India’s refurbished smartphone market has grown significantly in the last few years on the back of the rising aspirations of Indians for premium gadgets. Be it a college-going student or an early professional, everyone today aspires to own high-end smartphones.

However, these rising aspirations often clash with financial constraints. This, in turn, has increased the appetite for refurbished products, which are available in the market for a fraction of the cost.

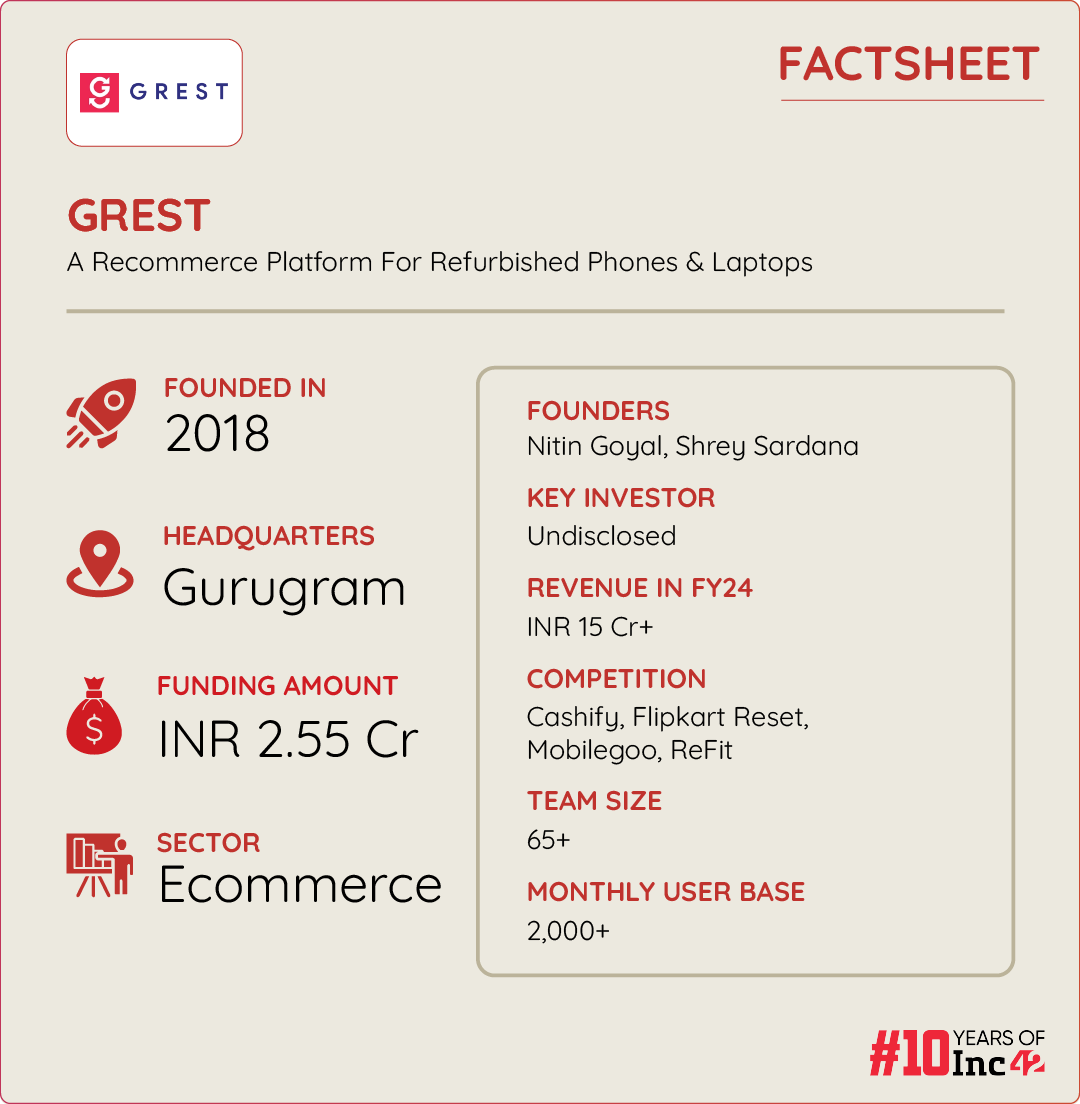

To cater to the growing aspirations of Indians and cash in on the rapidly growing refurbished smartphone market (projected to grow at a CAGR of 13.73% by 2028), Nitin Goyal and Shrey Sardana launched GREST in 2021.

What fueled the purpose behind their endeavor was the absence of premium-quality phones at affordable prices from the market. To cater to these aspirations of millennials and Gen Z, Goyal and his childhood friend Sardana decided to launch GREST.

The Gurugram-based recommerce platform sells refurbished iPhones, MacBooks, and laptops. GREST has over 500 SKUs, and every smartphone sold via its platform goes through 50+ points of quality checks.

Recently, the startup raised INR 2.5 Cr. Following the round, the startup has been able to achieve a 5X revenue growth. According to the founders, the recommerce startup has seen a 52% increase in units sold and registered a 200% revenue growth in Q2 FY25 compared to the same quarter in FY24, driven by high demand for premium phones.

The Greatest Story

Operational since 2021, GREST is the byproduct of Sardana and Goyal’s childhood dream of starting a business together.

Before joining forces, the duo were stuck in the corporate rat race. While Goyal has worked with multiple telecommunication giants, Sardana hails from the electronics repair sector.

With their electronics background, both founders consistently stayed attuned to industry trends. Around 2016-2017, the founders observed the trend of the recommerce industry picking up, particularly in repairing and refurbishing goods.

This period also saw a surge in ecommerce companies, brands and large retail chains actively adopting exchange plans.

By 2017, the exchange, trade-in and buyback market had grown significantly, with many ecommerce players adopting exchange schemes as their key sales drivers.

