Expectations around the new Donald Trump administration’s friendlier approach to crypto have set off a gold rush, sending Bitcoin prices soaring to an all-time high of $99,502.92 as of Friday, November 22.

As the world’s most popular cryptocurrency is nearing the historic milestone of $100,000, expectations are running high in India too. In particular, there’s hope among founders and crypto investors that if the US does ease crypto regulations, positive ripple effects will be felt in India.

India’s crypto ecosystem desperately needs some good news.

Over the past couple of years, most publications were dotted with anti-crypto news from shut downs to criminal cases, government probes into foreign exchange violations and the WazirX crypto heist. Globally also, the FTX collapse created an atmosphere of panic till mid 2024, when bitcoin prices shot up.

The industry’s footing was so shaky in 2023 that several pundits even made predictions of crypto’s demise altogether. However, Trump’s victory in the US presidential elections has breathed new life into the global crypto market, with its valuation skyrocketing to over $3.3 Bn since the day he was elected again as President.

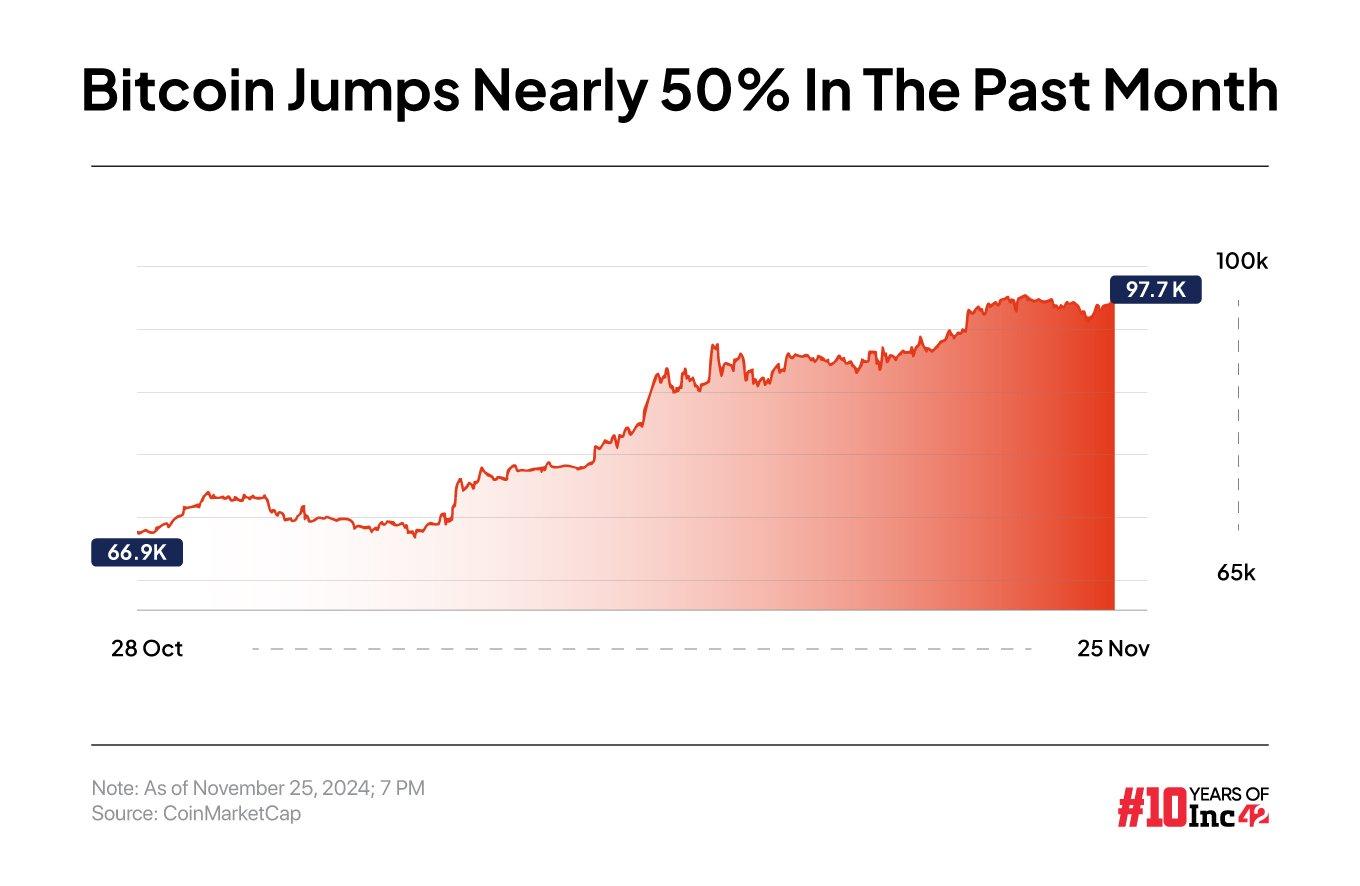

Bitcoin in particular has been booming since Trump’s return. BTC extended gains this week and surged past $99,000 for the first time in its history, before settling just under this mark as of Monday evening.

