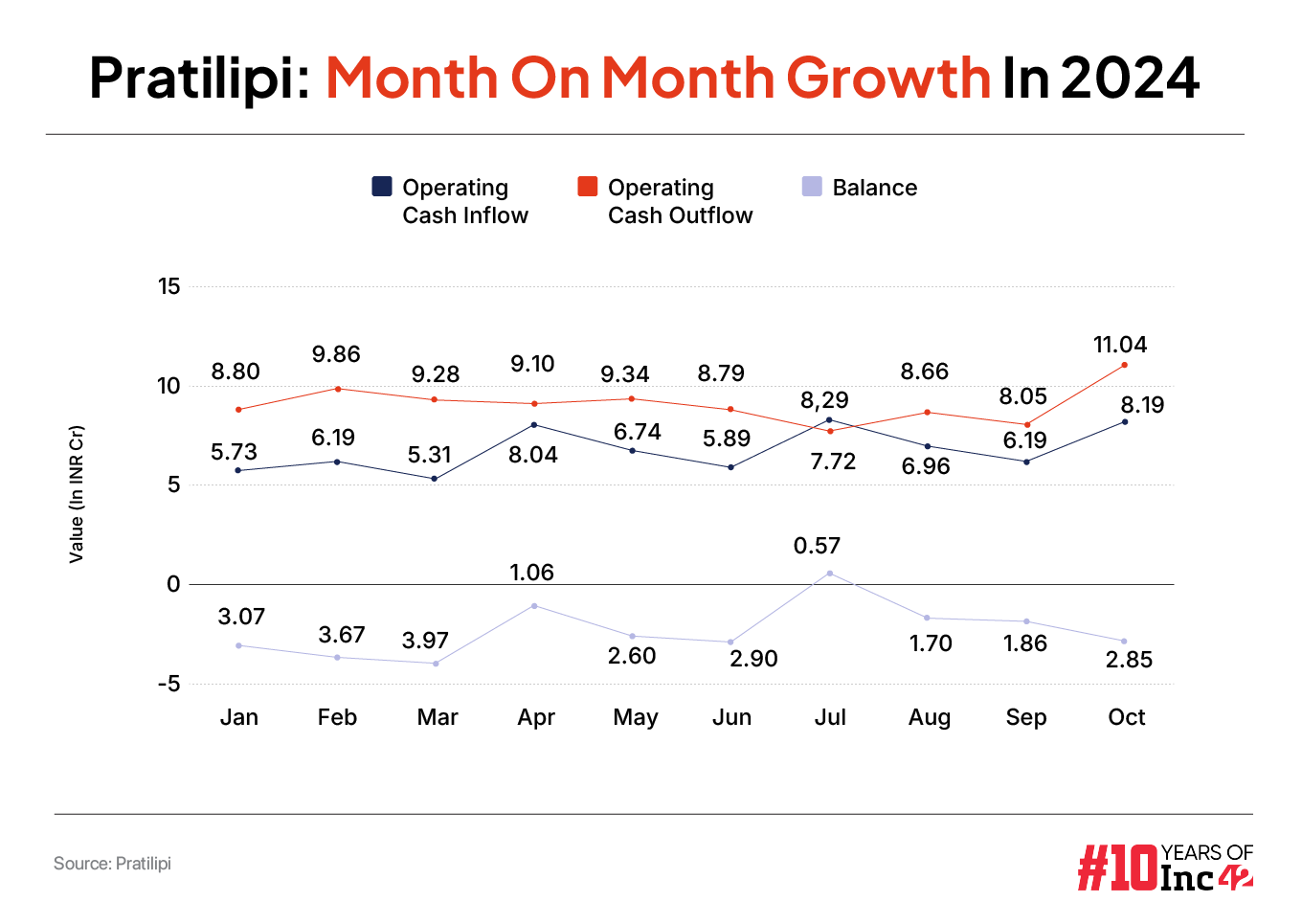

Pratilipi continued operating in the red in the next few years. In 2024, the situation becomes even more precarious. Between February and June, Pratilipi’s balance sheet showed a negative cash balance. The startup’s current liabilities were greater than cash in its accounts.

Where did Singh go next?

Building A Leaner Business

As it often happens, the first step was controlling costs. After raising a minor debt round, the startup slashed marketing and IP development budgets by over 90% and implemented a company-wide salary deferment.