During this time, Cashify was also gaining a lot of traction with its model of procuring old phones in exchange for new ones.

Inspired by the business model, the duo decided to repair and refurbish devices that were returned to ecommerce sellers for various reasons.

In 2018, the duo left their decade-long corporate careers to embark on their entrepreneurial journey and started Radical Aftermarket Services, a B2B service company focused on providing repair services.

For nearly two years, the founders focused on providing repair services. However, the Covid-19 pandemic disrupted the supply chain, prompting them to rethink their business model.

“During the pandemic, everyone around us was looking for a gadget, whether it was our maid or our security guard. Kids needed a gadget for their online classes, while many young professionals were looking for a second-hand iPhone to fulfill their aspiration,” Goyal said.

This highlighted an opportunity for affordable refurbished devices, prompting the founders to launch a platform in 2021 for both B2B and B2C consumers. Their goal was to meet the demand for premium gadgets at accessible prices.

Hence, the founders decided to pivot from the repair services offered by Radical Aftermarket Services to a product-based business and incorporated GREST.

GREST’s Market Play

GREST has evolved its distribution network in the last three years and is now present in 26 states and five Union Territories. It aims to create a niche in the refurbished phone market by reintroducing phones that are deemed “dead” or have short lifespans.

“We buy low-cost phones, address issues, and prepare them for resale. For spare parts, we have developed a machine to aid in this process. For example, screen replacements in the market typically cost INR 5-10K, but with our machine, the cost of a display replacement will drop to just INR 1,000,” Goyal said.

The founders have developed a beta version of this machine, which was previously available only in China. With this, they aim to eliminate supply chain dependencies and avoid relying on other countries for the future.

Based on the device’s condition, GREST employs a transparent grading system with three quality levels (Superb, Good, and Fair) to give customers clear insights into its cosmetic and functional status. Every phone undergoes a 50+ point inspection to ensure overall performance.

