With the proliferation of infrastructure-level, horizontal solutions led by global players, Indian investors want homegrown GenAI businesses to offer niche, sector-specific solutions.

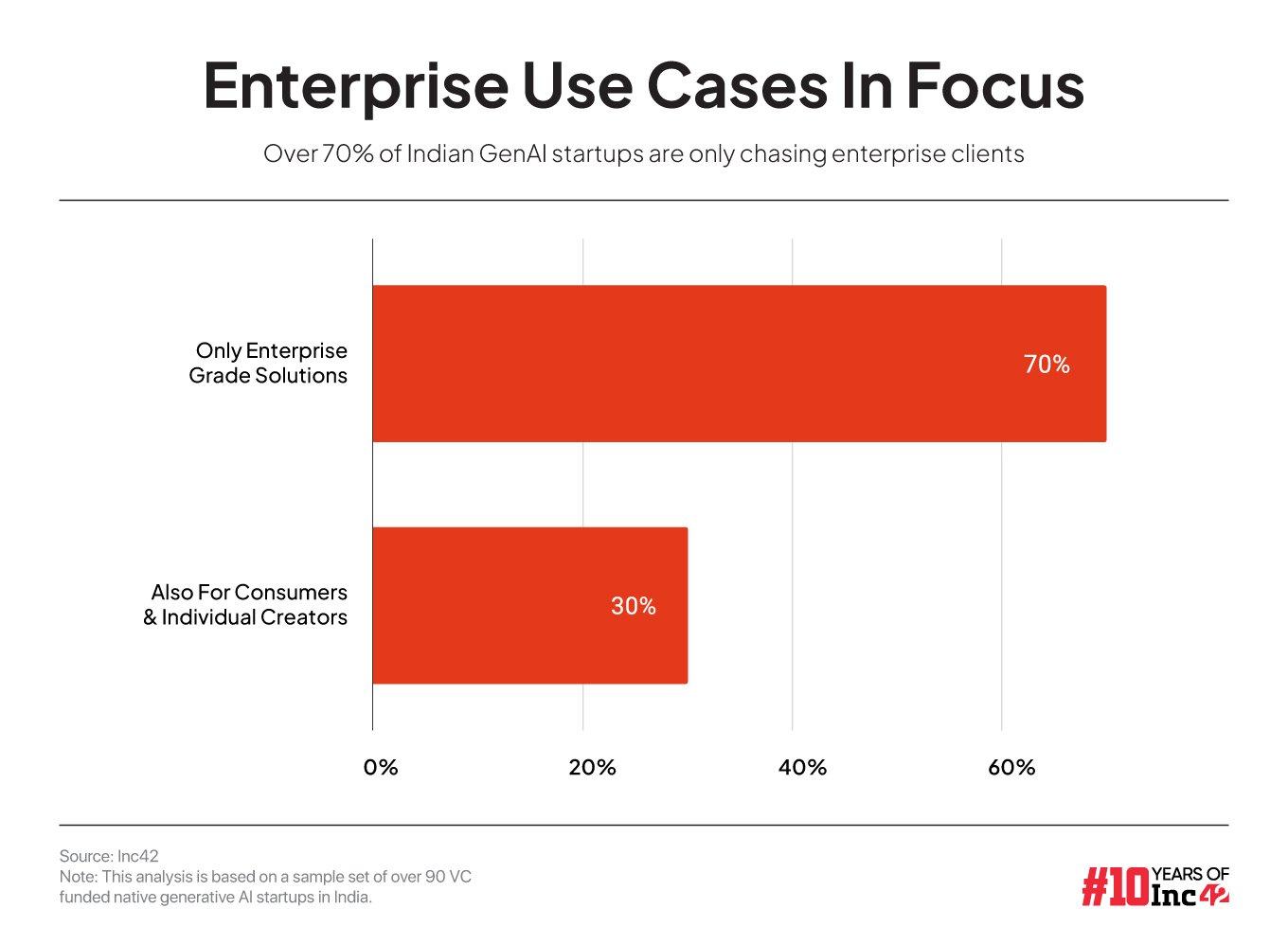

According to Inc42’s recent report, as many as 70% of GenAI startups are offering solutions only for enterprise clients, and the remaining 30% are building for consumers and individual creators.

84% of Indian VCs believe the recent GenAI investment boom is driven by the fear of missing out, a trend that could potentially harm the ecosystem in the long run

Today, the real-world impact of GenAI is more tangible than ever. From banks, insurance companies and hospitals to content and legal firms, GenAI applications are becoming mainstream, enhancing workflows, research, sales, customer service, and more.

Earlier this year, Inc42 predicted that the growing enterprise adoption of GenAI in 2024 would pave the way for a new generation of entrepreneurs, who can address India-specific vertical challenges shifting from the global horizontal approach. This vision is quickly taking shape and creating new opportunities for industry-focussed GenAI startups to secure funding from venture capitalists.