This represents a 99% jump since Bitcoin crashed to lows of $15,000 in late 2022. The optimism has also percolated to other digital assets, with Ethereum and Dogecoin up 9% and 5%, respectively, over the last seven days.

Founders of crypto companies and other stakeholders that Inc42 spoke to expect bitcoin prices to climb further as well as crypto adoption to increase as they anticipate Trump’s team to ease regulations on the crypto industry.

Citing market analysts, Balaji Srihari, business head of CoinSwitch, said that Bitcoin could reach the $100,000 mark as early as the end of November, which is historically the most bullish month for Bitcoin.

“Since the recent US election, Bitcoin has been consistently setting new records, encouraged by expectations of a more supportive regulatory framework and a potential national Bitcoin reserve that can legitimize Bitcoin as a government-backed asset,” Srihari added.

However, he advised investors to exercise caution, pointing out that big price jumps are often followed by sharp corrections and too much leverage could amplify risks during volatile periods.

Crypto exchange platform CoinDCX’s founder Sumit Gupta told Inc42 that the bitcoin rally led by Trump’s victory will also enhance Indian investors’ interest.

“Crypto markets are global in nature and run on the back of global factors. What happened in the US is essentially leading to a rally in Bitcoin prices with a good inflow of investment in bitcoin and the ETF also. People are expecting this to continue, and that will naturally spark interest among Indians investors,” said Gupta.

What’s Behind The Bitcoin Rally?

Bitcoin prices have been on an upswing since the Securities And Exchanges Commission (SEC) in the US approved nearly a dozen exchange-traded funds and options tied to Bitcoin for listing on the New York Stock Exchange.

In January, the US regulator approved Bitcoin ETFs of funds such as Fidelity, BlackRock, Invesco and Grayscale, among others. In the last week (Nov 18-21), US spot Bitcoin ETFs have amassed $2.84 Bn worth of cumulative net positive inflows, reflecting growing investor confidence in the crypto market.

Note that Bitcoin supply on the crypto exchanges is on the verge of drying up — thanks to the halving event that took place in April 2024. Bitcoin halving occurs every four years, which reduces the rate at which new Bitcoins are introduced into the market, leading to a supply shock.

Further, October has historically been the second-best month for Bitcoin with an average return of 21%, which is why it is often dubbed ‘Uptober’. By comparison, Bitcoin has given monthly returns of 46% on average in November, data from CoinGlass showed, making it the strongest month for Bitcoin price.

The rally in Bitcoin prices has also been helped by a record influx of stable coins into crypto exchanges, which reached a monthly high of $9.7 Bn in November.

Will Trump Make Good On His Crypto Promise?

As per industry reports, the crypto industry plowed in over $130 Mn in the US presidential race in 2024. The aggressive spending spree and lobbying campaign fueled a string of victories for supposedly pro-crypto legislators in recent US elections.

Take for example Republican candidate Bernie Moreno, who defeated Senator Sherrod Brown to win the US Senate election in Ohio. While Moreno has long been a supporter of crypto, Brown called for strict oversight of the industry.

Trump’s presidential bid, too, relied heavily on individual billionaires with crypto interests, not least Elon Musk, the CEO of Tesla and SpaceX.

Now, the industry is seeking a return on its investments. SEC chairman Gary Gensler is expected to be replaced by the Trump administration. Crypto advocates claim that only a more crypto-friendly leadership will push SEC toward easing the regulations for the industry.

Industry groups have also stepped up pressure on the Congress to pass a regulatory framework to bring crypto into the mainstream US financial system.

And the US elections have given Trump the mandate to make the US the “crypto capital of the planet” like he promised he would. As per a tracker run by a group called Stand With Crypto, the 2024 US election cycle saw as many as 274 pro-crypto lawmakers getting elected to the House and 20 to the Senate.

“It’s really the dawn of a new crypto era with this election that just happened because it’s the most pro-crypto congress ever… We couldn’t be in a better position to finally get some clarity and start to rebuild the crypto industry in America again ,” Brian Armstrong, CEO of Coinbase, told CNBC in a recent interview.