Its 50-point quality check includes cosmetic checks for frame and screen condition, connectivity tests for Wi-Fi, Bluetooth, cellular, GPS, and NFC, and functionality assessments for buttons, charging ports, and vibration. It also ensures battery health, examines hardware like sensors, microphones, and speakers, and performs performance testing for speed and touch responsiveness.

Additionally, it verifies lock and biometric features such as Face ID and Touch ID, conducts software validations like iOS activation and certified data wipes, and checks camera quality for both front and rear setups. Additionally, it provides a 6-month warranty on all refurbished phones, a 7-day return policy, and free shipping across India.

In addition to this, the startup operates through a five-tier supply chain. The first tier includes market players like Amazon, where GREST is a direct vendor. However, it doesn’t purchase stock from them as the pricing is determined by Amazon, according to the founder.

The second tier involves original equipment manufacturers (OEMs) like Samsung, OnePlus, Apple, etc. GREST has partnerships with offline retailers like Imagine, Invent, and other Apple retailers. These retailers act as buyback partners, replacing old phones with new ones when a consumer buys a new device.

The third tier includes major retail chains like Reliance Digital and Croma. GREST has PAN India partnerships with them. The fourth tier involves partnerships with unorganized players.

Lastly, on the B2C front, consumers who purchase refurbished phones from GREST are given the option to sell or exchange their old phones.

While sourcing and working on the business model was never a big challenge for the founders, the initial few months were challenging due to the lack of awareness.

“No one knew what refurbished phones were. While there was some awareness about second-hand phones, consumers often confused second-hand phones with refurbished ones. However, players like Cashify helped us create that awareness,” the founders said.

GREST’s Plan To Dominate India’s Refurbished Smartphone Market

Even though Cashify is its biggest rival, GREST positions itself quite differently. For starters, the founders have kept their prices consistently lower than Cashify.

“We tend to keep our prices 5-10% lower than Cashify. For iPhone 14-15 models, the price difference can be up to 15-20%. For MacBooks, the difference is even more significant,” the founder said.

According to the founders, Cashify primarily focuses on buying old phones, but there are very few players that solely sell refurbished phones. Recently, Amazon has also begun piloting the sales of refurbished phone sales with one seller.

It is pertinent to note that Cashify is a recommerce platform that allows users to sell old and used electronic items. The startup is widely known for selling refurbished mobile phones. It posted an operating revenue of INR 815.9 Cr for FY23,

According to the founder, what sets GREST apart from other players is its deep expertise across every stage of the refurbishment process.

“From sourcing devices via our proprietary C2B price discovery and evaluation application, in collaboration with over 20 big trusted partners, to performing advanced in-house repairs and refurbishments, we control every aspect,” Goyal said.

It takes pride in its 20,000 sq ft state-of-the-art facility, which is equipped to handle even the most complex repairs, including intricate chip-level and motherboard issues.

Going forward, the founders aim to expand beyond retailers and shopkeepers. For this, it is planning to launch its own company-operated physical stores in the first half of 2025. The first phase will include four stores in Delhi NCR. In the long term, GREST plans to expand to around 400 stores both in India and internationally.

The founders claim to have garnered INR 15 Cr in FY24 revenues. They project to double their top line in FY25. With a monthly revenue rate INR 4 Cr, the company has processed between 50,000 and 1,00,000 phones to date.

Now as GREST strives to differentiate itself from established players like Cashify with lower prices and a strong focus on refurbishment expertise, its ability to sustain in the market will be key.

While the refurbished smartphone market in India continues to expand from the current $5 Bn to $10 Bn by 2030, GREST’s success will depend not only on its pricing strategy but also on its ability to scale operations, enhance consumer trust, and maintain product quality in a rapidly evolving market.

With that said, the coming years will be critical in determining whether GREST can truly disrupt the refurbished phone market or if larger competitors will continue to hold sway.

[Edited By Shishir Parasher]