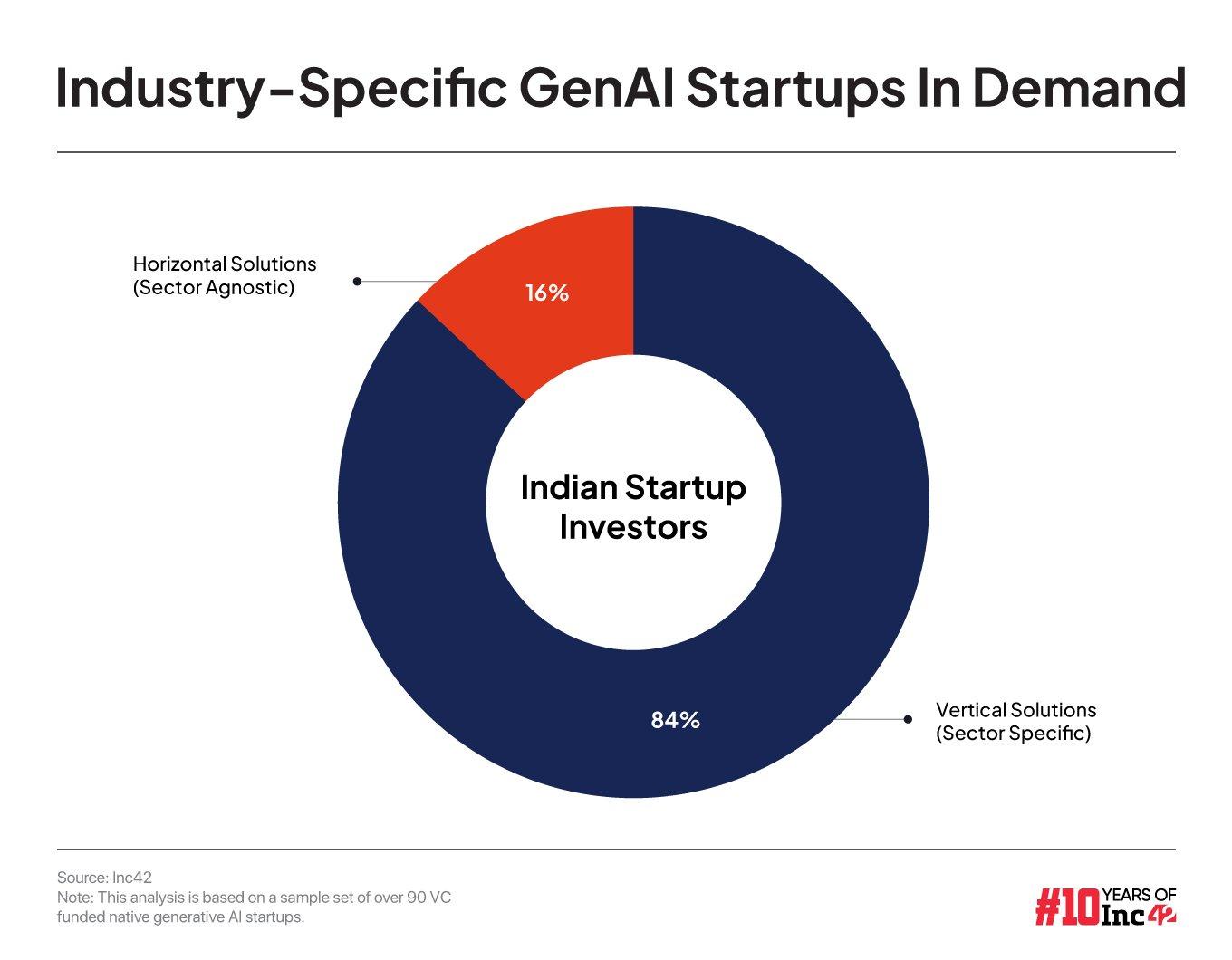

Notably, vertical solutions are designed to cater to industry-specific requirements while horizontal GenAI solutions are sector-agnostic. An industry-specific case in point is OnFinancewhich is a GenAI SaaS solutions provider for the financial sector. Similarly, GenAI platforms such as Boltzmann and immunitoAI are developing solutions focused on healthtech.

In fact, 84% of Indian VCs today prefer industry-focused startups over general-purpose solutions, Inc42’s recent report, ‘The Rise Of India’s GenAI Brigade Report, 2024’, has revealed.

With the proliferation of infrastructure-level, horizontal solutions led by global players, Indian investors want homegrown GenAI businesses to offer niche, sector-specific solutions.

In the last one year of thoroughly tracking new trends in the GenAI arena, what we have known is that investors are betting big on the rising traction of this tech in areas like fintech, enterprise SaaS, and healthtech. Inc42’s latest research also suggests that Indian investors’ top choice for vertical AI solutions is fintech, followed by healthcare and manufacturing.

Notably, as many as 57% of the 50 venture capital investors surveyed by Inc42 showed the highest confidence in the fintech sector for vertical GenAI solutions.

Access Free Report

So, What Is Making Vertical GenAI A Compelling Story?