Marketing expenses fell by about 85%, dropping from INR 40 Cr in FY23 to INR 6 Cr in FY24. But this had its own reverse impact. Where the company’s revenue grew by 50%, user acquisition and download rates slowed.

The app’s monthly active users (MAU) declined to around 2.5 Mn, while website MAU reached approximately 5-6 Mn. “But this decision reflected a strategic shift toward engaging a more dedicated, quality-focussed user base too,” Singh told Inc42 in a recent interaction.

Pratilipi’s perseverance finally paid off. With 26,000 monthly active writers and 1.6 Mn daily active users across India, Pratilipi officially became cash-flow positive in July 2024. In August 2024 alone, Pratilipi paid out over INR 1 Cr in royalties to writers, marking a rare achievement in an industry where Digital storytelling platforms often struggle to turn a profit.

Losses shrank 22% year-on-year (YoY) as it posted a loss of INR 152.64 Cr in FY23 against INR 196.44 Cr in FY22. Later, its losses further reduced by almost 62% YoY to INR 58.13 Cr in FY24.

After reinitiating full salaries, the startup handed out bonus ESOPs for the entire deferred amount. The deferred salaries will be paid back as arrears in full in November 2024, the cofounder claimed.

Reflecting on Pratilipi’s recent challenges, Singh said, “The last six months (January to June 2024), we had less than zero cash or near zero on the balance sheet. But we became cash flow positive in July. Once you’re cash flow positive, your destiny is in your hands.”

Pratilipi’s IP & Tech Stack

Controlling costs is one aspect. The product still has to serve the consumer and Pratilipi restructured its tech and product stack significantly in the past few years.

Singh believes that Pratilipi and ShareChat were among the first companies to build user-generated storytelling platforms at a large scale.

Between 2020 and 2022, Pratilipi launched Pratilipi Comics (for the graphic novel format) and Pratilipi FM, an audio storytelling platform. Focussing on content IP, the company acquired podcast studio IVM Podcasts in 2020. It also took over The Write Order Publications in 2021 and Westland Books in 2022.

Over the past four years, Pratilipi has built a repository of 15 Mn stories, which it describes as “the largest IP catalog in the country by like 5x-10x margin.”

The next step was acting on these IPs. In October 2023, Pratilipi began licensing its stories to partners for formats it couldn’t develop directly, such as TV shows, OTT content, and films. Acquiring the IP rights to books and podcasts allowed the company to pitch itself as a content factory for digital and traditional media.

“Last year, we realized there are some formats we can’t approach directly—either because we don’t know how or because it’s too expensive. So, we started licensing our stories to ecosystem partners, like TV shows, OTT platforms, and movies. From a business standpoint, we have launched five TV shows and one OTT show, with around 15 others in production,” Singh told Inc42.

Pratilipi also partnered with Disney Star for a unique multi-series content deal. This collaboration allows Disney Star to adapt Pratilipi’s stories into fiction TV shows across different languages, airing on its TV channels and digital platforms.

Pratilipi’s recent marketing efforts have also focused on leveraging these IPs across various media formats, so that these stories gain traction and are adapted for non-Pratilipi IP.