Further, in the run up to the presidential elections in the US, Trump vowed to set up a national Bitcoin reserve and form a crypto advisory council. If Trump follows through on his promises, the US could become a global leader in mainstreaming digital assets. “His pro-crypto stance will also influence other countries including India to have a clearer framework for digital assets,” Edul Patel, CEO of crypto exchange Mudrex, told Inc42.

If the US government positions Bitcoin as a strategic reserve asset, Giottus CEO Vikram Subburaj expects that many governments including India could follow suit. “In this context, it is important that India recognizes Bitcoin’s growing importance and ensures regulations to support its growth,” he added.

Crypto In India: Heists, Scams & Regulatory Uncertainty

It’s one thing to expect regulations to become friendlier for the crypto ecosystem, but the fact is that there are far too many issues to be cleared, and investigations pending which still limit the appeal of cryptocurrencies.

On July 18, homegrown crypto exchange WazirX suffered a cyberattack, with hackers decamping the platform with nearly $234 Mn worth of crypto assetsThis is the biggest crypto heist in India’s history.

About 4.4 Mn WazirX users were impacted in the attack, most of them Indians. While the hack itself was a major blow to crypto users in India, founder Nischal Shetty’s mishandling of the entire situation was also said to be alarming by those who lost their funds.

Since the day of the attack, Shetty has denied that WazirX was responsible for the security lapses that led to the heist.

In fact, he tried to shift the blame to former partners Liminal and Binance. While Shetty said that the hacked exchange will resume operations by February 2025 in a recent townhall meeting, WazirX’s future remains uncertain, and this has thrown a big caution among investors.

Four months after the WazirX hack, the exchange’s users have yet to completely recover their funds. some reports suggest that the alleged mastermind behind the WazirX hack nearly finished laundering stolen funds worth $230 Mn.

The WazirX saga has turned the spotlight on the need to regulate crypto in India. While the government levies a hefty 30% tax on crypto transactions, when a trader suffers losses due to such incidents, there’s no recourse to book these losses or adjust them against the gains.

Further, regulating the space becomes even more important if you watch crypto adoption trends. According to blockchain research firm Chainalysis, India leads the world in grassroots crypto adoptionwhile the US lags behind at fourth position.

This is an opportunity for the Indian government to truly capitalize on this momentum, according to the founders, but the government has not yet shown any intent in this direction.

Till recently, India has taken an aggressive stance against the crypto ecosystem. Earlier this year, the Financial Intelligence Unit, which comes under the finance ministry’s revenue department, sent notices to nine overseas exchanges, including Binance, Kucoin, Kraken, among others, for allegedly “illegally operating” in India.

The situation has been further exacerbated by Reserve Bank of India’s (RBI) governor Shaktikanta Das’ recent comments that cryptocurrencies should not be allowed to dominate due to their considerable risks to financial stability, monetary stability and the banking sector.

For the past two years, crypto experts have called for a reduction in the capital gains tax on crypto, but the same taxation structure has been retained in recent budgets.

Another major hurdle is funding for crypto startups which declined in the first half of 2023 after witnessing a momentum in 2022 and 2021. The sector raised mere $30 Mn in the first half of 2023 (H1 FY23) against $773 Mn in the year ago period ( H1FY22).

Given the situation in India, regulations for cryptocurrency can reduce risk related to uncertainties in the sector, industry leaders told Inc42.

Mudrex CEO Patel claims that a strong regulatory framework can boost Indian investors’ confidence. He further believes that India could do well to take hints from the US after Donald Trump’s victory and his pro-crypto stance.

“Trump’s win is set to bring significant changes to the US crypto landscape. This shift could encourage key global economies, including India, to advance regulatory clarity on digital assets. As a prominent member of the G7 and G20, India may feel added momentum from this outcome. With stronger regulatory frameworks, investor confidence is expected to rise, fostering broader adoption and stability in the crypto market,” Patel claimed.

It is important to note that the central government is planning to release a discussion paper on cryptocurrencieswhich will cover regulations for cryptos and seek input from industry stakeholders.

Given the ongoing BTC rally towards the $100,000 mark, the industry sentiment is largely positive. However, the experts caution that investors still need to stay vigilant as there’s plenty of misinformation in light of this rally.

As is usually the case, whenever Bitcoin sees a spike, the volume of cryptocurrency scams also increases. Trump’s return has pushed bitcoin for now, but regulations and taxation policies under his presidency will decide crypto’s path in the longer run not just for the US, but also for the rest of the world.

While India is a key trade ally for the US, it’s not yet clear whether the country will follow the US way when it comes to crypto.

Indian market regulators have the unenviable task of balancing the expectations of millions of crypto traders and the greater call for safety of investors when it comes to such volatile asset classes. The current optimism will continue to drive crypto activity in India for now, but how long will this bull run last?

Edited By Nikhil Subramaniam