Well, the answer to this key question is in the country’s ability to create differentiated products in a crowded market. Speaking with Inc42, Murali Krishna Gunturu, principal at Inflexor Ventures, said that general-purpose AI is already being solved by platforms like OpenAI’s ChatGPT. So, according to him, if in today’s time, a startup develops a ChatGPT clone or wrapper, it would be difficult to monetise.

“The solutions that startups develop must have individual moats, and a strong moat is extremely important for VCs to invest in a startup, which can be better created with a focus on building solutions around a specific industry or vertical,” Gunturu said.

Inflexor has so far invested in two GenAI startups – Ayna and Vitra.ai. While Vitra.ai has a horizontal approach, Ayna is building solutions to particularly solve photography bottlenecks in ecommerce. A few other vertically focused startups that raised funding this year include Febi.ai and jhana.ai.

While the interest among investors to inject money into horizontal use cases is not waning, as seen with recent investments in Neysa, Devnagri, CoRover, and others, the differentiator lies in keeping investors engaged and on their toes.

Vipul Patel, partner (seed investing) at IIMA Ventures highlighted that the significant development of general-purpose solutions has now proven to be a launchpad for industry-focussed GenAI solutions.

“Vertical solutions require access to industry or use-case specific quality data and building smaller models. The combination of both has a potential for creating a decent moat for the business is gaining investors’ interest,” Patel said.

Access Free Report

Interestingly, Sonal Saldanha, vice president at 3one4 Capital, who also leads the GenAI investments in the VC firm, has a slightly different perspective.

Emphasizing that 3one4 Capital has no strict boundaries when investing (vertical or horizontal), he said that general-purpose solutions like code editing, document management, call transcription, objectives and key results (OKR) management and recruiting will exist. However, the sheer TAM of work automation is larger, and these will be more verticalised to deliver better results. Therefore more investment interest is here.

“AI companies offer products that enable workflows and deliver output. It’s easier to be precise with the output and create user delight when the solution is more focussed/personalised to the user persona,” he said.

Meanwhile, Gunturu added that more nuanced enterprise use cases and their increasing demand could also be one of the driving factors behind this trend.

Are GenAI Startups Steering Towards Enterprise Use Cases?

According to Inc42’s recent report, as many as 70% of GenAI startups are offering solutions only for enterprise clients, and the remaining 30% are building for consumers and individual creators.

This trend reflects a strategic shift among Indian GenAI startups, driven by the dominance of global players like OpenAI and Anthropic in the consumer application space. Instead of competing in the crowded consumer market, domestic startups are now prioritizing localised, enterprise-grade solutions.

This focus is not only enhancing the monetization potential for Indian GenAI startups but also making them more attractive to VCs by addressing complex, nuanced challenges.

Speaking on the matter, Ganesh Gopalan, cofounder and CEO of Gnani.ai Said that his startup is focussed on the enterprise sector because he believes in the potential of enterprise use cases for enabling a transformative impact at scale.

“We work with enterprises in transforming their customer experiences because they often have complex challenges that are well-suited to the capabilities of GenAI,” Gopalan said, adding that Indian enterprises are accelerating the adoption of GenAI solutions.

Gnani.ai has most of its clients in the BFSI space with several others in automotive, retail, and healthcare. Its clients include the likes of Bajaj Group, TVS Credit, Muthoot Finance, and Fibe (formerly Early Salary).

Per IIMA Ventures’ Patel, enterprise customers are emerging as better targets than individual users in the GenAI market, as their intent to pay for a dependable quality solution is relatively higher.

On a similar note, 3one4 Capital’s Saldanha said that enterprises today want to be innovators and have carved out budgets to improve their productivity (lower cost, increase revenue), and enhance their product offerings with AI. This is leading to increased AI adoption at the enterprise level.

“However, not every product is designed to be enterprise-ready because of their customization expectations, security/compliance requirements, and long sale cycles… as investors we are looking at the startup’s team, the product, and the go-to-market holistically to decide what makes sense as a strategy in that instance,” Saldanha added.

Access Free Report

What’s Next In The GenAI Adoption Race?

Many global tech leaders and innovators have touted the wave of GenAI as bigger than the internet revolution. While India has been a bit late to the party, it is trying to make up for the loss by spearheading innovations and trends in the sector. Supporting this thesis is the Centre’s policy push for AI, which also seems to be in line with the sector.

However, the lack of skilled talent continues to be one of the biggest challenges for Indian GenAI startups. According to a recent Amazon Web Services (AWS) survey, 79% of Indian businesses found it challenging to acquire AI talent that met their expectations.

Moreover, Inc42’s latest research reveals that 84% of Indian VCs believe the recent GenAI investment boom is driven by the fear of missing out, a trend that could potentially harm the ecosystem in the long run. For context, startup funding in native Indian GenAI startups has surged 4.4X in 2024 from 2020.

At a time when GenAI seems to be setting the tone for further developments at the enterprise level, it would be interesting to see vertical use cases take center stage to dominate this market going forward.

[Edited By Shishir Parasher]

Access Free Report