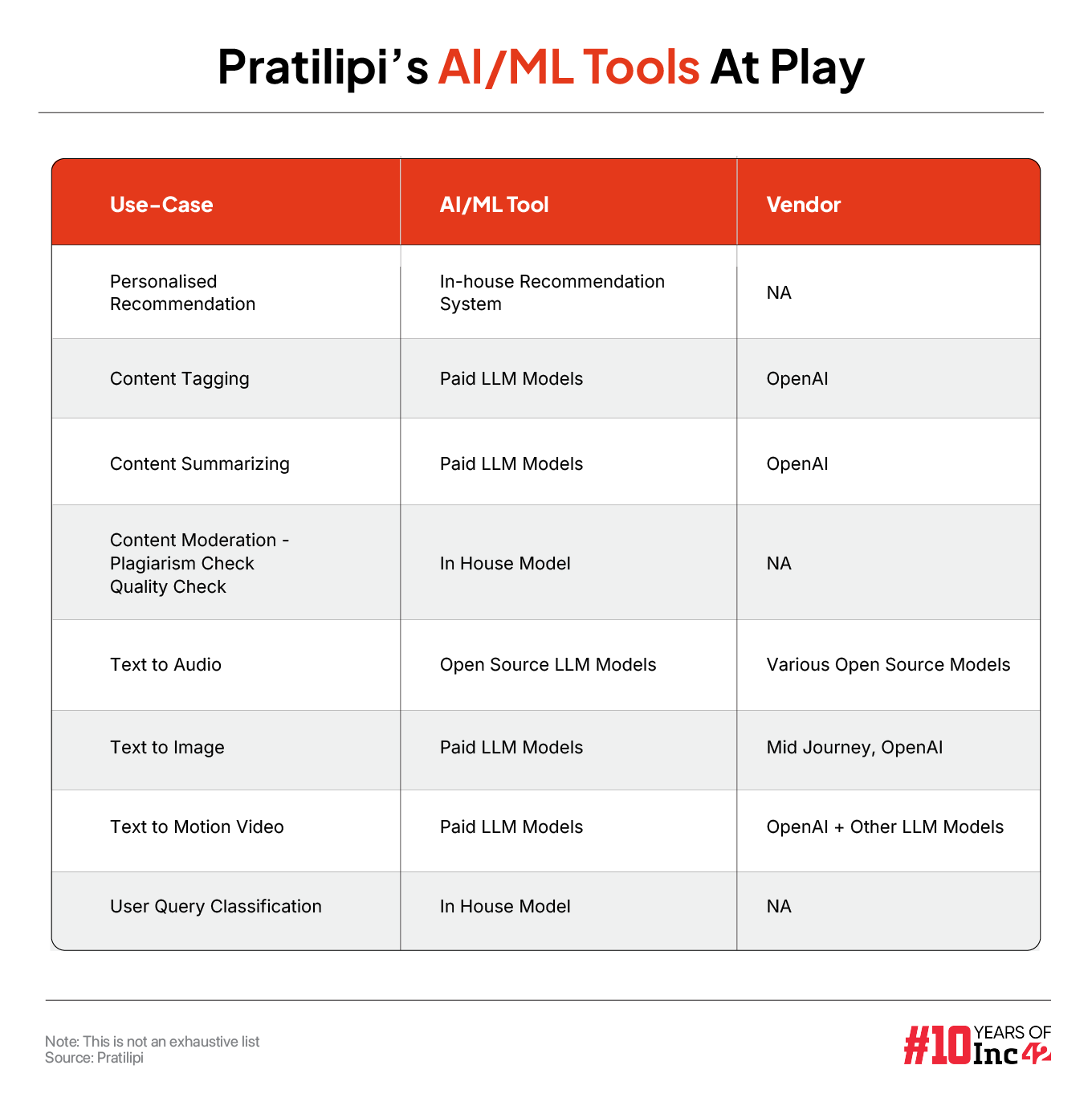

The other big shift, the CEO claimed, came from the adoption of machine learning and AI. Pratilipi claims to have implemented a multi-layered strategy to maintain content quality, protect intellectual property, and enhance user engagement. “In the last four or five years, advancements in technology have become so effective that nearly all of these tasks are now handled by it. So we have different models for different things.”

Here’s a breakdown of how the company is using these systems:

Will Profits Come Before IPO?

After the rollercoaster of the first eight years, Pratilipi is eyeing a public listing by 2026. The company is aiming for INR 110 Cr in revenue by FY25 and INR 180 Cr by FY26.

With IPs changing the monetisation momentum, Singh said that Pratilipi will focus on growth rather than profitability in FY25, with plans to flip the focus before the IPO. “We are now at a stage where we can become profitable whenever we want by reducing forward-looking investments or expenditures. We want to grow as quickly as possible before the last two quarters,” the cofounder noted.

This vast IP base provides a significant edge in the fiction domain, offering both competitive leverage and licensing opportunities across formats like comics, movies and TV. In nonfiction, Pratilipi expects traditional competitive dynamics, where market share will be distributed among various platforms and publishers.

However, the path to profitability remains uncertain in an industry marked by constant change and fierce competition. While Pratilipi has shown the ability to adapt and expand into new formats, it’s still dealing with persistent challenges such as increasing operational costs, changing consumer preferences for content, and evolving market dynamics on the content front, with AR and VR also being seen as the next big things.

Even prioritizing cost-intensive IP capacity building over short-term profits carries inherent risks, given that even digital media and OTT companies are looking at creating and owning IPs for long-term profits.

Will Pratilipi’s publishing platform and IP inventory remain relevant in the long run or will Singh & Co have to claw back one more time before that IPO push?